Reporting entity

Entity name: ____________

Fund Manager Organization Name (if applicable): ____________

The GRESB Real Estate Standard and Reference Guide (“Reference Guide”) accompanies the GRESB Real Estate Assessment and is published both as a standalone document and in the GRESB Portal alongside each assessment indicator. The Reference Guide reflects the opinions of GRESB and not of our members. The information in the Reference Guide has been provided in good faith and on an “as is” basis. We take reasonable care to check the accuracy and completeness of the Reference Guide prior to its publication. While we do not anticipate major changes, we reserve the right to make modifications to the Reference Guide. We will publicly announce any such modifications.

The Reference Guide is not provided as the basis for any professional advice or for transactional use. GRESB and its advisors, consultants, and sub‑contractors shall not be responsible or liable for any advice given to third parties, any investment decisions or trading, or any other actions taken by you or by third parties based on information contained in the Reference Guide.

Except where stated otherwise, GRESB is the exclusive owner of all intellectual property rights in all the information contained in the Reference Guide.

The Real Estate Standard and Reference Guide provides a comprehensive explanation of the reporting requirements for each indicator of the GRESB Real Estate Assessment. It reflects the structure of the assessment itself, which participants should complete within the GRESB Assessment Portal.

The Reference Guide is complemented by the Scoring Document, which explains each indicator’s scoring methodology. Together, these documents help GRESB Participants understand the assessment criteria, meet reporting requirements, and interpret their scores effectively.

For more information about GRESB, please contact info@helpdesk.gresb.com.

For additional guidance in completing the assessment and interpreting its results, refer to Appendix 3.

The GRESB Real Estate Assessment is the global standard for ESG benchmarking and reporting for listed property companies, private property funds, developers, and investors that invest directly in real estate. The methodology is consistent across different regions and investment vehicles, and it aligns with international reporting frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), and Principles for Responsible Investment (PRI).

The Real Estate Assessment generates two overarching benchmarks: the GRESB Real Estate Standing Investments Benchmark, which comprises participants completing both the Management and Performance Components, and the GRESB Development Benchmark, which comprises participants completing both the Management and Development Components.

Choosing the assessment components to submit is at the participant’s discretion.

While most GRESB Participants complete two assessment components (for either the Standing Investments Benchmark or the Development Benchmark), some choose to only complete the Management Component in their first years of participation.

In cases where an entity has both standing investments and development projects and considers itself both an operator of buildings and involved in development activities, it is highly recommended to participate in both benchmarks, which means completing all three components. As a result, participants will receive two GRESB Scores, two GRESB Ratings, two Peer Groups, etc., capturing how an entity approaches its respective activities in both benchmarks. For more information on the results metrics included in the Benchmark Report, refer to How to Read your Benchmark Report.

Each indicator in the assessment is allocated to one of the three sustainability dimensions (E‑ environmental; S‑ social; G‑ governance):

| E | S | G | |

|---|---|---|---|

| Management | 0% | 34% | 66% |

| Performance | 89% | 11% | 0% |

| Development | 73% | 21% | 6% |

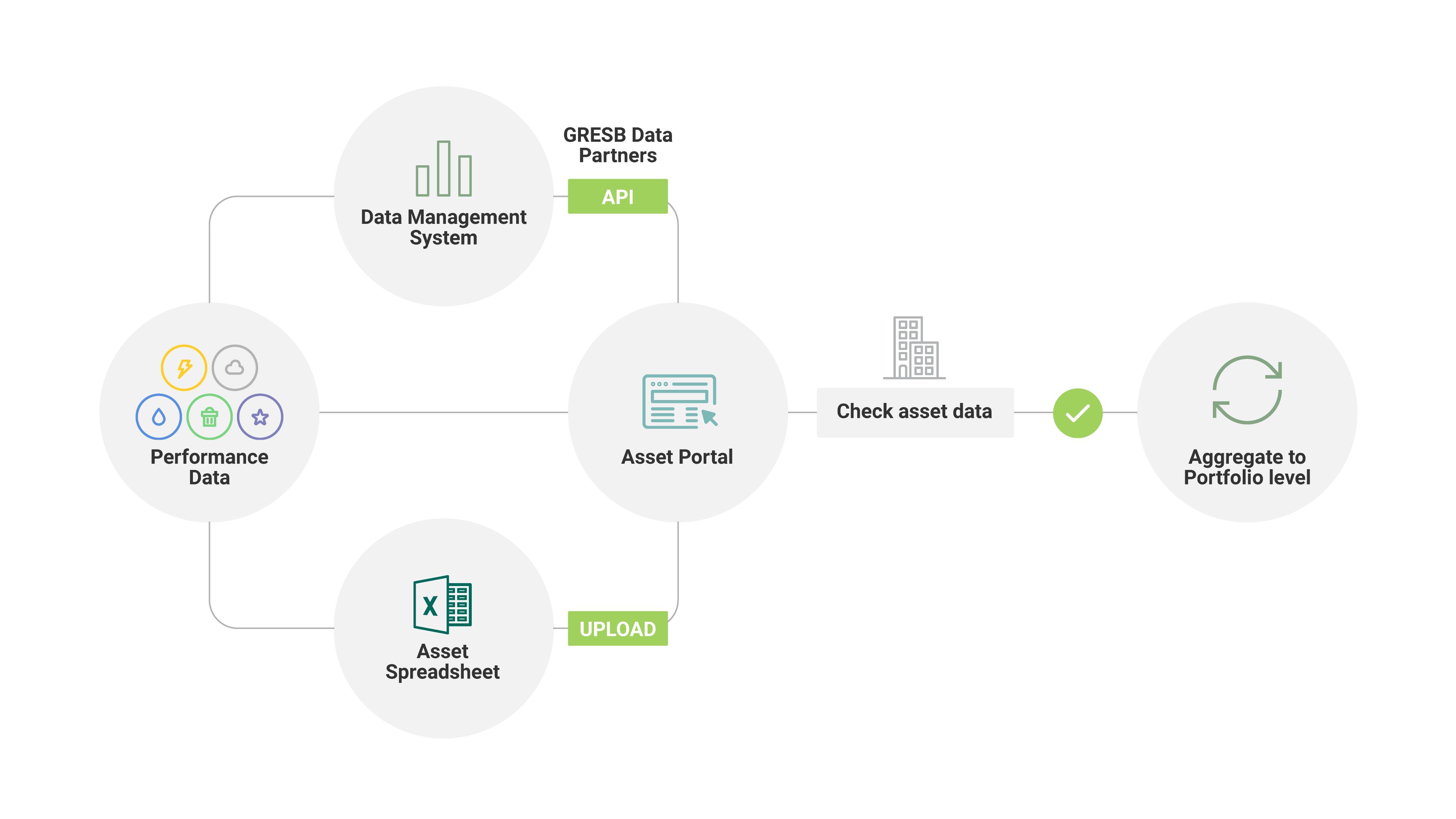

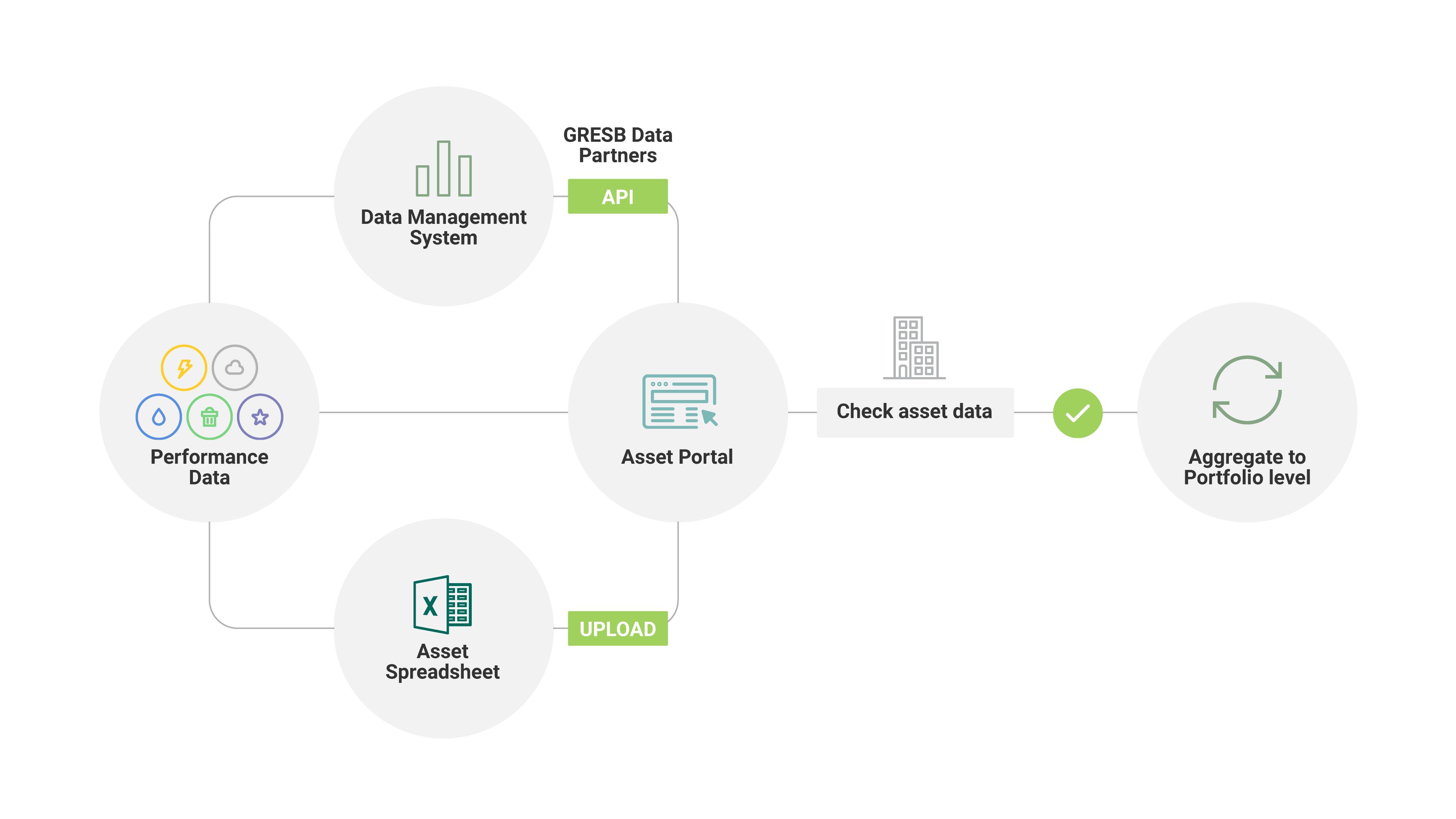

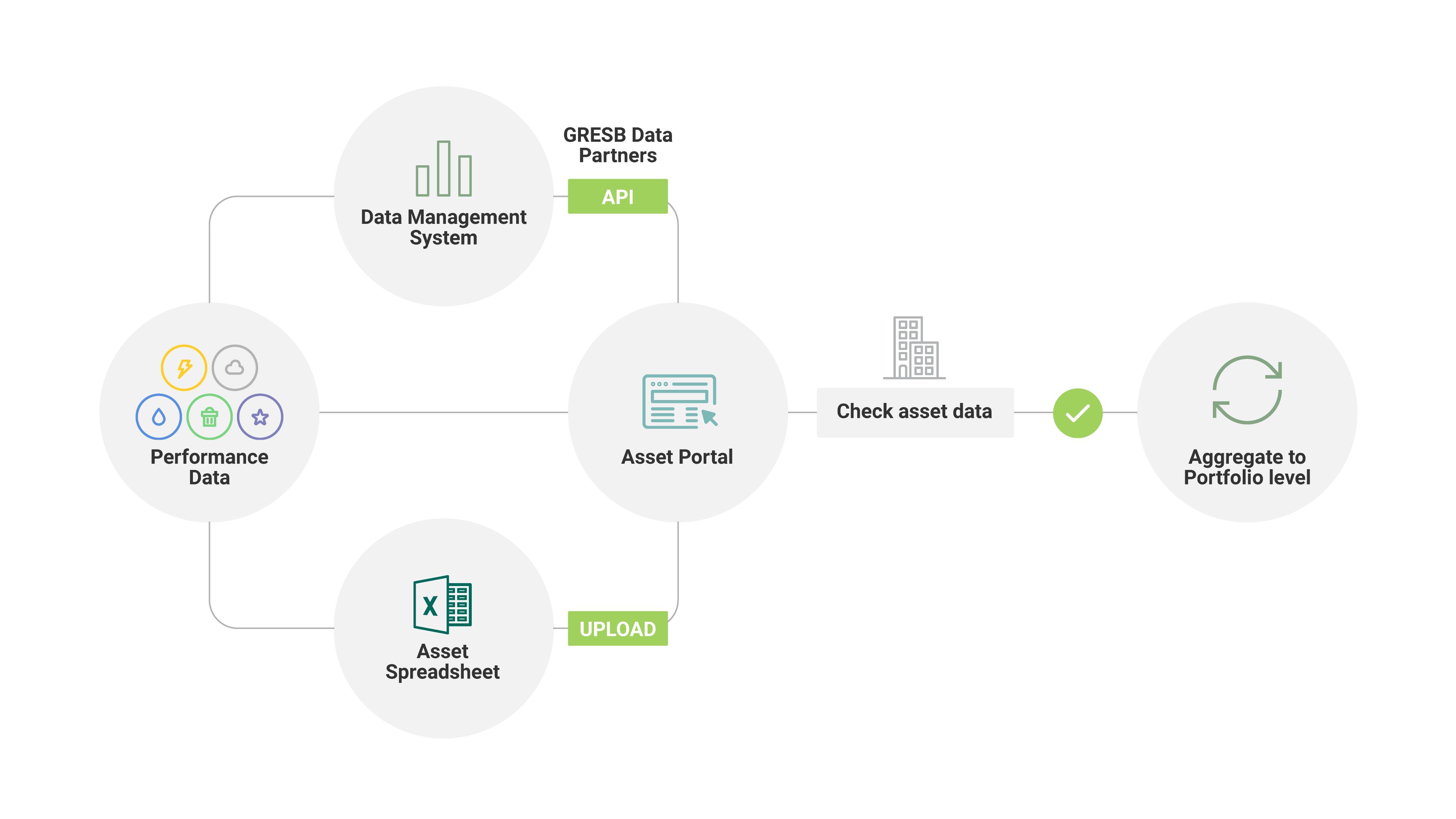

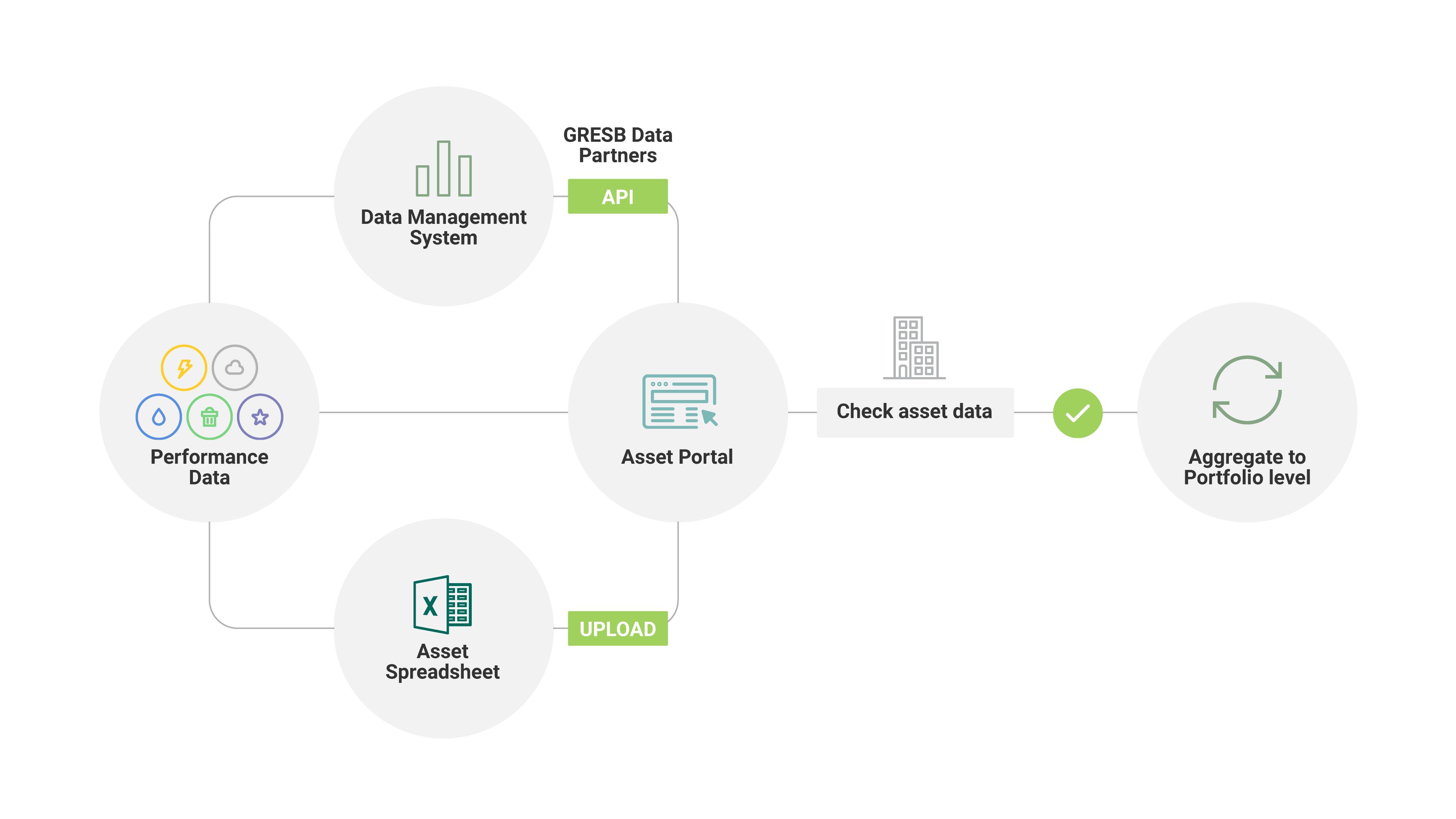

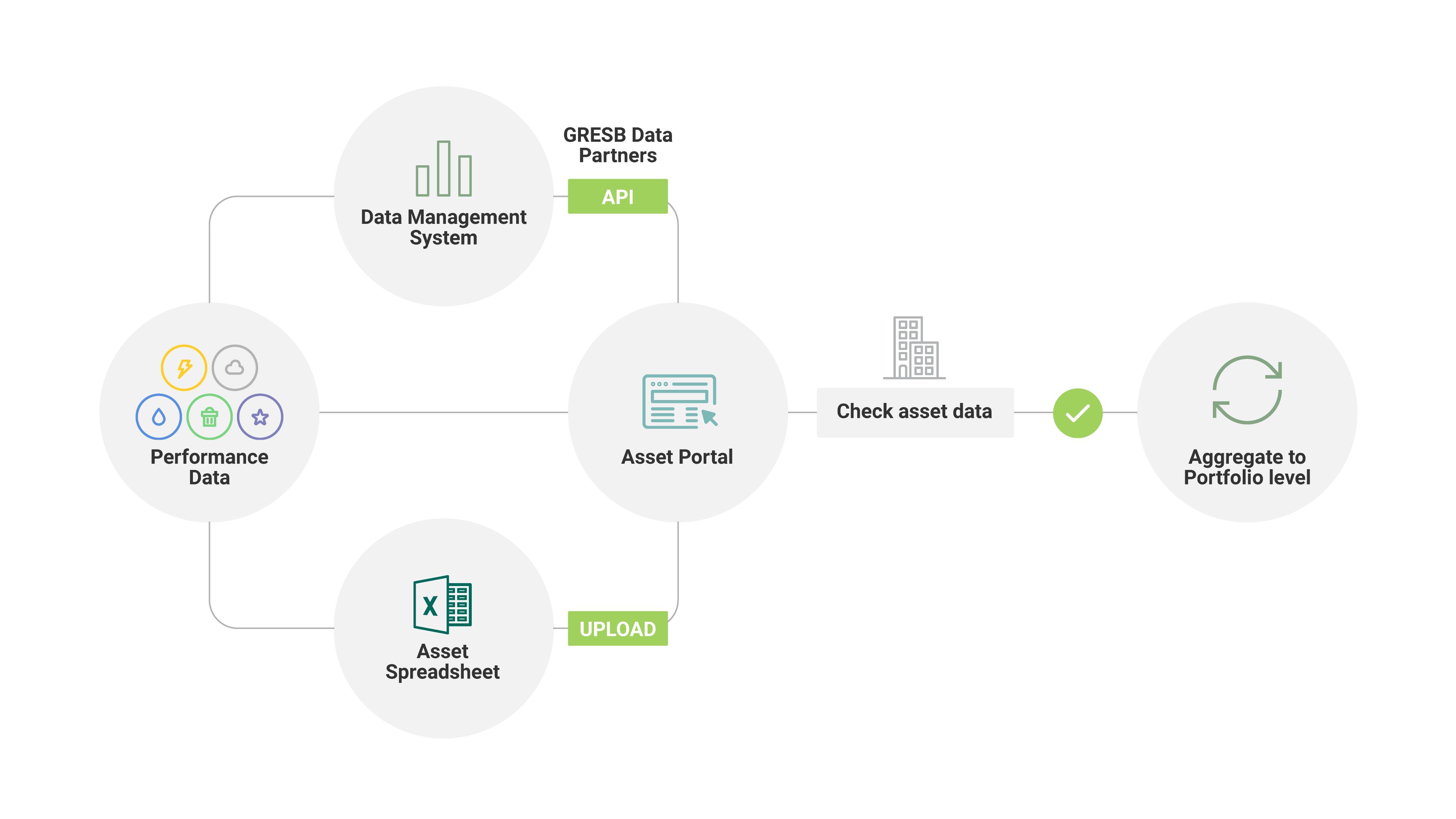

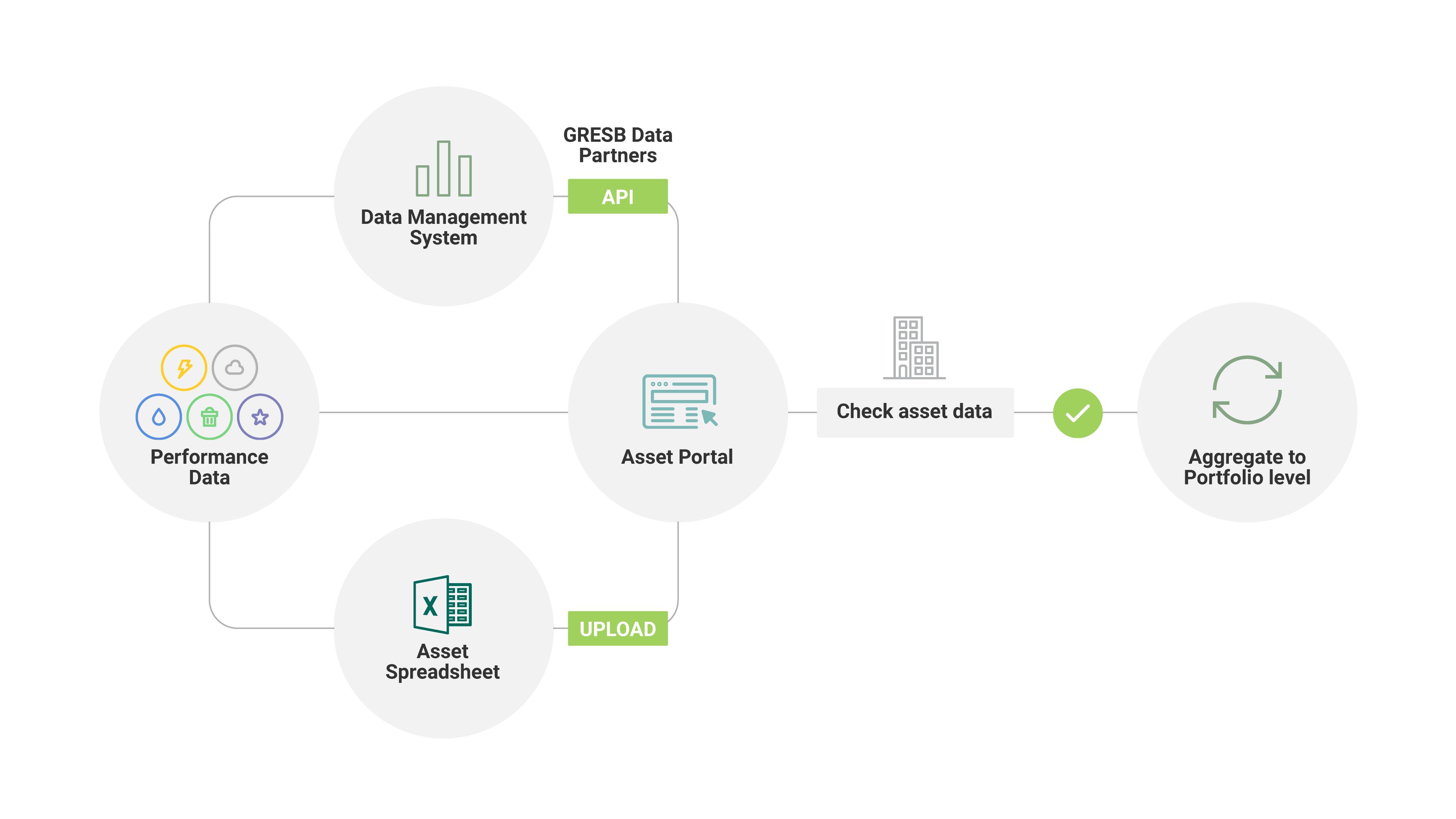

Every indicator is identified by a short title (e.g. ESG Objectives) and a code (e.g. LE2). All indicators include a primary question that can be answered with ‘Yes,’ ‘No,’ or 'Not Applicable' except for indicators in the Performance Component that are answered with asset-level data and that must be reported through the Asset Spreadsheet or the asset workspace in the GRESB Portal (referred to as the “Asset Portal”).

Scoring details can be found in the Scoring Document.

Response types for each indicator may use one or more of the following elements:

A concise summary of the GRESB Real Estate Assessment indicators and their corresponding reporting and evidence requirements can be found here.

The GRESB Real Estate Assessment provides investors with actionable information and tools to monitor and manage the sustainability-related risks and opportunities of their investments and to prepare for increasingly rigorous ESG-related obligations. Assessment participants receive comparative business intelligence on where they stand against their peers, a roadmap with the actions they can take to improve their ESG performance, and a communication platform to engage with investors. Participants who submit the Real Estate Assessment will receive a Benchmark Report.

Participants can purchase additional products and services, such as a Results Consultation, via the GRESB Portal following the results release to clarify outcomes and identify improvement opportunities.

The Assessment Portal opens on April 1. The submission deadline is July 1 (23:59:59 PST), providing participants with a three‑month window to complete the assessment. This is a fixed deadline, and GRESB will not accept submissions received after this date.

GRESB releases preliminary results to participants on September 1. In September, during the Review Period, participants can submit an Assessment Correction request to GRESB to amend any incorrect or incomplete data point.

GRESB launches the final results to GRESB Participant and Investor Members on October 1. For more information about the assessment timeline, click here.

GRESB requires property companies and funds to report on their whole portfolio for both the Performance and Development Components. This includes all real estate assets (operational and development) that were held during the reporting year, including those that were sold or purchased.

Participants must report on all standing investments that were part of their portfolio, regardless of the percentage of ownership or operational control, including those sold or purchased during the reporting year. However, vacant land, dormant assets, cash, ground leases, or other non–real estate assets owned by the entity are excluded from this requirement.

Assets that were owned for only one day during the reporting year should be excluded from the reporting scope.

A standing investment is an asset owned by the reporting entity that has completed construction and is not under major renovation. The primary purpose of owning the asset must be to generate income or the asset must be actively consuming resources. Examples of assets that consume resources without the primary goal of generating rental income include security and monitoring centres, water treatment or irrigation pump stations, boiler or chiller plants serving multiple buildings, playgrounds, fitness centres in residential or mixed-use buildings, and maintenance sheds.

A dormant asset is defined as a property that is entirely non-operational during the reporting period and, as such, neither consumes energy or water nor generates emissions or waste. This designation applies primarily to assets marked for major redevelopment or similar inactive status. Assets consuming residual resources, such as standby energy for minimal operations, do not qualify as dormant and must be included in the Performance Component. The dormant classification applies strictly to assets without any operational activity or resource use.

GRESB distinguishes between landlord and tenant controlled areas in the Energy, GHG Emissions, Water, and Waste aspects of the Performance Component. GRESB has done so in recognition of the fact that landlords of tenant-controlled areas may have little or no control over the use or purchase of utilities for the asset or over waste management practices.

GRESB does not specifically distinguish between landlord- and tenant-controlled areas outside of the Energy, GHG Emissions, Water, and Waste aspects.

GRESB requires participants to report assets under design, new construction, and major renovation projects that were in progress by the end of the reporting year, as well as projects that were completed during the reporting year. Participants should exclude vacant land, cash, projects funded through forward funding or purchase funds, and other non–real estate assets owned by the entity.

For assets under design, participants are required to report these in the Assessment as soon as all mandatory parameters are available. These parameters include the property sub-type, location, floor area (GFA), and the asset's contribution to the fund-level GAV, ensuring accurate reporting of % GAV values in indicator DR1 of the GRESB Real Estate Assessment.

New construction includes all activities to obtain or change building or land use permissions and financing. It includes construction work for the project with the intention of enhancing the property’s value. The development of new buildings and additions to existing buildings that affect usable space can be treated as new construction. New construction projects refer to buildings that were under construction at any time during the reporting year.

Major renovations involve alterations that affect more than 50 percent of the total building floor area or cause the relocation of more than 50 percent of regular building occupants. Major renovation projects refer to buildings that were under construction at any time during the reporting year.

Participants are required to report on all assets held as part of a joint venture, joint operation, or joint ownership, regardless of whether they have direct operational control over an asset. There are two primary types of joint ventures and each should be reported as follows:

In both cases, participants must report on any measures taken for these assets, even if the joint arrangement limits the participant’s direct operational control. This ensures that investors are aware of the associated risks and exposure.

If an asset is part of multiple portfolios managed by the same fund manager, it should be treated as a joint venture in each portfolio, following the rules outlined above.

Information provided in the Entity and Reporting Characteristics aspect identifies the reporting entity's characteristics that remain constant across different reporting years.

EC1

Reporting entity

Entity name: ____________

Fund Manager Organization Name (if applicable): ____________

Identify the participating entity. This information will be displayed in the GRESB Portal and in the entity’s Benchmark Report(s).

Complete all applicable fields.

Entity manager (organization) name: Legal name of the organization that manages the entity (typically applicable for non-listed entities only).

Entity name: Fund or company name of the investable entity for which the Assessment is submitted. In the case of listed companies, the entity name is the legal name of the organization, also used for identification on international stock exchanges. In the case of non-listed entities, the entity name identifies the investable portfolio for which the Assessment is submitted.

EC2

Nature of ownership

Public (listed on a Stock Exchange) entity

Specify ISIN: ____________

Legal status:

Property company

Real Estate Investment Trust (REIT)

Private (non-listed) entity

Investment style:

Core

Value-added

Opportunistic

Debt

Social/Affordable Housing

Open or closed end:

Open end

Closed end

Type of investment vehicle:

Club Deal

Direct Investment

Fund

Joint Venture (JV)

Separate Account

Special Purpose Vehicle

Government entity

Legal Entity Identifier (optional): ____________

Describe the ownership status and characteristics of the participating entity.

Select one of the options and select all applicable sub-options. Entities reporting to GRESB are expected to represent investable vehicles, and these entities are expected to represent all real estate assets held by the vehicle (i.e., the whole portfolio).

If two or more listed companies merge into one entity during the reporting year, report on the structure, policies and procedures of the newly formed entity as of the end of the reporting year.

Note: GRESB Real Estate Investor Members that invest in listed real estate securities have access to the results of all listed entities that participate in the GRESB Real Estate Assessment. Publicly traded closed-end funds should be considered as non-listed entities given their level of disclosure requirements.

Closed end fund: An investment vehicle with a fixed amount of capital. Limited liquidity, with the redemption of units provided for at the end of the life of the vehicle.

Club Deal An investment vehicle or structure with generally a limited number of investors investing in a common strategy. Typically, investors have more discretion and control than in a typical fund, and have veto rights over major decisions.

Core: An entity that includes a preponderance of core attributes; the entity as a whole will have low leasing exposure and low leverage. A low percentage of non-core assets is acceptable. As a result, such portfolios should achieve relatively high-income returns and exhibit relatively low volatility. Low-risk entities that invest in stabilized, income producing property, which is typically held for 5 to 10 years and have limited acquisition/disposal activity after the fund has been invested. Assets in core funds are characterized by stable income returns with less capital growth.

A Core Plus fund invests in similar style assets but adopts a more aggressive management style. Core Plus entities are considered Core for the purposes of the GRESB Assessment.

Debt: A fund or similar entity that has been set up for the purposes of issuing or investing in loans or bonds.

Direct Investment: The purchase of a controlling interest or a minority interest of such size and influence that active control is a feasible objective.

Fund or vehicle: Terms used to describe a structure where at least three investors’ capital is pooled together and managed as a single entity with a common investment aim. For the purposes of these definitions, these terms can be used interchangeably.

Government entity: A real estate portfolio managed by a government agency (e.g. U.S. General Services Administration, GSA). Government portfolios are formed of publicly owned, publicly managed and publicly leased properties.

ISIN: International Securities Identification Number. ISINs are assigned to securities to facilitate unambiguous clearing and settlement procedures. They are composed of a 12-digit alphanumeric code and act to unify different ticker symbols, which can vary by exchange and currency for the same security. In the United States, ISINs are extended versions of 9-character CUSIP codes.

Joint Venture: A vehicle where at least two parties share a common investment objective. Control over significant risk management decisions is not transferred to an external manager, but is exercised by members in the venture.

LEI The Legal Entity Identifier (LEI) is a unique global identifier for legal entities participating in financial transactions. Also known as an LEI code or LEI number, its purpose is to help identify legal entities on a globally accessible database.

Open end fund: An investment vehicle with a variable and unlimited amount of capital. Investors may purchase or redeem units or shares from the vehicle as outlined in contractual agreements.

Opportunistic: An entity of preponderantly non-core investments that is expected to derive most of its return from appreciation/ depreciation and/ or which is expected to and may exhibit significant volatility in returns. This volatility may be due to a variety of characteristics, such as exposure to development, significant leasing risk, high leverage, or a combination of moderate risk factors. High-risk entities that invest in greater yielding assets; for example, developments without pre-leasing, properties involving significant repositioning or that are distressed, and large portfolio acquisitions, purchased to be re-packaged and sold in smaller lot sizes. Opportunity funds generally maintain higher leverage limits and have shorter holding periods for assets.

Private entity: A company or fund that is not a listed or traded on any stock exchange. Also known as non-listed entities or private portfolios.

Public entity: A company that is publicly listed and traded on a recognized stock exchange, such as Nasdaq or NYSE. Also known as "listed entities”.

REIT: A Real Estate Investment Trust is an investment vehicle for real estate that is comparable to a mutual fund. Listed REITs are traded on a stock exchange.

Separate Account: SMAs, also referred to as managed accounts, wrap accounts or individually managed accounts, are portfolios managed exclusively for the investor according to their investing and tax preferences and requirements. The investor owns the underlying assets directly, unlike a mutual fund.

Social/Affordable Housing An entity that generally focuses on the social/affordable housing sector for its investments. Affordable housing refers to housing units that are affordable to buy or rent by the low-income section of a society (for example, whose income is below median household income). Affordability is defined with a maximum percentage of gross income which may differ from country to country and depending on whether this is a percentage of net, gross, individual or household income.

Special Purpose Vehicle Subsidiary created by a parent company to isolate financial risk. Its legal status is of a separate company, with its own balance sheet.

Value-added: An entity that generally includes a mix of core investments and non-core investments that will have less stable income streams. The entity as a whole is likely to have moderate lease exposure and moderate leverage. As a result, such entities should achieve a significant portion of the return from appreciation/ depreciation and are expected to exhibit moderate volatility.

Moderately higher-risk entities that typically engage in “forms of active management, such as tenant lease-up, repositioning or redevelopment, to generate returns through adding value to the investment properties”.

EC3

Entity commencement date

![[Year]](/images/tables/year/y2024-7140a687.svg)

Describe the activity year of commencement or establishment date of the entity.

Provide the year of commencement/establishment.

Year of commencement: The year in which the reporting entity began investing in the market. If a listed entity is delisted (i.e., taken private) but remains under the same management, the date of original commencement can be used for “date of first closing” for the new non-listed entity. If the entity is taken private by a new management company, the first day of closing should be the date of privatization. This information is not used for scoring and used for context only; portfolio vintage may affect the ability to implement ESG policies and strategies.

Year of establishment: A date specified by the manager on which the vehicle is launched, the initial capital subscription is completed, and the commitment period commences.

EC4

Reporting year

Calendar year

Fiscal year

Specify the starting month Month

Set the entity’s annual reporting year.

Select one of the options.

Participants are required to specify the starting month of their fiscal year. If participants select Fiscal year, starting months between February and June must correspond to calendar years 2024/2025. For example, an entity reporting from April to March will be considered covering the period of April 2024 - March 2025. On the other hand, starting months between July and December must correspond to calendar years 2023/2024. For example an entity reporting from October to September will be considered as covering the period of October 2023 - September 2024.

The table below details the period for which information throughout the Assessment would be expected, should a given starting month be selected:

| Starting month | Reporting Year |

|---|---|

| January | Select "Calendar Year" |

| February | Feb 2024 - Jan 2025 |

| March | Mar 2024 - Feb 2025 |

| April | Apr 2024 - Mar 2025 |

| May | May 2024 - Apr 2025 |

| June | Jun 2024 - May 2025 |

| July | Jul 2023 - Jun 2024 |

| August | Aug 2023 - Jul 2024 |

| September | Sept 2023 - Aug 2024 |

| October | Oct 2023 - Sept 2024 |

| November | Nov 2023 - Oct 2024 |

| December | Dec 2023 - Nov 2024 |

Calendar year: January 1 – December 31.

Fiscal year: The period used to calculate annual financial statements. Depending on the jurisdiction the fiscal year can start on April 1, July 1, October 1, etc.

Reporting year: Responses provided in the Assessment must refer to the reporting year identified in this indicator and should correspond to the most recently closed calendar year / fiscal year, as applicable. A response to an indicator must be true at the close of the reporting year; however, the response does not need to have been true for the entire reporting year. GRESB does not favour the use of calendar year over fiscal year or vice versa, as long as the chosen reporting year is used consistently throughout the Assessment.

RC1

Reporting currency

Values are reported in: Currency

Set the currency for which the entity’s real estate portfolio of assets is denominated.

State the currency used by the entity for Assessment indicators that require a monetary value as a response.

Other: State the other currency form.

RC2

Economic size

What was the gross asset value (GAV) of the portfolio at the end of the reporting year in millions?

________________________

Gross Asset Value (“GAV”) is a metric used in GRESB data analysis to identify the size of the portfolio.

Complete the GAV field in millions (e.g., a GAV of $75,000,000 must be reported as 75).

Do not include a currency, as this has been reported in indicator RC1 above, but make sure the currency applied for GAV reporting is consistent with indicator RC1.

The value provided should be the GAV of the real estate portfolio at the end of the reporting year, and should include Development projects(if any) and need to reflect the percentage of financial ownership the entity has for each asset when calculating the economic size. Do not include the GAV of assets sold before the end of year.

As an alternative to GAV, you may report using the market value, the fair value or Net Asset Value (NAV) of the portfolio, at the end of the reporting year.

GAV: Gross Asset Value.

RC3

Floor area metrics

Metrics are reported in:

m2

sq. ft.

Metrics are needed to ensure comparability for benchmarking and reporting purposes. Set the reporting units used by the entity.

Select one of the options, and use it consistently when reporting the floor area of the portfolio.

RC4

Property type and Geography

Portfolio predominant location (*): Location

Portfolio predominant property type (**): Property type

Provide information on the entity's portfolio location and property type composition. This indicator is used for reporting purposes only. For participants that submit the Performance Component, the portfolio composition reported in indicator R1 will be used to determine the predominant location and property type for the entity.

Select the predominant location in which the entity’s investments are located and the predominant property type of the portfolio using the fraction of total GAV or net operating income (NOI).

For further details, refer to Appendix 5 – Property Types Classification.

Note: The predominant country drop-down menu includes less granular options, such as sub-regions, regions, and "Globally Diversified". The predominant property type list also includes property sectors. If an entity has a diversified portfolio, please select the "Other" option.

EPRA Best Practices Recommendations on Sustainability Reporting, 3rd version, September 2017: 5.7, Analysis-Segmental-Analysis

RC5

Nature of entity's business

The entity's core business:

Management of standing investments only (continue with Management and Performance Components)

Management of standing investments and development of new construction and major renovation projects (continue with Management, Performance, and Development Components)

Development of new construction and major renovation projects (continue with Management and Development Components)

The entity’s primary business activities during the reporting year is used to determine which GRESB Components are applicable and should be completed. Refer to section Introduction for an overview of the 2025 Assessments Structure.

Select the option applicable to the reporting entity. Refer to section Introduction for an overview of the 2025 Assessments Structure.

Major Renovations: Alterations that affect more than 50 percent of the total building floor area or cause relocation of more than 50 percent of regular building occupants. Major renovation projects refer to buildings that were under construction at any time during the reporting year.

New Construction: Includes all activities to obtain or change building or land use permissions and financing. Includes construction work for the project with the intention of enhancing the property’s value. Development of new buildings and additions to existing buildings that affect usable space can be treated as new constructions. New construction projects refer to buildings that were under construction at any time during the reporting year.

Standing Investments: Real estate properties where construction work has been completed and which are owned for the purpose of leasing and producing rental income. The level of occupancy is not relevant for this definition. Also known as operating buildings.

Management: Leadership

Management: LeadershipThis aspect evaluates how the entity integrates ESG into its overall business strategy. The purpose of this section is to (1) identify public ESG commitments made by the entity, (2) identify who is responsible for managing ESG issues and has decision-making authority; (3) communicate to investors how the entity structures management of ESG issues and (4) determine how ESG is embedded into the entity.

LE1

ESG leadership commitments

Has the entity made a public commitment to ESG leadership standards and/or principles?

Yes

Select all commitments included (multiple answers possible)

General ESG commitments

Global Investor Coalition on Climate Change (including AIGCC, Ceres, IGCC, IIGCC)

International Labour Organization (ILO) Standards

Montreal Pledge

OECD - Guidelines for multinational enterprises

PRI signatory

RE 100

Science Based Targets initiative

Task Force on Climate-related Financial Disclosures (TCFD)

UN Environment Programme Finance Initiative

UN Global Compact

UN Sustainable Development Goals

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Net Zero commitments

BBP Climate Commitment

Net Zero Asset Managers initiative: Net Zero Asset Managers Commitment

PAII Net Zero Asset Owner Commitment

Science Based Targets initiative: Net Zero Standard commitment

The Climate Pledge

Transform to Net Zero

ULI Greenprint Net Zero Carbon Operations Goal

UN-convened Net-Zero Asset Owner Alliance

UNFCCC Climate Neutral Now Pledge

WorldGBC Net Zero Carbon Buildings Commitment

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

No

LE1

Not scored , G

This indicator assesses the entity's commitment to ESG leadership standards or principles. By making a commitment to ESG leadership standards or principles, an entity publicly demonstrates its commitment to ESG, uses organizational standards and/or frameworks that are universally accepted and may have obligations to comply with the standards and/or frameworks.

Select yes or no. If yes, select all applicable sub-options.

URL: Hyperlink is mandatory for this indicator, but is used for reporting purposes only. Ensure that the hyperlink is not outdated and the relevant page can be accessed within two steps. The URL should demonstrate the existence of publicly available commitments to ESG/Net Zero leadership relating to each of the standards and/or principles selected.

Other: State the other public commitment. Ensure that the other answer provided is not a duplicate of a selected option above. It is possible to report multiple other answers.

This indicator is not subject to automatic or manual validation.

See Appendix 4 - Validation for additional information about GRESB Validation.

Not scored, G

This indicator is not scored and is used for reporting purposes only.

BBP Climate Commitment: The BBP Climate Commitment requires signatories to publish net zero carbon pathways and delivery plans, disclose the energy performance of their assets and develop comprehensive climate resilience strategies.

ESG leadership standards and/or principles: International governmental or organizational standards, principles, frameworks, and/or initiatives that are universally accepted and include a public commitment (i.e., via a public register). These standards are governed independently from commercial interests of one or multiple groups. They are defined in alignment with international frameworks of advancing ESG with accountability and obligations to comply with the standards.

Global Investor Coalition on Climate Change: A collaboration among four regional partner organisations around the world to increase investor education and engagement on climate change and climate-related policies. Launched in 2012, the coalition provides a global platform for dialogue between and among investors and world governments to accelerate low-carbon investment practices, corporate actions on climate risk and opportunities, and international policies that support the goals of the Paris Agreement.

International Labour Organization (ILO) Standards: International labour standards are legal instruments drawn up by the ILO's constituents (governments, employers and workers) and setting out basic principles and rights at work.

Montreal Pledge: Supported by the Principles for Responsible Investment (PRI) and the United Nations Environment Programme Finance Initiative (UNEP FI), the pledge is a commitment by investors to annually measure and publicly disclose their portfolios carbon footprint.

Net Zero Asset Managers initiative: The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius; and to supporting investing aligned with net zero emissions by 2050 or sooner.

Net Zero leadership standards and/or principles: International governmental or organizational standards, principles, frameworks, and/or initiatives that are universally accepted and include a public commitment (i.e., via a public register). These standards are governed independently from commercial interests of one or multiple groups. They are defined in alignment with international frameworks on Net Zero with accountability and obligations to comply with the standards.

OECD - Guidelines for multinational enterprises: The OECD Guidelines for Multinational Enterprises are recommendations addressed by governments to multinational enterprises operating in or from adhering countries. They provide non-binding principles and standards for responsible business conduct in a global context consistent with applicable laws and internationally recognised standards.

PAII Net Zero Asset Owner Commitment: IIGCC’s Paris Aligned Investment Initiative (PAII) looks at how investors can align their portfolios to the goals of the Paris Agreement.

PRI: The PRI works with its international network of signatories to put the six Principles for Responsible Investment into practice. Its goals are to understand the investment implications of environmental, social and governance issues and to support signatories in integrating these issues into investment and ownership decisions.

RE 100: RE100 is a global initiative uniting businesses committed to 100% renewable electricity, working to massively increase demand for and delivery of renewable energy. RE100 is convened by The Climate Group in partnership with CDP.

Science Based Targets initiative: The initiative is a collaboration between CDP, the United Nations Global Compact, World Resources Institute, and the World Wide Fund for Nature (WWF) which has a goal of enabling companies setting science based targets to reduce GHG emissions.

Science Based Targets initiative - Net Zero Standard commitment: The SBTi’s Corporate Net-Zero Standard is a framework for corporate net-zero target setting in line with climate science. It includes the guidance, criteria, and recommendations companies need to set science-based net-zero targets consistent with limiting global temperature rise to 1.5°C.

Task Force on Climate-related Financial Disclosures (TCFD): The Task Force on Climate-related Financial Disclosures will develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.

The Climate Pledge: The Climate Pledge is a commitment to reach net-zero carbon emissions by 2040—10 years ahead of the Paris Agreement.

Transform to Net Zero: Transform to Net Zero aims to deliver guidance and business plans to enable a transformation to net zero emissions, as well as research, advocacy, and best practices to make it easier for the private sector to not only set ambitious goals–but also deliver meaningful emissions reductions and economic success.

ULI Greenprint Net Zero Carbon Operations Goal: The ULI Greenprint goal is to reduce the carbon emissions of its members' collective buildings under operational control to net zero by the year 2050.

UN Environment Programme Finance Initiative: The UNEP FI is a partnership between United Nations Environment and the global financial sector with a mission to promote sustainable finance.

UN Global Compact: The UN Global Compact is a voluntary initiative based on CEO commitments to implement universal sustainability principles and to take steps to support UN goals.

UN Sustainable Development Goals: The Sustainable Development Goals are a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere. The 17 Goals were adopted by all UN Member States in 2015, as part of the 2030 Agenda for Sustainable Development which set out a 15-year plan to achieve the Goals.

UN-convened Net-Zero Asset Owner Alliance: The UN-convened Net-Zero Asset Owner Alliance (NZAOA) is a member-led initiative of institutional investors committed to transitioning their investment portfolios to net-zero GHG emissions by 2050 – consistent with a maximum temperature rise of 1.5°C.

UNFCCC Climate Neutral Now Pledge: Climate Neutral Now encourages and supports organizations and other interested stakeholders to act now in order to achieve a climate neutral world by 2050 as enshrined in the Paris Agreement.

WorldGBC’s Net Zero Carbon Buildings Commitment: The Net Zero Carbon Buildings Commitment (the Commitment) challenges companies, cities, states and regions to reach Net Zero operating emissions in their portfolios by 2030, and to advocate for all buildings to be Net Zero in operation by 2050.

International Labour Organization, International Labour Organization Standards, 2014

Net Zero Asset Managers initiative

OECD Guidelines for Multinational Enterprises

PAII Net Zero Asset Owner Commitment

Science Based Targets initiative

Task Force on Climate-related Financial Disclosures, 2015

ULI Greenprint Net Zero Carbon Operations Goal

UN Global Compact Principles, 2000

UN Sustainable Development Goals

UN-convened Net-Zero Asset Owner Alliance

UNEP Finance Initiative Statement, 1992

LE2

ESG objectives

Does the entity have ESG objectives?

Yes

The objectives relate to (multiple answers possible)

General objectives

Environment

Social

Governance

Issue-specific objectives

Human capital

Health and well-being

The objectives are

Publicly available

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Not publicly available

Communicate the objectives and explain how they are integrated into the overall business strategy (maximum 250 words)

________________________

No

LE2

1 point , G

Clear Environmental, Social, and Governance (ESG) objectives help participants identify material issues and integrate them into the overall day-to-day management practices.

Select yes or no. If yes, select all applicable sub-options.

URL: Hyperlink is mandatory for this indicator when publicly available is selected, but is used for reporting purposes only. Ensure that the hyperlink is not outdated and the relevant page can be accessed within two steps. The URL should demonstrate the existence of publicly available ESG objectives for each of the objectives selected.

Open text box: The content of this open text box is not used for scoring, but will be included in the Benchmark Report. Participants should use this open text box to communicate on

This indicator is not subject to automatic or manual validation.

See Appendix 4 - Validation for additional information about GRESB Validation.

1 point, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Open text box: The open text box is not scored and is for reporting purposes only.

See the Scoring Document for additional information on scoring.

Environmental objectives: Overall goals arising from policies that an entity sets itself to achieve regarding relevant environmental issues, such as greenhouse gas emissions, renewable energy, or sustainable procurement. These objectives should be quantifiable and correlated with the entity's ambitions. The objectives should be quantifiable and correlated with the entity's ambitions. In turn, they determine targets, which are detailed performance requirements necessary to achieve the environmental objectives.

ESG objectives: Strategic priorities and key topics for the management and/or improvement of ESG issues.

Governance objectives: Overall goals arising from policies that an entity sets itself to achieve regarding relevant governance issues, such as bribery and corruption, cybersecurity, or board composition. These objectives should be quantifiable and correlated with the entity's ambitions.

Health and well-being: “Health is a complete state of physical, mental and social well-being, not merely the absence of disease or infirmity” (WHO). Health & well-being is impacted by genetics and individual behavior as well as environmental conditions. Particularly relevant to GRESB stakeholders are the social determinants of health, which are the “conditions in which people are born, grow, work, live and age, and the wider set of forces and systems shaping the conditions of daily life.” These are the conditions that enable or discourage healthy living. This could include issues such as physical activity, healthy eating, equitable workplaces, maternity and paternity leave, access to healthcare, reduction in toxic exposures, etc.

Human capital: Human capital refers to the knowledge, culture, skills, experience, and overall contributions of an organization’s workforce. It encompasses strategies for fairly attracting, developing, and retaining talent, fostering a productive and engaged workplace, and ensuring fair and effective workforce management. Many organizational approaches can contribute to human capital objectives, including talent development & advancement; skills-based hiring & development; and diversity, equity, and inclusion.

Social objectives: Overall goals arising from policies that an entity sets itself to achieve regarding relevant social issues, such as customer satisfaction, employee engagement, or stakeholder relations. These objectives should be quantifiable and correlated with the entity's ambitions.

EPRA Best Practices Recommendations on Sustainability Reporting, 3rd version, September 2017: 5.7, Analysis

SASB (March 2016)-Real Estate Owners, Developers & Investment Trusts: IF0402-05

LE3

Individual responsible for ESG, climate-related, and/or human capital objectives

Does the entity have one or more persons responsible for implementing ESG, climate-related, and/or human capital objectives?

Yes

ESG

Select the persons responsible (multiple answers possible)

Dedicated employee(s) for whom ESG is the core responsibility

Provide the details for the most senior of these employees

Name: ____________

Job title: ____________

Employee(s) for whom ESG is among their responsibilities

Provide the details for the most senior of these employees

Name: ____________

Job title: ____________

External consultants/manager

Name of the main contact: ____________

Job title: ____________

Investment partners (co-investors/JV partners)

Name of the main contact: ____________

Job title: ____________

Climate-related risks and opportunities

Select the persons responsible (multiple answers possible)

Dedicated employee(s) for whom climate-related issues are core responsibilities

Provide the details for the most senior of these employees

Name: ____________

Job title: ____________

Employee(s) for whom climate-related issues are among their responsibilities

Provide the details for the most senior of these employees

Name: ____________

Job title: ____________

External consultants/manager

Name of the main contact: ____________

Job title: ____________

Investment partners (co-investors/JV partners)

Name of the main contact: ____________

Job title: ____________

Human capital

Select the persons responsible (multiple answers possible)

Dedicated employee for whom human capital is the core responsibility

Provide the details for the most senior of these employees:

Name: ____________

Job title: ____________

Employee for whom human capital is among their responsibilities

Provide the details for the most senior of these employees:

Name: ____________

Job title: ____________

External consultant/manager

Name of the main contact: ____________

Job title: ____________

Investment partners (co-investors/JV partners)

Name of the main contact: ____________

Job title: ____________

No

LE3

2 points , G

The intent of this indicator is to identify how the entity has allocated responsibilities for the management of ESG, climate-related risk and opportunities, and human capital. Having personnel dedicated to ESG, climate-related risks and opportunities, and/or human capital, increases the likelihood that the entity’s objectives and performance on these topics will be properly managed.

Select yes or no. If yes, select all applicable sub-options.

An entity can have an employee whose core responsibilities include ESG, Climate-related risks and opportunities, and human capital simultaneously.Details of persons responsible: Participants must provide the name and job title of the relevant person. This information will be used for reporting purposes only.

This indicator is not subject to automatic or manual validation.

See Appendix 4 - Validation for additional information about GRESB Validation.

2 points, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

See the Scoring Document for additional information on scoring.

Dedicated employee(s) for whom climate-related issues are core responsibilities: The employee(s)’ main responsibility is defining, implementing and monitoring the climate-related objectives at entity level.

Dedicated employee(s) for whom human capital is the core responsibility: The employee(s)’ main responsibility is defining, implementing and monitoring the human capital objectives at entity level.

Dedicated employee(s) for whom ESG is the core responsibility: The employee(s)’ main responsibility is defining, implementing and monitoring the ESG objectives at entity level.

Human capital objectives: Strategic priorities and key topics for the management and/or improvement of human capital issues.

Employee(s) for whom climate-related issues are among their responsibilities: The implementation and monitoring of climate-related issues is part of the employee’s role, but is not necessarily their main responsibility.

Employee(s) for whom human capital is among their responsibilities: The implementation and monitoring of human capital issues is part of the employee(s)’ role, but is not necessarily their main responsibility.

Employee(s) for whom ESG is among their responsibilities: The implementation and monitoring of ESG is part of the employee’s role, but is not necessarily their main responsibility.

ESG objectives: Strategic priorities and key topics for the management and/or improvement of ESG issues.

Climate-related objectives: Strategic priorities and key topics for the management and/or improvement of climate-related issues.

External consultants/manager: Organizations or persons to which participants outsource some or all of their ESG strategy and/or implementation.

Investment partners (co-investor/JV partners): A General Partner that co-owns and operates (part of) the entity’s assets and is responsible for implementing ESG objectives at a property level.

Persons responsible: A person or group of people who work on the implementation and completion of the task, project, or strategy.

GRI Sustainability Reporting Standards (2016): 102-20

Recommendations of the Task Force on Climate-Related Financial Disclosures June 2017: Governance A&B

LE4

ESG taskforce/committee

Does the entity have an ESG taskforce or committee?

Yes

Select the members of this taskforce or committee (multiple answers possible)

Board of Directors

C-suite level staff/Senior management

Investment Committee

Fund/portfolio managers

Asset managers

ESG portfolio manager

Investment analysts

Dedicated staff on ESG issues

External managers or service providers

Investor relations

Other: ____________

No

LE4

1 point , G

This indicator identifies the existence of an internal taskforce focused on ESG components, which demonstrates a structured approach towards integrating ESG practices across the entity.

Select yes or no. If yes, select all applicable sub-options.

Other: State the other type of member included in the taskforce. Other answers can include individuals (e.g., HR representative) or groups of individuals (e.g., Product innovation team). Ensure that the other answer provided is not a duplicate of a selected option above (e.g., sustainability team when ‘dedicated staff on ESG issues’ is selected). It is possible to report on multiple other answers. If multiple other answers are acceptable, only one will be counted towards scoring.

See Appendix 4 - Validation for additional information about GRESB Validation.

1 point, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Other: The 'Other' answer is manually validated and points are contingent on the validation decision.

See the Scoring Document for additional information on scoring.

Asset manager: A person or group of people responsible for developing and overseeing financial and strategic developments of real estate investments at asset level.

Board of Directors: A body of elected or appointed members who jointly oversee the activities of a company or organization as detailed in the corporate charter. Boards normally comprise both executive and non-executive directors.

C-suite level staff/Senior management: A team of individuals who have the day-to-day responsibility of managing the entity. C-suite level staff are sometimes referred to, within corporations, as senior management, executive management, executive leadership team, top management, upper management, higher management, or simply seniors.

Dedicated staff on ESG issues: Individuals whose core responsibility is to address ESG issues.

ESG portfolio manager: A person or a group who manages the ESG strategy and implementation of a portfolio of real estate investments.

ESG taskforce/committee: A group of individuals who meet, at least four times per year, to discuss and monitor the implementation of the entity’s ESG objectives.

External managers or service providers: Organizations, businesses or individuals that offer services to others in exchange for payment. These include, but are not limited to, consultants, agents and brokers.

Fund/portfolio manager: A person or a group who manages a portfolio of real estate investments, and the deployment of investor capital, by creating and implementing asset level strategies, across the entire portfolio.

Investment analysts: A person or group with expertise in evaluating financial and investment information, typically for the purpose of making buy, sell and hold recommendations for securities.

Investment committee: A group of selected people who establish a formal process to manage the plan’s investment strategy.

Investor relations: A person or a group that provides investors with an accurate account of company affairs so investors can make better informed decisions.

GRI Sustainability Reporting Standards (2016): 103-32

RobecoSAM Corporate Sustainability Assessment 2017: 3.1.5, Responsibilities & Committees

Recommendations of the Task Force on Climate-Related Financial Disclosures June 2017: Governance A&B

LE5

ESG, climate-related and/or human capital senior decision maker

Does the entity have a senior decision-maker accountable for ESG, climate-related, and/or human capital issues?

Yes

ESG

Provide the details for the most senior decision-maker on ESG issues

Name: ____________

Job title: ____________

The individual’s most senior role is as part of

Board of Directors

C-suite level staff/Senior management

Investment Committee

Other: ____________

Climate-related risks and opportunities

Provide the details for the most senior decision-maker on climate-related issues

Name: ____________

Job title: ____________

The individual’s most senior role is as part of

Board of Directors

C-suite level staff/Senior management

Investment Committee

Other: ____________

Human capital

Provide the details for the most senior decision-maker on human capital:

Name: ____________

Job title: ____________

The individual's most senior role is as part of:

Board of directors

C-suite level staff/Senior management

Investment committee

Other: ____________

Describe the process of informing the most senior decision-maker on the ESG, climate-related, and human capital performance of the entity (maximum 250 words)

________________________

No

LE5

1 point , G

The presence of senior management dedicated to ESG, climate-related risks and opportunities, and/or human capital, increases the likelihood that objectives on these topics will be met. A structured process to keep the most senior decision-maker informed on the entity’s ESG/climate-related/human capital performance increases accountability and encourages continuous improvement.

Select yes or no. If yes, select the applicable sub-option.

Senior decision-maker: The entity’s most senior decision-maker on ESG, climate, and human capital is expected to be actively involved in the process of defining the ESG, climate related and human capital objectives, and should approve associated strategic decisions regarding ESG, climate, and human capital. This person cannot be the same as the individual identified in LE3.

Details of employee: Participants must provide the name and job title of the relevant employee. This information will be used for reporting purposes only.

Open text box: The content of this open text box is not used for scoring, but will be included in the Benchmark Report. Participants should use this open text box to communicate on

Other: State the other senior decision-maker on sustainability issues. The answer should only refer to the department or governance structure of which the senior decision maker is part of. Ensure that the other answer provided is not a duplicate of a selected option above. Report only one other answer. Note that Fund/Portfolio manager cannot be used as an ‘Other’ answer unless a written statement is included in the open text box confirming that the individual is a senior member.

See Appendix 4 - Validation for additional information about GRESB Validation.

1 point, G

Scoring of this indicator is equal to the fraction assigned to the selected option, multiplied by the total score of the indicator.

Other: The 'Other' answer is manually validated and points are contingent on the validation decision.

Open text box: The open text box is not scored and is for reporting purposes only.

See the Scoring Document for additional information on scoring.

Asset manager: A person or group of people responsible for developing and overseeing financial and strategic developments of real estate investments at asset level.

Board of Directors: A body of elected or appointed members who jointly oversee the activities of a company or organization as detailed in the corporate charter. Boards normally comprise both executive and non-executive directors.

C-suite level staff/Senior management: A team of individuals who have the day-to-day responsibility of managing the entity. C-suite level staff are sometimes referred to, within corporations, as senior management, executive management, executive leadership team, top management, upper management, higher management, or simply seniors.

Investment committee: A group of selected people who establish a formal process to manage the plan’s investment strategy.

Person accountable: A person with sign off (approval) authority over the deliverable task, project or strategy. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for climate-related issues: A senior individual with sign off (approval) authority for approving strategic climate-related objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for human capital: A senior individual with sign off (approval) authority for approving strategic human capital objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for ESG: A senior individual with sign off (approval) authority for approving strategic ESG objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

CDP, CC1.1

GRI Sustainability Reporting Standards (2016): 103-32

RobecoSAM Corporate Sustainability Assessment 2017: 3.1.5, Responsibilities & Committees

Recommendations of the Task Force on Climate-Related Financial Disclosures June 2017: Governance A&B

LE6

Personnel ESG performance targets

Does the entity include ESG factors in the annual performance targets of personnel?

Yes

Does performance on these targets have predetermined financial consequences?

Yes

Select the personnel to whom these factors apply (multiple answers possible):

Board of Directors

C-suite level staff/Senior management

Investment Committee

Fund/portfolio managers

Asset managers

ESG portfolio manager

Investment analysts

Dedicated staff on ESG issues

External managers or service providers

Investor relations

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

No

LE6

2 points , G

This indicator identifies whether, and how, ESG issues are addressed in personnel performance targets. It also identifies how the ESG-related objectives outlined in LE2 are reflected within the organizational structure. Including ESG factors in annual performance targets for employees can increase the entity’s capacity to improve ESG performance.

Select yes or no. If yes, select all applicable sub-options.

If the targets and consequences apply to all employees of the entity, select all relevant personnel types in the indicator.

The provided evidence must cover all the following elements:

Existence of ESG-related performance targets: the evidence must demonstrate that annual ESG performance targets are explicitly tied to the selected personnel groups.

Personnel group applicability: targets must relate to all members within the selected personnel groups

Financial consequences tied to ESG performance: the evidence must explain the financial implications (positive or negative) for meeting or failing to meet ESG targets for each selected personnel group. This includes clearly linking the financial consequences (e.g., bonuses, pay adjustments, penalties, promotion or demotion, etc.) to the ESG targets of each selected personnel group. The connection must be clearly defined within the provided documents, open text box, or cover page.

Examples of acceptable evidence: policy documents, process guidelines, employee performance reviews for the reporting year, employment contracts or documentation describing financial consequences (e.g., bonus schemes, web pages). Note that sensitive information may be redacted from the documents as long as the requirements outlined above are clearly met. If the consequences are not clearly defined and connected to the ESG targets within the provided evidence, then sufficient explanation must be provided within the evidence open text box.

Other answers: state the specific employee type and ensure the following:

See Appendix 4 - Validation for additional information about GRESB Validation.

2 points, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Evidence: The evidence is manually validated and points are contingent on the validation decision.

Other: The 'Other' answer is manually validated and points are contingent on the validation decision.

See the Scoring Document for additional information on scoring.

Annual performance targets: Targets set in annual performance reviews, which are assessments of employee performance.

Asset manager: A person or group of people responsible for developing and overseeing financial and strategic developments of real estate investments at asset level.

Board of Directors: A body of elected or appointed members who jointly oversee the activities of a company or organization as detailed in the corporate charter. Boards normally comprise both executive and non-executive directors.

C-suite level staff/Senior management: A team of individuals who have the day-to-day responsibility of managing the entity. C-suite level staff are sometimes referred to, within corporations, as senior management, executive management, executive leadership team, top management, upper management, higher management, or simply seniors.

Dedicated staff on ESG issues: Individuals whose core responsibility is to address ESG issues.

ESG portfolio manager: A person or a group who manages the ESG strategy and implementation of a portfolio of real estate investments.

ESG Factors: Criteria associated with the entity’s ESG objectives.

External managers or service providers: Organizations, businesses or individuals that offer services to others in exchange for payment. These include, but are not limited to, consultants, agents and brokers.

Financial consequences: Predetermined monetary benefits (or detriments) incorporated into the employee compensation structures. Examples include bonuses, raises, profit-sharing, financial rewards, and financial incentives. The financial consequences are contingent upon the achievement of the annual performance targets.

Fund/portfolio manager: A person or a group who manages a portfolio of real estate investments, and the deployment of investor capital, by creating and implementing asset level strategies, across the entire portfolio.

Investment analysts: A person or group with expertise in evaluating financial and investment information, typically for the purpose of making buy, sell and hold recommendations for securities.

Investment committee: A group of selected people who establish a formal process to manage the plan’s investment strategy.

Investor relations: A person or a group that provides investors with an accurate account of company affairs so investors can make better informed decisions.

RobecoSAM Corporate Sustainability Assessment 2017: 3.1.7, Executive Compensation-Success Metrics and Vesting

Management: Policies

Management: PoliciesThis aspect confirms the existence and scope of the entity’s policies that address environmental, social and governance issues.

PO1

Policy on environmental issues

Does the entity have a policy/policies on environmental issues?

Yes

Select all environmental issues included (multiple answers possible)

Biodiversity and habitat

Climate/climate change adaptation

Energy consumption

Greenhouse gas emissions

Indoor environmental quality

Material sourcing

Pollution prevention

Renewable energy

Resilience to catastrophe/disaster

Sustainable procurement

Waste management

Water consumption

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Does the entity have a policy to address Net Zero?

Yes

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

No

PO1

1.5 points , G

This indicator describes the existence and scope of policies that address environmental issues. Policies on environmental issues assist entities with incorporating ESG criteria into their business practices.

Select yes or no. If yes, select all applicable sub-options.

Please refer to Appendix 4 - Validation for General Validation Criteria.

The provided evidence must demonstrate the existence of formal policy document(s) that address(es) each of the selected environmental issues and not simply a list of general goals and/or commitments.

A policy is a guide for action which can serve the purpose of:

Acceptable evidence may include, but is not limited to, an environmental policy document, official documents or links to online resources describing the entity's environmental policy(ies). References such as bullet points or passages within a policy can be provided to describe the goals or ambition for each issue.

The evidence should support each of the selected issues with a relevant document such as an energy consumption policy or a waste management policy. Note that overarching environmental policy documents covering multiple issues must have separate sections/clauses relevant to each of the selected issues.

Evidence provided for Net Zero policy is subject to the same reporting requirements as policies on other environmental issues. The same document can be used to support the existence of a policy addressing Net Zero as well as all other selected environmental issues.

For entities that either achieved full points for any of the indicators PO1, PO2, and PO3 in the previous submission or do not wish to modify their selections or evidence, GRESB allows them to forgo reporting on these indicators, provided the same policies remain in place and the supporting documents remain unchanged. GRESB recognizes that an entity's policies typically remain consistent year over year and are often in place for multiple reporting periods. In such cases, the entity will retain the same validation status and points as in the previous year.

Other: List applicable environmental issues that apply to the entity but are not already listed. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option (e.g. “Recycling” when “‘Waste” is selected). It is possible to report multiple ‘Other’ answers. If multiple ‘Other’ answers are acceptable, only one will be counted towards scoring.

See Appendix 4 - Validation for additional information about GRESB Validation.

1.5 points, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Evidence: The evidence is manually validated and points are contingent on the validation decision.

Other: The 'Other' answer is manually validated and points are contingent on the validation decision.

See the Scoring Document for additional information on scoring.

Biodiversity and habitat: Issues related to wildlife, endangered species, ecosystem services, habitat management, and relevant topics. Biodiversity refers to the variety of all plant and animal species. Habitat refers to the natural environment in which these plant and animal species live and function.

Climate change adaptation: Preparation for long-term change in climatic conditions or climate related events. Examples of climate change adaptation measures can include, but are not limited to: building flood defenses, xeriscaping and using tree species resistant to storms and fires, adapting building codes to extreme weather events.

Energy consumption: the use of energy by the entity.

Feedback sessions: Meetings with individual stakeholders to gather feedback about ESG-specific issues.

Greenhouse gas emissions: GHGs refers to the seven gases listed in the GHG Protocol Corporate Standard: carbon dioxide (CO2); methane (CH4); nitrous oxide (N2O); hydrofluorocarbons (HFCs); perfluorocarbons (PFCs); nitrogen trifluoride (NF3) and sulfur hexafluoride (SF6). They are expressed in CO2 equivalents (CO2e).

Indoor environmental quality: Refers to the conditions inside the building. It includes air quality, access to daylight and views, pleasant acoustic conditions and occupant control over lighting and thermal comfort.

Material sourcing: Responsible sourcing of materials considers the environmental, social and economic impacts of the procurement and production of products and materials.

Net Zero: Net zero means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere.

Policy: Defines a commitment, direction or intention as formally adopted by the entity.

Pollution prevention: Any practice that reduces, eliminates, or prevents pollution. Pollution includes air pollution, noise pollution, light pollution, thermal pollution, land/soil pollution, and water/marine pollution (including groundwater, wastewater, and stormwater). Smoking and/tobacco policy is not a pollution prevention policy/strategy.

Resilience to catastrophe/disaster: Preparedness of the built environment towards existing and future threats of natural disaster (e.g., the ability to absorb disturbances such as increased precipitation or flooding while maintaining its structure). This can be achieved by management policies, informational technologies, educating tenants, communities, suppliers and physical measures at the asset level.

Sustainable procurement: Encourage, facilitate or require the reduction of consumption of goods within the building or premises and/or the sourcing of sustainable or ethical goods. Clauses can relate to reduction of paper consumption, supply of biodegradable materials, use of recycled paper, building materials, etc.

Waste management: Issues associated with hazardous and non-hazardous waste generation, reuse, recycling, composting, recovery, incineration, landfill and on-site storage.

Water consumption: The use of water resources by the entity.

The United Nations Framework Convention on Climate Change, 1994 Global Reporting Initiative

EPRA Best Practices Recommendations on Sustainability Reporting, 3rd version, September 2017: 7.9, Narrative on performance

GRI Sustainability Reporting Standards (2016): GRI, 301, 302, 303, 304, 305, 306, 307; GRI, 416

PO2

Policy on social issues

Does the entity have a policy/policies on social issues?

Yes

Select all social issues included (multiple answers possible)

Child labor

Community development

Customer satisfaction

Employee engagement

Employee health & well-being

Employee remuneration

Forced or compulsory labor

Freedom of association

Health and safety: community

Health and safety: contractors

Health and safety: employees

Health and safety: tenants/customers

Human rights

Human capital

Labor standards and working conditions

Social enterprise partnering

Stakeholder relations

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

PO2

1.5 points , G

This indicator describes the existence and scope of policies that address social issues. Policies on social issues assist entities with incorporating ESG criteria into their business practices.

Select yes or no. If yes, select all applicable sub-options.

The provided evidence must demonstrate the existence of formal policy document(s) that address(es) each of the selected social issues and not simply a list of general goals and/or commitments.

A policy is a guide for action which can serve the purpose of:

Acceptable evidence may include, but is not limited to, a social policy document, official documents or links to online resources describing the entity's social policy(ies). References such as bullet points or passages within a policy, can be provided to describe the goals or ambition for each issue.

The evidence should support each of the selected issues with a relevant document such as an employee health & wellbeing policy, human rights policy, code of conduct, or community investment statement. Note that overarching social policy documents covering multiple issues must have separate sections/clauses relevant to each of the selected issues

For entities that either achieved full points for any of the indicators PO1, PO2, and PO3 in the previous submission or do not wish to modify their selections or evidence, GRESB allows them to forgo reporting on these indicators, provided the same policies remain in place and the supporting documents remain unchanged. GRESB recognizes that an entity's policies typically remain consistent year over year and are often in place for multiple reporting periods. In such cases, the entity will retain the same validation status and points as in the previous year.

Other: List applicable social issues that apply to the entity but are not already listed. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option (e.g. “Collective bargaining agreements” when “‘Freedom of association” is selected). It is possible to report multiple ‘Other’ answers. If multiple ‘Other’ answers are acceptable, only one will be counted in scoring.

See Appendix 4 - Validation for additional information about GRESB Validation.

1.5 points, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Evidence: The evidence is manually validated and points are contingent on the validation decision.

Other: The 'Other' answer is manually validated and points are contingent on the validation decision.

See the Scoring Document for additional information on scoring.

Child labor: Work that children should not be doing because they are too young, or, if they have reached the minimum age, because it is dangerous or otherwise unsuitable for them.

Community development: Actions to minimize, mitigate, or compensate for adverse social and/or economic impacts, and/or to identify opportunities or actions to enhance positive impacts on individuals/groups living or working in areas that are affected/could be affected by the organization's activities.

Customer satisfaction: Customer satisfaction is one measure of an entity's sensitivity to its customers’ needs and preferences and, from an organizational perspective, is essential for long-term success. In the context of ESG, customer satisfaction provides insight into how the entity approaches its relationship with one stakeholder group (customers).

Human capital: Human capital refers to the knowledge, culture, skills, experience, and overall contributions of an organization’s workforce. It encompasses strategies for fairly attracting, developing, and retaining talent, fostering a productive and engaged workplace, and ensuring fair and effective workforce management. Many organizational approaches can contribute to human capital objectives, including talent development & advancement; skills-based hiring & development; and diversity, equity, and inclusion.

Employee engagement: An employee's involvement with, commitment to, and satisfaction with the entity.

Employee health & well-being: The health & well-being of employees responsible for the entity.

Employee remuneration: Remuneration is payment or compensation received for services or employment. This includes a basic salary plus additional amounts such as those based on years of service, bonuses including cash and equity such as stocks and shares, benefit payments, overtime, time owed, and any additional allowances (such as transportation, living and childcare allowances).

Forced or compulsory labor: All work or service which is expected from any person under the menace of any penalty and for which the said person has not offered himself voluntarily.

Freedom of association: Right of employers and workers to form, to join and to run their own organizations without prior authorization or interference by the state or any other entity.

Health & safety: community The health & safety of the community surrounding the entity.

Health and safety: contractors The health and safety of the entity's contractors.

Health and safety: employees The health and safety of employees responsible for the entity.

Health & safety: tenant/customer The health & safety of tenants and customers of the entity.

Human rights: Human rights are rights inherent to all human beings, whatever their nationality, place of residence, sex, national or ethnic origin, colour, religion, language or any other status.

Labor standards and working conditions: Labor standards and working conditions are at the core of paid work and employment relationships. Working conditions cover a broad range of topics and issues, from working time (hours of work, rest periods, and work schedules) to remuneration, as well as the physical conditions and mental demands that exist in the workplace.

Policy: Defines a commitment, direction or intention as formally adopted by the entity.

Social enterprise partnering: Entity’s partnerships with organizations that have social objectives which serve as the primary purpose of the organization.

Stakeholder relations: Stakeholder relations is the practice of forging mutually beneficial connections with third-party groups and individuals that have a stake in common interest.

EPRA Best Practices Recommendations on Sustainability Reporting, 3rd version, September 2017: 7.9, Narrative on performance

GRI Sustainability Reporting Standards (2016): GRI, 301, 302, 303, 304, 305, 306, 307; GRI, 416

ILO Declaration on Fundamental Principles and Rights at Work

World Health OrganizationPO3