Reporting entity

Entity Name: ____________

Fund Manager Organization Name (May be same as entity name): ____________

The GRESB Infrastructure Fund Assessment Reference Guide (“Reference Guide”) accompanies the GRESB Infrastructure Fund Assessment and is published both as a standalone document and in the GRESB Portal alongside each assessment indicator. The Reference Guide reflects the opinions of GRESB and not of our members. The information in the Reference Guide has been provided in good faith and is provided on an “as is” basis. We take reasonable care to check the accuracy and completeness of the Reference Guide prior to its publication. While we do not anticipate major changes, we reserve the right to make modifications to the Reference Guide. We will publicly announce any such modifications.

The Reference Guide is not provided as the basis for any professional advice or for transactional use. GRESB and its advisors, consultants, and sub‑contractors shall not be responsible or liable for any advice given to third parties, any investment decisions or trading, or any other actions taken by you or by third parties based on information contained in the Reference Guide.

Except where stated otherwise, GRESB is the exclusive owner of all intellectual property rights in all the information contained in the Reference Guide.

The Infrastructure Fund Reference Guide provides a comprehensive explanation of the reporting requirements for each indicator of the GRESB Infrastructure Fund Assessment. It reflects the structure of the assessment itself, which participants should complete within the GRESB Portal.

The Reference Guide is complemented by the Scoring Document, which explains each indicator’s scoring methodology. Together, these documents help participants understand the assessment criteria, meet reporting requirements, and interpret their scores effectively.

For more information about GRESB, please contact info@helpdesk.gresb.com.

For additional guidance in completing the assessment and interpreting its results, refer to Appendix 3.

The GRESB Infrastructure Assessments are the global standard for ESG benchmarking and reporting for institutional investors, fund managers, infrastructure companies, and asset operators working in the infrastructure space. The methodology is consistent across different regions, investment vehicles, and asset types, and it aligns with international reporting frameworks, such as Task Force on Climate-Related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), and Principles for Responsible Investment (PRI).

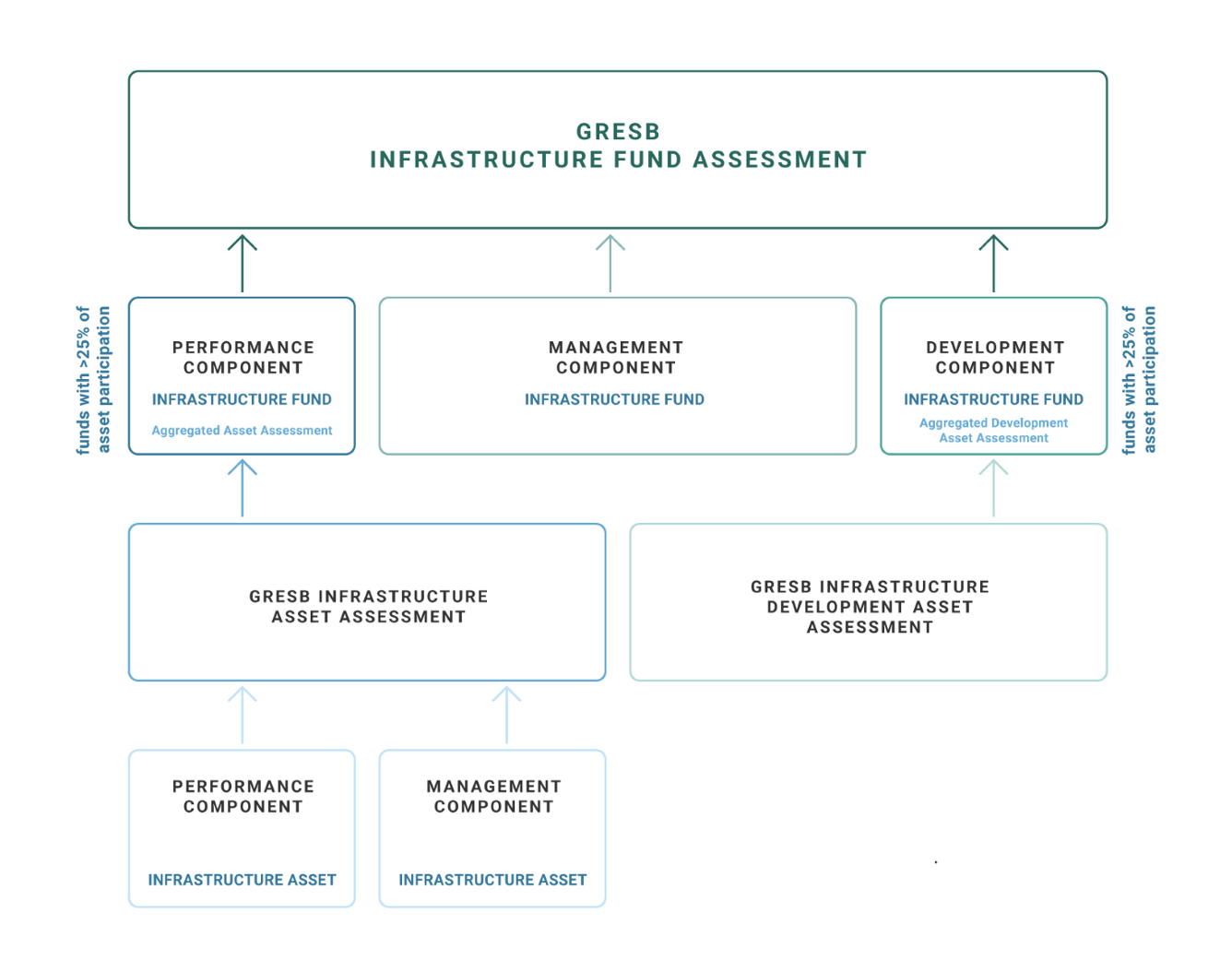

There are three complementary GRESB Infrastructure Assessments: a Fund Assessment, an Asset Assessment, and a Development Asset Assessment. The Fund Assessment is intended for infrastructure funds and portfolios of assets, while the Asset Assessment and the Development Asset Assessment are meant to be completed by the individual underlying assets (portfolio companies). All assessments cover the full breadth of infrastructure sectors, including:

Infrastructure funds, portfolios and companies can participate in the Fund Assessment. Common examples of infrastructure funds include:

Fund managers complete the Fund Assessment to describe their investment management and engagement processes and performance. Additionally, we encourage funds to participate with their underlying assets participating in the Asset Assessment and Development Asset Assessment.

The Infrastructure Fund Assessment is made of only one Management Component. The Infrastructure Asset and Development Asset Assessments, which funds’ underlying assets complete, include Performance and Development Components (respectively) that may contribute to a fund’s overall GRESB Score.

All funds must complete the Management Component. The Management Component measures the entity’s strategy and leadership management, policies and processes, risk management, and stakeholder engagement approach. It is framed at the organizational level and is suitable for any type of infrastructure fund.

The Management Component of the Infrastructure Asset Assessment consists of 24 indicators across 6 aspects:

Funds completing the Management Component will obtain a Management Score— Infrastructure Fund.

Performance and Development Components

Funds do not complete a Performance or a Development Component themselves. Instead, the underlying assets of the fund complete them.

If more than 25% of the fund’s underlying assets complete the Infrastructure Asset Assessment and/or Infrastructure Development Asset Assessment, the scores of these assets are averaged and the fund will obtain a Performance Score - Infrastructure Fund

If more than 25% of the fund’s underlying assets complete the Infrastructure Development Asset Assessment and are linked to the fund in the GRESB Portal, the scores of these development assets are averaged and the fund will obtain a Development Score – Infrastructure Fund.

Together, the Performance and Development Scores join with the fund’s Management Score to create the premier measurements of ESG performance:

In cases where a fund’s portfolio is comprised of both operational and development assets and it meets the 25% participation threshold for both asset assessments, it will receive two scores, two GRESB ratings, two peer groups, etc., capturing how an entity approaches its respective activities in both benchmarks.

* For more information on the results metrics included in the Benchmark Report, refer to How to Read your Benchmark Report.

Each indicator is allocated to one of the three sustainability dimensions (E‑ environmental; S‑ social; G‑ governance):

| E | S | G | |

|---|---|---|---|

| Fund Assessment | 4% | 18% | 78% |

Every indicator has a short title (e.g. ESG Specific Objectives) and a code (e.g. LE3). These are usually followed by a primary question that can be answered with ‘Yes’ or ‘No.’ Performance Component indicators also require participants to input quantitative data in a tabular format.

When selecting ‘Yes,’ participants are required to provide further information by selecting one or more options. When selecting 'No,’ participants may not select any additional sub-options. Participants should select all options that accurately describe the organizational activities. Indicators that require an additional upload of supporting evidence are highlighted at the bottom of the indicator. A list of manually validated indicators can also be found in Appendix 4. Scoring details can be found in the Scoring Document.

Response options for each indicator may use one or more of the following five core elements: radio buttons, checkboxes, performance tables, ’Other’ answers, and open text boxes. These elements are explained below:

A concise summary of the GRESB Infrastructure Asset Assessment indicators and their corresponding reporting and evidence requirements can be found here.

The GRESB Infrastructure Fund Assessment provides investors with actionable information and tools to monitor and manage the ESG-related risks and opportunities of their investments, and to prepare for increasingly rigorous ESG obligations. Assessment participants receive comparative business intelligence on where they stand against their peers, a roadmap with the actions they can take to improve their ESG performance, and a communication platform to engage with investors. Participants that submit the Infrastructure Fund Assessment will receive a Benchmark Report.

Participants can purchase additional products and services, such as a Results Consultation, via the GRESB Portal following the results release to clarify outcomes and identify improvement opportunities.

The Assessment Portal opens on April 1. The submission deadline is July 1 (23:59:59 PST), providing participants with a three-month window to complete the assessment. This is a fixed deadline. GRESB will not accept submissions received after this date.

GRESB releases preliminary results to participants on September 1. In September, during the Review Period, participants can submit an Assessment Correction request to GRESB to amend any incorrect or incomplete data point. More information can be found here.

GRESB launches the final results to GRESB Participant and Investor Members on October 1. For more information about the assessment timeline, click here.

Information provided in the Entity and Reporting Characteristics consists of two parts:

Entity characteristics: Identifies the reporting entity's characteristics that remain constant across different reporting periods (year-on-year).

Reporting characteristics: Describe the entity, define the reporting scope for the current reporting year and determines the structure of the Assessment submission.

EC1

Reporting entity

Entity Name: ____________

Fund Manager Organization Name (May be same as entity name): ____________

EC1

Identify the reporting (participating) entity. The entity name will be used to identify the entity on the GRESB portal and will be displayed in the entity’s Benchmark Report.

Complete all applicable fields.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Entity name: Name of the fund or portfolio for which the Assessment is submitted. In the case of listed funds, the entity name is the legal name of the fund, also used for identification on international stock exchanges. In the case of non-listed entities, the entity name identifies the investable fund or portfolio for which the Assessment is submitted.

Fund Manager Organization name (May be same as entity name): Legal name of the organization responsible for the overall management, governance and oversight of the entity.

EC2

Nature of ownership

Public entity (listed on a Stock Exchange)

Specify ISIN: ____________

Private (non-listed) entity

Entity style classification

Debt

Core

Value added

Opportunistic

Open or closed end:

Open end

Closed end

Type of investment vehicle

Direct investment

Joint venture (JV)

Separate account

Special Purpose Vehicle

Other

-

________________________

Government entity

Legal Entity Identifier (optional): ____________

EC2

Describe the ownership status and characteristics of the participating entity.

Select the nature of the participating entity. Select at least one of the applicable sub-options and provide details if applicable. Entities reporting to GRESB are expected to represent investable vehicles, and these entities are expected to represent all infrastructure assets held by the vehicle (i.e., the whole portfolio).

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Note: GRESB Infrastructure Investor Members that invest in listed infrastructure securities have access to the results of all listed entities that participate in the GRESB Infrastructure Assessments. Publicly traded closed-end funds should be considered as non-listed entities given their level of disclosure requirements.

Other: Other answer must be outside the options listed in the indicator to be valid.

Closed end fund: Fund with a fixed amount of capital and a finite life. Limited liquidity, with the redemption of units provided for at the end of the life of the fund.

Core, Value Add, Opportunistic: These are classifications of investment risk and return sometimes used by infrastructure investors. GRESB does not seek to define these but merely requires participants to select if they apply one of these classifications.

Debt: A fund or similar entity that has been set up for the purposes of issuing or investing in loans.

Direct investment:The purchase of a controlling interest or a minority interest of such size and influence that active control is a feasible objective.

Government entity: An infrastructure portfolio owned and managed by a government agency. Government portfolios are formed of publicly owned, and/or publicly managed assets.

ISIN: International Securities Identification Number. ISINs are assigned to securities to facilitate unambiguous clearing and settlement procedures. They are composed of a 12-digit alphanumeric code and act to unify different ticker symbols, which can vary by exchange and currency for the same security. In the United States, ISINs are extended versions of 9-character CUSIP codes.

Joint Venture: A vehicle where at least two parties share a common investment objective. Control over significant risk management decisions is not transferred to an external manager, but is exercised by members in the venture.

Open end fund: An investment vehicle with a variable and unlimited amount of capital. Investors may purchase or redeem units or shares from the vehicle as outlined in contractual agreements.

Private entity: A company or fund that is not a listed or traded on any stock exchange. Also known as non-listed entities or private portfolios.

Public entity: A company that is publicly listed and traded on a recognized stock exchange, such as Nasdaq or NYSE. Also known as "listed entities”.

Separate account: A portfolio of assets managed by a professional investment firm with a single investor client.

Special Purpose Vehicle: A subsidiary created by a parent company to isolate financial risk.

INREV Guidelines, Definitions, 2017

EC3

Entity commencement date

![[Year]](/images/tables/year/y2024-7140a687.svg)

EC3

Describe the activity commencement or establishment date of the entity.

Provide the year of commencement/establishment.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Year of commencement: The year in which the reporting entity began investing in the market. If a listed entity is delisted (i.e., taken private) but remains under the same management, the date of original commencement can be used for “date of first closing” for the new non-listed entity. If the entity is taken private by a new management company, the first day of closing should be the date of privatization. This information is not used for scoring and used for context only; portfolio vintage may affect the ability to implement ESG policies and strategies.

Year of establishment: A date specified by the manager on which the vehicle is launched, the initial capital subscription is completed, and the commitment period commences.

EC4

Reporting year

Calendar year

Fiscal year

Specify the starting month Month

EC4

Set the entity’s annual reporting year.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Select one of the options.

Participants are required to specify the starting month of their fiscal year. If participants select Fiscal year, starting months between February and June must correspond to calendar years 2024/2025. For example, an entity reporting from April to March will be considered covering the period of April 2024 - March 2025. On the other hand, starting months between July and December must correspond to calendar years 2023/2024. For example an entity reporting from October to September will be considered as covering the period of October 2023 - September 2024.

The table below details the period for which information throughout the Assessment would be expected, should a given starting month be selected:

| Starting month | Reporting Year |

|---|---|

| January | Select "Calendar Year" |

| February | Feb 2024 - Jan 2025 |

| March | Mar 2024 - Feb 2025 |

| April | Apr 2024 - Mar 2025 |

| May | May 2024 - Apr 2025 |

| June | Jun 2024 - May 2025 |

| July | Jul 2023 - Jun 2024 |

| August | Aug 2023 - Jul 2024 |

| September | Sept 2023 - Aug 2024 |

| October | Oct 2023 - Sept 2024 |

| November | Nov 2023 - Oct 2024 |

| December | Dec 2023 - Nov 2024 |

Calendar year: January 1, 2024 – December 31, 2024.

Fiscal year: The period used to calculate annual financial statements. Depending on the jurisdiction the fiscal year can start on April 1, July 1, October 1, etc.

Reporting year: Answers must refer to the reporting period identified in EC3 in the Infrastructure Assessment. A response to an indicator must be true at the close of the reporting period; however, the response does not need to have been true for the entire reporting period. GRESB does not favor the use of calendar year over fiscal year or vice versa, as long as the chosen reporting period is used consistently throughout the Assessment.

RC1

Reporting currency

Values are reported in Currency

RC1

Set the currency for which the entity is denominated.

State the currency used by the entity for Assessment indicators that require a monetary value as a response.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

RC2

Economic size

Aggregate Gross Asset Value (GAV) (in millions): ____________

Aggregated Net Asset Value (NAV) (or invested capital) (in millions):

________________________

RC2

Establish the economic size of the entity.

Complete the measure(s) of the economic size of the entity in terms of aggregate Gross Asset Value (GAV) and aggregate Net Asset Value (NAV), both in millions (e.g. $75,000,000 must be reported as 75). Both values should be provided as at the end of the reporting year.

As with all information provided to GRESB, this information will be kept confidential to just you and any investors for which you give access permission.

Do not include a currency (symbol) with the value provided, as this has been reported in indicator RC1 above, but make sure the value reported is consistent with the currency selected in RC1.

Other: Other answer must be outside the options listed in the indicator to be valid. State the primary measure of economic size and the applicable value.

Aggregate Gross Asset Value (GAV): The total market value of assets owned by the entity.

Aggregate Net Asset Value (NAV) or Invested Capital: The total equity invested in assets by the entity. Aggregate NAV = Aggregate GAV - Aggregate Debt.

INREV Guidelines, Definitions, 2017

RC3

Sector & geography

What is the sector focus of the entity?

Diversified

Data Infrastructure

Energy and Water Resources

Environmental Services

Network Utilities

Power Generation X-Renewables

Renewable Power

Social Infrastructure

Transport

Other: ____________

What is the regional focus of the entity?

Globally diversified

Africa

Americas

Asia

Europe

Oceania

RC3

Establish the sector and geographic focus of the entity. This is used to determine peers for benchmarking and reporting purposes.

Select the sector and geographic focus of the entity. If this is sector specific, then select the relevant sector.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Other: Other answer must be outside the options listed in the indicator to be valid. State the sector focus.

Data Infrastructure: Companies involved in the provision of telecommunication and data infrastructure.

Diversified focus: If the entity is invested in more than one of the listed sectors.

Energy and Water Resources: Companies involved in the treatment and delivery of natural resources.

Environmental Services: Companies involved in the treatment of water, wastewater, and solid waste for sanitation and reuse purposes.

Globally diversified: If the entity is significantly invested in more than one of the listed geographic regions.

Network Utilities: Companies operating an infrastructure network with natural monopoly characteristics (barriers to entry, increasing returns to scale).

Power Generation x-Renewables: Stand-alone power generation using a range of technologies except wind, solar, and other renewable sources.

Renewable Power: Stand-alone power generation and transmission companies using wind, solar, hydro and other renewable energy sources. Also energy storage companies.

Sector: A group of specific industrial activities and types of physical assets and technologies.

Social Infrastructure: Companies involved in the delivery of support and accommodation services for public or other services.

Transport: Companies involved in the provision of transportation infrastructure services.

EDHECInfra, The Infrastructure Company Classification Standards (TICCS™), 2020

United Nations Standard Country or Area Codes for Statistical Use (M49)

RC4

Nature of entity's business

What is the entity's core business?

Management of standing investment/operating assets

Development of new construction and major renovation projects

RC4

The entity’s primary business activities during the reporting year is useful for distinguishing infrastructure funds. The information can be used to develop further insights and potentially for peer grouping.

Select the option applicable to the reporting entity.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Major Renovations: Alterations that affect more than 50 percent of the total asset or cause relocation of more than 50 percent of regular building occupants. Major renovation projects refer to assets that were under construction at any time during the reporting year.

New Construction: Includes all activities to obtain or change building or land use permissions and financing. Includes construction work for the project with the intention of enhancing the asset's value. Development of new facilities and additions to existing facilities can be treated as new constructions. New construction projects refer to facilities that were under construction at any time during the reporting year.

Standing Investments: Assets where construction work has been completed and which are owned for the purpose of providing a service in exchange of an income. Also known as an operating asset.

RC5

Description of the fund

Provide a description of the entity (max 250 words): ____________

RC5

Provide a description of the entity.

The description may include:

It is not necessary to re-state information that has already been provided in prior indicators, such as the entity's sector focus, geographic focus or nature of business.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

RC6

Portfolio of entity assets

Did the entity own or lend to any asset investments?

Yes

![[AssetTable]](/images/tables/asset_table/y2024-dc4f6fed.svg)

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

RC6

The Portfolio Assets Table shows the entity’s portfolio of underlying investments in infrastructure assets. The table includes details on each asset; including Primary Sector, weight within the portfolio and whether the asset is in development [pre-operational].

Linking its underlying assets allows the fund to earn a Performance Score and/or Development Score, so long as asset participation thresholds are met (see the Scoring section and/or Scoring Document for more information).

These two scores combined with the score of the fund in its Management Component generate the fund’s overall scores, referred to as ‘GRESB Score - Infrastructure Fund’ and/or ‘GRESB Development Score – Infrastructure Fund’.

Pre-fill: The table will be prefilled with assets that were connected in 2024. It is very important to review the table carefully, with particular attention to the weightings assigned. Participants have the option to delete, edit or add assets to the table, if necessary.

The table can be accessed in two locations, either within the Assessment Portal (via the 'Assets' tab) or within the Assessment Response (in the 'Summary of Entity Assets' section).

It is mandatory for participants to list and complete details for ALL infrastructure assets (operational and pre-operational) held by the Fund, as at the end of the reporting year (identified in EC4), irrespective of whether they are participating in the 2024 GRESB Asset Assessment or not.

The Table includes the following columns:

Asset sector: Select the primary sector of the asset from the dropdown box. The sector classification has been aligned with the new EDHECInfra TICCS standard Industrial Classifications and is provided in the Terminology. If the sector of the asset sits outside the listed options, then select 'Other' and specify the sector. This information will not be used for benchmarking purposes.

Asset weight: Enter the weight of the asset within the portfolio. Weights must sum up to 100%. Weights should be equity based i.e. the weight of an asset is the equity invested in the asset divided by the total equity invested in all assets in the fund (i.e. the invested capital).

% ownership: Enter the fund’s % ownership share in the asset as a proportion of the asset’s total GAV. I.e the fund’s investment in the asset divided by the asset’s total GAV.

Reason for excluding from scoring (optional): Participants have the option to exclude specific assets from contributing to the Performance Component Score - Infrastructure Fund and Development Component Score - Infrastructure Fund if there is a valid reason. Valid exclusion reasons are:

Contact name: Provide the name of the contact person for the asset entity.

Email: Provide the email address for the contact person for the asset entity.

The 'Connect' button should be selected if the reporting entity wants to create a connection to an existing GRESB Assessment or invite someone to respond for the Asset. Once selected, there are four options (with supporting guidance) to follow in order to Connect. Only select 'Connect' if the asset intends to participate in the 2025 GRESB Assessment, otherwise leave the status at 'Not Connected'.

What happens once a connection request has been sent:

No points are awarded for completing the table.

However, to receive a GRESB Score - Infrastructure Fund [Management + Performance Scores] or a GRESB Development Score – Infrastructure Fund [Management + Development Scores], the following conditions must be met:

Performance Score: At least 25% of the fund’s underlying assets (based on equity invested) must participate in a GRESB Assessment and be linked to the fund in the GRESB Portal. Within this 25%, at least one asset must participate in the GRESB Asset Assessment.

Development Score: At least 25% of the fund’s underlying assets (based on equity invested) must participate in a GRESB Assessment and be linked to the fund in the GRESB Portal. Within this 25%, at least one asset must participate in the GRESB Development Asset Assessment.

2025 Updates

Exclusions of assets from the aggregate Performance/Development Score – Infrastructure Fund

Funds are entitled to exclude specific assets from contributing to the Performance/Development Score if there is a valid reason (see reasons in ‘Requirements’ section above). The weights of excluded assets will be redistributed among the remaining assets.

In addition, in 2025, first-time GRESB Fund Assessment participants can exclude any assets from scoring using the “New Fund Participant” exclusion reason, under the following conditions:

Note also that in 2025, first-year participant assets choosing to report to GRESB Asset Assessment or Development Asset Assessment using the Grace Period will be automatically excluded from the Fund Score and data.

See the Scoring Document for additional information.

Asset in development: Refers to an investment in a new asset that has some level of development or construction requirement and risk.

Energy and Water Resources: Companies involved in the treatment and delivery of natural resources.

Environmental Services: Companies involved in the treatment of water, wastewater, and solid waste for sanitation and reuse purposes.

Data Infrastructure: Companies involved in the provision of telecommunication and data infrastructure.

Network Utilities: Companies operating an infrastructure network with natural monopoly characteristics (barriers to entry, increasing returns to scale).

Power Generation x-Renewables: Stand-alone power generation using a range of technologies except wind, solar, and other renewable sources.

Renewable Power: Stand-alone power generation and transmission companies using wind, solar, hydro and other renewable energy sources. Also energy storage companies.

Sector: A group of specific industrial activities and types of physical assets and technologies.

Social Infrastructure: Companies involved in the delivery of support and accommodation services for public or other services.

Transport: Companies involved in the provision of transportation infrastructure services.

EDHECInfra, The Infrastructure Company Classification Standards (TICCS™️), 2021

Leadership

LeadershipThis aspect evaluates how the entity integrates ESG into its overall business strategy, its ESG commitments and objectives, and how responsibilities for making decisions relating to ESG have been assigned within the entity.

LE1

ESG leadership commitments

Has the entity made a public commitment to ESG standards or principles?

Yes

ESG commitments (multiple answers possible)

Commitments that are publicly evidenced and oblige the organization to take action (multiple answers possible).

Equator Principles

PRI

UN Global Compact

Business for nature

Climate Action in Financial Institutions Initiative

Climate Action 100+

Climate League 2030

EV100

Finance for Biodiversity

Global Launch of Partnership for Carbon Accounting Financials (PCAF)

IFC Operating Principles for Impact Management

IIGCC Paris Aligned Investment Initiative

Montreal Pledge

Partnership for Carbon Accounting Financials

Powering Past Coal Alliance (PPCA)

RE 100

Science Based Targets Initiative

UN Global Compact Our Only Future

40:40 Vision

Other: ____________

Commitments that are publicly evidenced and do not oblige the organization to take action (multiple answers possible).

UN Environment Programme Finance Initiative

Support the goals

Coalition for Climate Resilient Investment (CCRI)

Global Investor Coalition on Climate Change (including AIGCC, Ceres, IGCC, IIGCC)

Task Force on Climate-related Financial Disclosures

World Business Council for Sustainable Development's Call to Action

30% Club

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Net Zero Commitments (multiple answers possible)

Net Zero Asset Managers initiative: Net Zero Asset Managers Commitment

PAII Net Zero Asset Owner Commitment

Science Based Targets initiative: Net Zero Standard commitment

The Climate Pledge

Transform to Net Zero

UN-convened Net-Zero Asset Owner Alliance

UNFCCC Climate Neutral Now Pledge

WorldGBC Net Zero Carbon Buildings Commitment

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

LE1

Not scored , G

The intent of this indicator is to assess the entity's commitment to ESG leadership standards or principles. By making a commitment to ESG leadership standards or principles, an entity publicly demonstrates its commitment to ESG, uses organizational standards and/or frameworks that are universally accepted and may have obligations to comply with the standards and/or frameworks.

Select Yes or No: If selecting 'Yes', select all applicable sub-options.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Commitments: All commitments should be publicly available, and the entity should be either a member or signatory if it selects an option. The commitments are divided between those that require action to be taken by the entity and those that don’t.

Commitments that oblige to act may, for example:

It is possible to report using the ‘Other’ answer option. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option.

List commitment: Open text box, enter name of relevant commitment(s).

The Global Investor Coalition on Climate Change (GIC): Participants may select this checkbox only if they are a member of any part of the four regional groups (i.e. AIGCC, Ceres, IGCC and IIGCC).

Hyperlink: Providing a hyperlink is mandatory for this indicator when ‘Publicly available’ is selected. Ensure that the hyperlink is active and that the relevant page can be accessed within two steps. The URL should demonstrate the existence of the publicly available objective(s) selected.

Evidence: Document or hyperlink. The evidence should sufficiently support all the items selected for this question. Participants may upload several documents. When providing a document upload, it is mandatory to indicate where relevant information can be found within the document.

The provided evidence must cover the following elements:

Examples of appropriate evidence include:

Other: Add an external, formal, commitment that applies to the entity but is not already listed. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option (e.g. “UN Sustainability Goals” when “‘Support the Goals” is selected). Note that other answers provided in the “General ESG commitments” section of this indicator will not be accepted again as an other answer in any of the E, S or G “ issue-specific commitments” sections a second time.

Any ‘Other’ answer provided will be manually validated and must be accepted before achieving the respective fractional score.

See Appendix 4 of the reference guide for information about GRESB Validation.

This indicator is not scored and used for reporting purposes only.

40:40 Vision:

Business for Nature:

Climate Action in Financial Institutions Initiative:

Climate League 2030:

Coalition for Climate Resilient Investment (CCRI):

Equator Principles: The Equator Principles is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risks.

EV100:

Finance for Biodiversity:

Global Investor Coalition on Climate Change:

Operating Principles for Impact Management:

IIGCC Paris Aligned Investment Initiative:

Montreal Carbon Pledge:

RE100:

Science Based Targets Initiative:

Support the Goals:

Partnership for Carbon Accounting Financials:

Powering PastCoal Alliance (PPCA):

Task Force on Climate-related Financial Disclosures:

Transform to Net Zero:

UN Environment Programme Finance Initiative:

UNFCCC Climate Neutral Now Pledge

UN-convened Net-Zero Asset Owner Alliance:

The Climate Pledge:

UN Global Compact:

UN Global Compact Our Only Future:

United Nations-supported Principles for Responsible Investment (UN PRI):

World Business Council for Sustainable Development’s Call to Action:

WorldGBC’s Net Zero Carbon Buildings Commitment:

30% Club:

UNPRI, PRI Reporting Framework, 2021

Equator Principles, 2013

UN Global Compact Principles, 2000

UNEP Finance Initiative Statement, 1992

Task Force on Climate-related Financial Disclosures, 2015

International Labour Organization, International Labour Organization Standards, 2014

Climate Action in Financial Institutions Initiative, Principles for Mainstreaming Climate Action, 2015

Good practice example: Please refer to this linkLE2

Responsible investment strategy

Does the entity have a sustainable investment strategy?

Yes

The strategy incorporates the following approaches (multiple answers possible)

Corporate engagement and shareholder action

Impact/community investing

Integration of ESG factors

Positive/best-in-class screening

Negative/exclusionary screening

Norms-based screening

Sustainability themed investing

Describe the strategy and how it is being implemented (for reporting purposes only)(maximum 250 words)

________________________

The strategy is:

Publicly available

Provide applicable hyperlink or a separate publicly available evidence

URL____________

Indicate where in the evidence the relevant information can be found____

Not publicly available

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

LE2

1.62 points , G

The intent of this indicator is to assess and categorize the sustainable investment strategies adopted by the entity. The Global Sustainable Investment Review (GSIA) standardized seven sustainable investment strategies which have emerged as a global standard of classification. Alignment with standardized responsible investment strategies provides more valuable benchmarking information for investors.

Select Yes or No: If selecting 'Yes', select applicable sub-options.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

Open Text Box (for reporting purposes only): Explain the strategy and how it is implemented within the entity. The description may include the following criteria:

Hyperlink: Providing a hyperlink is mandatory for this indicator when ‘Publicly available’ is selected. Ensure that the hyperlink is active and that the relevant page can be accessed within two steps. The URL should demonstrate the existence of the publicly available approaches selected.

Evidence: Document or hyperlink. Participants may upload several documents. When providing a document upload, it is mandatory to indicate where relevant information can be found within the document.

Evidence requirements:

Evidence examples may include but are not limited to:

See Appendix 4 of the reference guide for information about GRESB Validation.

1.62 points, G

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.

Evidence: The evidence is manually validated, and points are contingent on the validation decision.

See the Scoring Document for additional information.

Corporate engagement and shareholder action: The use of shareholder power to influence corporate behavior, including through direct corporate engagement (i.e., communicating with senior management and/or boards of companies), filing or co-filing shareholder proposals, and proxy voting that is guided by comprehensive ESG guidelines.

ESG integration: The systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis.

Formally adopted: To set and communicate a strategy/target/program, at least internally, and having implemented or prepared actions to achieve this.

Impact/community investing: Targeted investments, typically made in private markets, aimed at solving social or environmental problems, and including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social or environmental purpose.

Negative/exclusionary screening: The exclusion from a fund or portfolio of certain sectors, companies or practices based on specific ESG criteria.

Norms-based screening: Screening of investments against minimum standards of business practice based on international norms.

Positive/best-in-class screening: Investment in sectors, companies or projects selected for positive ESG performance relative to industry peers.

Sustainability themed investing: Investment in themes or assets specifically related to sustainability (for example clean energy, green technology or sustainable agriculture).

Impact/community investing: Targeted investments, typically made in private markets, aimed at solving social or environmental problems, and including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social or environmental purpose.

Sustainable investing: An investment approach that considers environmental, social and governance (ESG) factors in portfolio selection and management.

Global Sustainable InvestmentAlliance (GSIA), Global Sustainable Investment Review, 2018

LE3

ESG, climate-related and/or Human Capital senior decision maker

Does the entity have a senior decision-maker accountable for ESG, climate-related, and/or Human Capital issues?

Yes

ESG

Provide the details for most senior decision-maker on ESG issues

Name: ____________

Job title: ____________

The individual's most senior role is as part of:

Board of directors

C-suite level staff/Senior management

Fund/portfolio managers

Investment committee

Other: ____________

Climate-related risks and opportunities

Provide the details for the most senior decision-maker:

Name: ____________

Job title: ____________

The individual's most senior role is as part of:

Board of directors

C-suite level staff/Senior management

Fund/portfolio managers

Investment committee

Other: ____________

Human Capital

Provide the details for the most senior decision-maker on Human Capital:

Name: ____________

Job title: ____________

The individual's most senior role is as part of:

Board of directors

C-suite level staff/Senior management

Fund/portfolio managers

Investment committee

Other: ____________

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

LE3

1.62 points , G

The intent of the indicator is to emphasize the importance of senior management’s active role in overseeing ESG, climate-related risks and opportunities, and/or Human Capital initiatives. Their involvement increases the likelihood of successfully achieving objectives in these areas. Having a structured governance mechanism to keep the most senior decision-maker informed about the entity’s performance promotes accountability and continuous improvement.

Select Yes or No: If selecting 'Yes', select applicable sub-options.

Senior decision-maker: The entity’s most senior decision-maker on ESG issues, climate-related risks and opportunities and/or Human Capital is expected to be actively involved in the process of defining the objectives relating to the topic(s) and should approve associated strategic decisions regarding ESG issues, climate-related risks and opportunities and/or Human Capital. It is also possible to list the same person for ESG issues, climate-related risks and opportunities and/or Human Capital. The employee details provided will be used for reporting purposes only.

Role of the senior decision-maker: Select one option from the list of bodies that the senior decision-maker is part of. If multiple options apply, select the body that bears the highest level of responsibility. It is possible to report using the ‘other’ answer option. Ensure that the ‘other’ answer provided is not a duplicate or subset of another option.

Details of employee: Participants must provide the name and job title of the relevant employee. This information will be used for reporting purposes only. This information will remain confidential.

Reporting level: Answers should be applicable at the entity and/or manager level. In the case where the senior decision-maker that is accountable for ESG issues is part of a third-party organization, then provide the organization name.

Prefill: This indicator remained the same as the 2024 Assessment and some sections have been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

The ‘Other’ answer provided will be subject to manual validation.

Other: List a specific senior decision-maker’s position title who is accountable for ESG issues and/or climate-related issues. Vague answers will not be sufficient for validation. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option (e.g. “Executive board” when “‘Board of directors” is selected). It is possible to report multiple ‘Other’ answers. If multiple ‘Other’ answers are accepted, only one will be counted towards scoring.

See Appendix 4 of the reference guide for information about GRESB Validation.

1.62 points, G

Scoring is based on the number of selected options. It is necessary to select all checkboxes to obtain the maximum score.

Other: The 'Other' answer is manually validated, and points are contingent on the validation decision.

See the Scoring Document for additional information.

Asset manager: A person or group of people responsible for developing and overseeing financial and strategic developments of investments at asset level.

Board of Directors: A body of elected or appointed members who jointly oversee the activities of a company or organization as detailed in the corporate charter. Boards normally comprise both executive and non-executive directors.

C-suite level staff: A team of individuals who have the day-to-day responsibility of managing the entity. C-suite level staff are sometimes referred to, within corporations, as senior management, executive management, executive leadership team, top management, upper management, higher management, or simply seniors.

Human capital: Human capital refers to the knowledge, culture, skills, experience, and overall contributions of an organization’s workforce. It encompasses strategies for fairly attracting, developing, and retaining talent, fostering a productive and engaged workplace, and ensuring fair and effective workforce management. Many organizational approaches can contribute to human capital objectives, including talent development & advancement; skills-based hiring & development; and diversity, equity, and inclusion.

ESG strategy: Strategy that (1) sets out the participant’s procedures and (2) sets the direction and guidance for the entity’s implementation of ESG measures.

Fund/portfolio manager: A person or a group who manages a portfolio of investments and the deployment of investor capital by creating and implementing asset level strategies across the entire portfolio or fund.

Investment Committee: A group of individuals who oversee the entity’s investment strategy, evaluates investment proposals and maintains the investment policies, subject to the Board’s approval.

Person accountable: A person with sign off (approval) authority over the deliverable task, project or strategy. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for ESG issues: A senior individual with sign off (approval) authority for approving strategic ESG objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for climate-related issues: A senior individual with sign off (approval) authority for approving strategic climate-related objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

Senior decision-maker accountable for Human Capital: A senior individual with sign off (approval) authority for approving strategic ESG objectives and steps undertaken to achieve these objectives. The accountable person can delegate the work to other responsible people who will work on the implementation and completion of the task, project or strategy.

CDP, CDP Scoring Methodology, CC1.1, 2017

Global Reporting Initiative, GRI 2: General Disclosures 2021

LE4

Personnel ESG performance targets

Does the entity include ESG factors in the annual performance targets of personnel?

Yes

Does performance against these targets have predetermined financial consequences?

Yes

Select the personnel to whom these factors apply (multiple answers possible)

All other employees

Asset managers

Board of directors

C-suite level staff/Senior management

Dedicated staff on ESG issues

ESG managers

External managers or service providers

Fund/portfolio managers

Investment analysts

Investment committee

Investor relations

Other: ____________

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

LE4

1.62 points , G

This indicator intends to identify whether and to what extent ESG issues are addressed in personnel performance targets. Including ESG factors in annual performance targets for all personnel can increase the entity’s capacity to achieve improved ESG performance.

Select Yes or No: If selecting 'Yes', select applicable sub-options.

Financial consequences: Select from the available sub-options. Financial consequences are any consequences that relate to monetary impacts. For good practice examples, see the ‘References’ section below.

It is possible to report using the ‘Other’ answer option. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option.

Prefill: This indicator is similar to the one included in the 2024 Assessment and some sections have been prefilled from the 2024 Assessment. Review the response and/or evidence carefully.

The evidence and ‘Other’ answer provided will be subject to manual validation.

Other: Add a response that applies to the entity but is not already listed. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option (e.g. “Executive board” when “‘Board of directors” is selected). If multiple ‘Other’ answers are listed, more than one may be accepted in manual validation.

Evidence: Document or hyperlink. The evidence should sufficiently support all the items selected for this question. If a hyperlink is provided, ensure that it is active and that the relevant page can be accessed within two steps. It is possible to upload multiple documents, as long as it’s clear where information can be found.

The provided evidence must cover all the following elements:Existence of ESG-related performance targets: demonstrate that ESG performance targets are explicitly tied to the annual performance of the selected personnel groups:

Personnel group applicability: targets must relate to all members within the selected personnel groups:

Financial consequences tied to ESG performance: the evidence must explain the financial implications (positive or negative) for meeting or failing to meet ESG targets for each selected personnel group. This includes clearly linking the financial consequences (e.g., bonuses, pay adjustments, penalties, etc.) to the ESG targets of each selected personnel group. The connection must be clearly defined within the provided documents, open text box, or cover page.

Examples of acceptable evidence: policy documents, process guidelines, employee performance reviews for the reporting year, employment contracts or documentation describing financial consequences (e.g., bonus schemes, web pages). Note that sensitive information may be redacted from the documents as long as the requirements outlined above are clearly met. If the consequences are not clearly defined and connected to the ESG targets within the provided evidence, then sufficient explanation must be provided within the evidence open text box.

Other answers: state the specific employee type and ensure the following:

See Appendix 4 of the reference guide for information about GRESB Validation.

1.62 points, G

Scoring is based on the number of selected options. It is necessary to select all checkboxes to obtain the maximum score.

Evidence: The evidence is manually validated, and points are contingent on the validation decision.

See the Scoring Document for additional information.

Annual performance targets: Targets set in annual performance reviews based on assessments of employee performance.

Asset manager: A person or group of people responsible for developing and overseeing financial and strategic developments of investments at asset level.

Board of Directors: A body of elected or appointed members who jointly oversee the activities of a company or organization as detailed in the corporate charter. Boards normally comprise both executive and non-executive directors.

C-suite level staff: A team of individuals who have the day-to-day responsibility of managing the entity. C-suite level staff are sometimes referred to, within corporations, as senior management, executive management, executive leadership team, top management, upper management, higher management, or simply seniors.

Dedicated employee(s) for whom ESG is the core responsibility: The employee(s)’ main responsibility is defining, implementing and monitoring the ESG objectives at entity level.

ESG manager: Dedicated employee(s) who manages the ESG strategy and implementation of the entity.

External manager or service provider: Organizations, businesses or individuals that offer services to others in exchange for payment. These include, but are not limited to, consultants, agents and brokers.

Fund/portfolio manager: A person or a group who manages a portfolio of investments and the deployment of investor capital by creating and implementing asset level strategies across the entire portfolio or fund.

Investment analysts: A person or group with expertise in evaluating financial and investment information, typically for the purpose of making buy, sell and hold recommendations for securities.

Investment Committee: A group of individuals who oversee the entity’s investment strategy, evaluates investment proposals and maintains the investment policies, subject to the Board’s approval.

Investor relations: A person or a group that provides investors with an accurate account of company affairs so investors can make better informed decisions.

Financial consequences: Predetermined monetary benefits (or detriments) incorporated into the employee compensation structures. Examples include bonuses, raises, profit-sharing, financial rewards, and financial incentives. The financial consequences are contingent upon the achievement of the annual performance targets.

Global Reporting Initiative, GRI 102-35: Remuneration policies, 2016

Good practice example: Please refer to the remuneration report using this link

Good practice example: Please click here

Policies

PoliciesThis aspect evaluates the steps undertaken to stay abreast of material ESG related risks.

PO1

Policies on environmental issues

Does the entity have a policy or policies on environmental issues?

Yes

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Does the entity have a policy to address Net Zero?

Yes

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

PO1

1.08 points , E

The intent of this indicator is to assess the existence and scope of policies that address environmental issues. Policies on environmental issues assist organizations with incorporating environmental criteria into their business practices.

Select Yes or No: If selecting ‘Yes’, select applicable sub-options.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

This indicator is subject to manual validation.

Evidence: Document of hyperlink. The evidence should sufficiently support all the items selected for this question. If a hyperlink is provided, ensure that it is active and that the relevant page can be accessed within two steps. It is possible to upload multiple documents, as long as it’s clear where information can be found.

This indicator has two sections for evidence upload:

Supporting evidence is mandatory for both sections. However, only section 2 (Net Zero policies) will be subject to manual validation. Any evidence uploaded in section 1 (General/issue-specific policies) is for reporting purposes only.

An entity should report that it has an environmental policy when:

The provided evidence must demonstrate the existence of a formal policy document(s) that address(es) each of the selected environmental issues and not simply a list of general goals and/or commitments.

A policy is a guide for action which can serve the purpose of:

Acceptable evidence may include an environmental policy document, official documents or links to online resources describing the entity's environmental policy(ies). References such as bullet points or passages within a policy, can be provided to describe the goals or ambition for each issue.

The evidence should support each of the selected issues with a relevant document such as energy consumption policy or a waste management policy. The same document can be used to support the existence of a policy addressing Net Zero as well as all other selected environmental issues. Note that overarching environmental policy documents covering multiple issues must have separate sections/clauses relevant to each of the selected issues.

For entities that either achieved full points for any of the indicator PO1 in the previous submission or do not wish to modify their selections or evidence, GRESB allows them to forgo reporting on these indicators, provided the same policies remain in place and the supporting documents remain unchanged. GRESB recognizes that an entity's policies typically remain consistent year over year and are often in place for multiple reporting periods. In such cases, the entity will retain the same validation status and points as in the previous year.

See Appendix 4 of the reference guide for additional information about GRESB Validation.Scoring is based on the number of selected options.

Evidence

If selecting ‘Yes’ to having a policy(ies) on environmental issues, evidence is not scored and is used for reporting purposes only.

If selecting ‘Yes’ to having a Net Zero policy, evidence is manually validated and points are contingent on the validation decision.

See the Scoring Document for additional information.

Environmental issues: The impact on living and non-living natural systems, including land, air, water and ecosystems. This includes, but is not limited to biodiversity, transport, contamination, GHG emissions, energy, water, waste, natural hazards, supply chain environmental standards, and product and service-related impacts, as well as environmental compliance and expenditures.

Net Zero: Net zero means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere.

Policy: Defines a commitment, direction or intention as formally adopted by the entity.

Indicator partially aligned with

PRI Reporting Framework 2018, Direct Infrastructure Supplement, INF 02, INF 13

PO2

Policies on social issues

Does the entity have a policy or policies on social issues?

Yes

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

PO2

1.08 points , S

The intent of this indicator is to assess the existence and scope of policies that address social issues. Policies on social issues assist organizations with incorporating social criteria into their business practices.

Select Yes or No: If selecting ‘Yes’, select applicable sub-options.

Supporting evidence is mandatory but is for reporting purposes only.

An entity should report that it has a social policy when:

The provided evidence must demonstrate the existence of a formal policy document(s) that address(es) each of the selected social issues and not simply a list of general goals and/or commitments.

A policy is a guide for action which can serve the purpose of:

Acceptable evidence may include a formal policy that is in place such as a social policy document, official documents or links to online resources describing the entity's social policies. Reference can be provided, such as bullets or passages within a policy, to describe the goals or ambition for each issue.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

This indicator is not subject to automatic or manual validation.

Scoring is based on the selection of ‘Yes,’

Evidence not scored and used for reporting purposes only.

See the Scoring Document for additional information.

Policy: Defines a commitment, direction or intention as formally adopted by the entity.

Social issues: Concerns the impacts the entity has on the social systems within which it operates. This includes, but is not limited to community social and economic impacts, safety, health & well-being.

Indicator partially aligned with

PRI Reporting Framework 2018, Direct Infrastructure Supplement, INF 02, INF 13

The Taskforce on Nature-related Financial Disclosures Recommendations (TNFD) version 1.0 September 2023: Governance Pillar

PO3

Policies on governance issues

Does the entity have a policy or policies on governance issues?

Yes

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

PO3

1.08 points , G

The intent of this indicator is to assess the existence and scope of policies that address governance issues. Policies on governance issues assist organizations with incorporating governance criteria into their business practices.

Select Yes or No: If selecting ‘Yes’, select applicable sub-options.

Supporting evidence is mandatory but is for reporting purposes only.

An entity should report that it has a governance policy when:

The provided evidence must demonstrate the existence of a formal policy document(s) that address(es) each of the selected governance issues and not simply a list of general goals and/or commitments.

A policy is a guide for action which can serve the purpose of:

Acceptable evidence may include a formal policy that is in place such as a governance policy document, official documents or links to online resources describing the entity's governance policies. Reference can be provided, such as bullets or passages within a policy, to describe the goals or ambition for each issue.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

This indicator is not subject to automatic or manual validation.

Scoring is based on the selection of ‘Yes,’

Evidence not scored and used for reporting purposes only.

See the Scoring Document for additional information.

Governance issues: Governance structure and composition of the entity. This includes how the highest governance body is established and structured in support of the entity’s purpose, and how this purpose relates to economic, environmental and social dimensions.

Policy: Defines a commitment, direction or intention as formally adopted by the entity.

Indicator partially aligned with

PRI Reporting Framework 2018, Direct Infrastructure Supplement, INF 02, INF 13

Good practice example: Please refer to this link.

Targets

TargetsNet Zero targets guide entities and their employees towards measurable improvements and are a key driver for integrating sustainability into business operations. This aspect confirms the existence and scope of Net Zero targets.

T1

Net Zero Targets

Does the entity have a GHG emissions reduction target aligned with Net Zero?

Yes

Target baseline year

Target end year

Select the scope of the Net Zero target:

Scope 1+2 (location-based)

Scope 1+2 (market-based)

Scope 1+2 (location-based) + Scope 3

Scope 1+2 (market-based) + Scope 3

Is the target aligned with a Net Zero target-setting framework?

Yes

Net Zero target-setting framework: ____________

No

Is the target science-based?

Yes

No

Is the target validated by a third party?

Yes

Validated by: ____________

No

Does the Net Zero target include an interim target?

Yes

Interim target: ____________%

Interim target year

No

Is the target publicly communicated?

Yes

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

No

Explain the methodology used to establish the target and communicate the entity’s plans/intentions to achieve it (e.g. energy efficiency, renewable energy generation and/or procurement, carbon offsets, anticipated budgets associated with decarbonizing assets, acquisition/disposition activities, etc.) (maximum 500 words)

________________________

No

NEW

Not scored , E

The intent of this indicator is to assess whether the entity has a GHG emissions reduction target aligned with Net Zero.

Net Zero targets are considered a key part of an entity’s decarbonization strategy. They can strengthen investor confidence regarding the entity’s decarbonization strategy and guide the entity in its transition to a low-carbon economy. This indicator provides an opportunity for the entity to indicate the existence of a Net Zero target and collects additional information on understanding the target’s underlying characteristics and the methodology used to set them.

Select Yes or No: If selecting 'Yes', then the following subsections must be completed to detail the characteristics of the target:

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

This indicator is not subject to automatic or manual validation.

This indicator is not scored and is used for reporting purposes only.

Net Zero: Net zero means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere.

Net Zero

Reporting

ReportingThe intent of this Aspect is to assess the entity’s ESG policies and approach to disclosure.

RP1

ESG Reporting

Does the entity disclose its ESG actions and/or performance?

Yes

Select all applicable options (multiple answers possible)

Integrated Report*

*Integrated Report must be aligned with the IIRC framework

Select the applicable reporting level

Group

Investment manager or business unit

Entity

Is this disclosure third-party reviewed?

Yes

Externally checked

Externally verified

using Scheme name

Externally assured

using Scheme name

No

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Stand-alone sustainability report(s)

Select the applicable reporting level

Group

Investment manager or business unit

Entity

Aligned with third-party standard Guideline name

Is this disclosure third-party reviewed?

Yes

Externally checked

Externally verified

using Scheme name

Externally assured

using Scheme name

No

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Section in Annual Report

Select the applicable reporting level

Group

Investment manager or business unit

Entity

Aligned with third-party standard Guideline name

Is this disclosure third-party reviewed?

Yes

Externally checked

Externally verified

using Scheme name

Externally assured

using Scheme name

No

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Dedicated section on website

Select the applicable reporting level

Group

Investment manager or business unit

Entity

URL____________

Indicate where in the evidence the relevant information can be found____

Entity reporting to investors

Frequency of reporting: ____________

Aligned with third-party standard Guideline name

Is this disclosure third-party reviewed?

Yes

Externally checked

Externally verified

using Scheme name

Externally assured

using Scheme name

No

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

Other: ____________

Select the applicable reporting level

Group

Investment manager or business unit

Entity

Aligned with third-party standard Guideline name

Is this disclosure third-party reviewed?

Yes

Externally checked

Externally verified

using Scheme name

Externally assured

using Scheme name

No

Provide applicable evidence

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

RP1

3.24 points , G

The intent of this indicator is to assess the level of ESG disclosure undertaken by the entity. It also evaluates the entity’s use of third-party review to ensure the reliability, integrity, and accuracy of ESG disclosure. Reporting of ESG information and performance demonstrates an entity’s transparency in explaining how ESG policies and management practices are implemented by the entity, and how these practices impact the business and may form an important part of the entity’s communication to external stakeholders In addition, third-party ESG disclosure review increases investors’ confidence in the information disclosed.

Select Yes or No: If selecting 'Yes', select applicable sub-options.

In all cases:

The full list of accepted schemes is located in Appendix 5 of the Reference Guide. Additional schemes may also receive recognition if they meet GRESB’s criteria. To submit a new scheme for review, please contact the GRESB team. The final deadline for submitting a new assurance/verification scheme for review by the GRESB team is March 15th. Schemes submitted for review after March 15th will not be reviewed until the subsequent reporting year.

Prefill: This indicator has remained the same as the 2024 Assessment and has been prefilled with 2024 Assessment answers. Review the response and/or evidence carefully.

The evidence and ‘Other’ answer provided will be subject to manual validation.

Other: Add a disclosure method that applies to the entity but is not already listed. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option selected. It is possible to report multiple ‘Other’ answers. If multiple ‘Other’ answers are accepted, only one will be counted towards scoring.

Evidence: Document or hyperlink. The evidence should sufficiently support all the items selected for this question. If a hyperlink is provided, ensure that it is active and that the relevant page can be accessed within two steps. It is possible to upload multiple documents, as long as it’s clear where information can be found. A piece of supporting evidence document or URL cannot be uploaded for more than one disclosure method selected, i.e., identical documents will not be accepted for more than one disclosure type.

General evidence requirements:

Specific evidence requirements per disclosure type:

Evidence requirements IR report: The document upload or URL provided must contain clear evidence of alignment with the IFRS Integrated Reporting Framework (formerly the International Integrated Reporting Council (IIRC) Integrated Reporting Framework (December 2013)) within the report itself. Note that references to the IFRS accounting standards, IFRS S1 or S2, and SASB are not equivalent. Integrated reports can reference 2024, 2023, or 2022 performance and/or actions.

Evidence requirements Annual Report: Annual Reports should cover the reporting year as described in EC4. Annual Reports from the prior reporting year detailing actions and/or performance are acceptable if it is explicitly stated that the Annual Report for the current reporting year has not yet been published. If an entity reports on a semi-annual basis, both semi-annual reports must be uploaded to cover the 12 months of reporting identified in EC4.

Evidence requirements Standalone sustainability report: Sustainability reports referencing the current or previous reporting year as described in EC4 are accepted. They must be published separately from the Annual Report. If the entity intends to refer to a section in the Annual Report they should select ‘Annual Report’.

Evidence requirements Dedicated section on corporate website: The webpage(s) must explicitly address ESG and include actions and/or performance undertaken by the entity during the reporting year as given in EC4. A hyperlink to the Annual Report or Sustainability report is not valid. In addition, a list of general goals and/or commitments on the website is not sufficient.

Evidence requirements Entity reporting to investors: A summary outlining an entity’s overall approach to sustainability that does not contain any analysis of performance is insufficient. Entity reporting to investors should include year-on-year comparison of sustainability performances supported by explanatory comments. Performance achievements should be linked to measures formerly implemented by the entity. Updates to investors provided after the reporting year may be valid, as long as the actions described apply to the reporting year (as indicated in EC4). Quarterly updates, newsletters, or press releases disclosing ESG actions and/or performance are also considered valid, but the entity should indicate the frequency of reporting (i.e., Quarterly). Additionally, evidence of periodical ESG disclosures required by regional sustainable finance regulations can be included and will be counted as evidence for this indicator. Entity reporting to investors must reference actions/performance of the entity itself, not solely its investment manager or group.

Evidence requirements ‘Other’:An additional disclosure method such as third-party forms of disclosure like CDP Questionnaires or UN PRI Transparency Reports is considered valid. Disclosure methods with a different reporting level can also be provided (i.e. if an entity-level ESG report is provided for Stand-alone sustainability report, a group-level ESG report can be provided for ‘Other’.) Quarterly updates, Board reports, investor presentations, newsletters, or press releases disclosing ESG actions and/or performance are considered valid. Ensure applicability to the reporting year as provided in EC4 based on the actions and/or performance disclosed.

See Appendix 4 of the reference guide for additional information about GRESB Validation.

Scoring is based on the number of selected options. It is not necessary to select all options to achieve the maximum score.