Disclaimer: GRESB Infrastructure Fund Assessment Scoring Document

The GRESB Infrastructure Fund Assessment Scoring Document accompanies the GRESB Fund Standard and Reference Guide and is published as a standalone document. The Scoring Document reflects the opinions of GRESB and not of our members. The information in the Scoring Document has been provided in good faith and is provided on an “as is” basis. We take reasonable care to check the accuracy and completeness of the Scoring Document prior to its publication. While we do not anticipate major changes, we reserve the right to make modifications to the Scoring Document. We will publicly announce any such modifications. The Scoring Document is not provided as the basis for any professional advice or for transactional use. GRESB and its advisors, consultants and sub‑contractors shall not be responsible or liable for any advice given to third parties, any investment decisions or trading or any other actions taken by you or by third parties based on information contained in the Scoring Document. Except where stated otherwise, GRESB is the exclusive owner of all intellectual property rights in all the information contained in the Scoring Document.

Purpose of this document

The GRESB Infrastructure Fund Scoring Document provides a comprehensive explanation of how individual indicators are scored within the Infrastructure Fund Assessment. It is designed to complement the Reference Guide, which outlines the specific reporting requirements for each indicator. Together, these documents help participants understand the assessment criteria, meet reporting requirements, and interpret their scores effectively.

For additional guidance on understanding the Benchmark Report insights, refer to the “How to Read Your Benchmark Report” document. Frequently asked scoring-related questions are also addressed in the FAQ document.

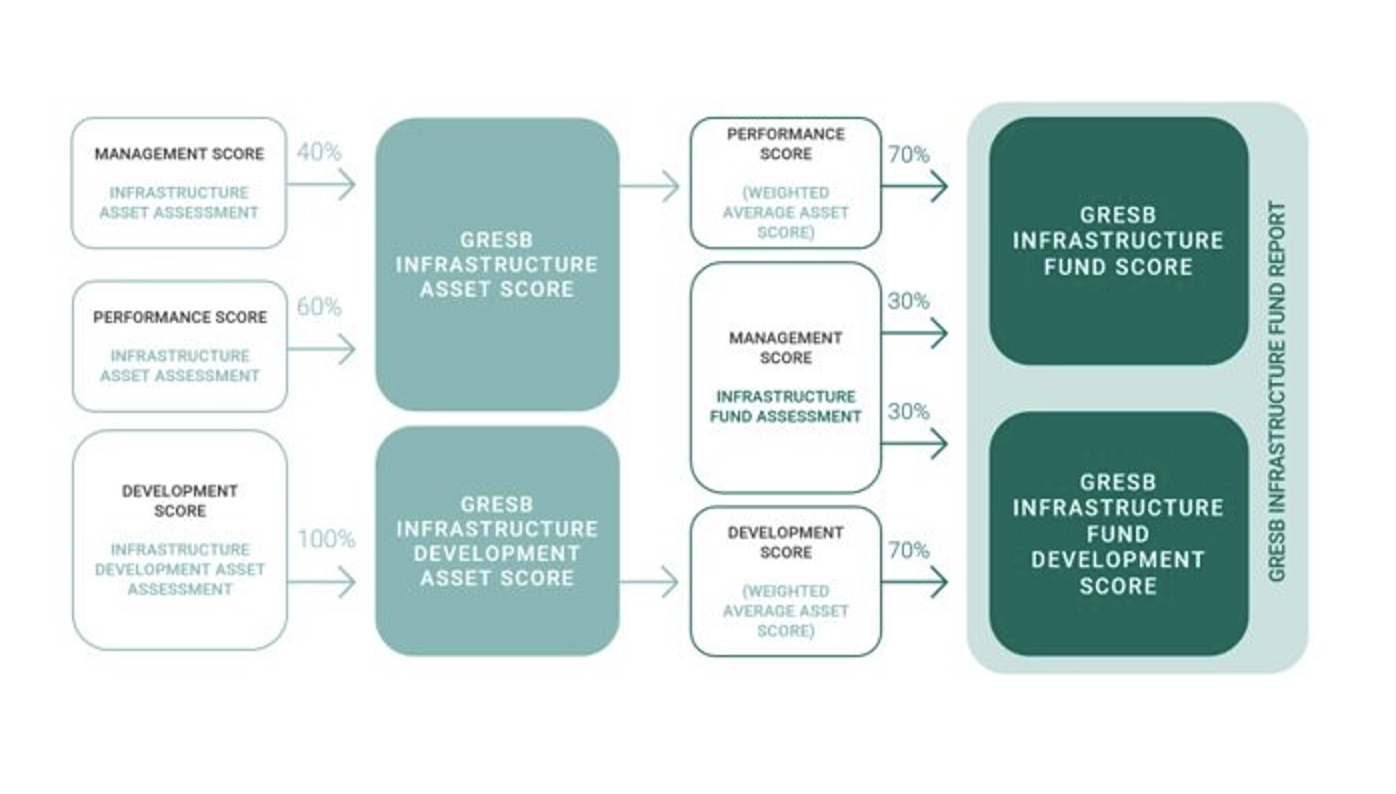

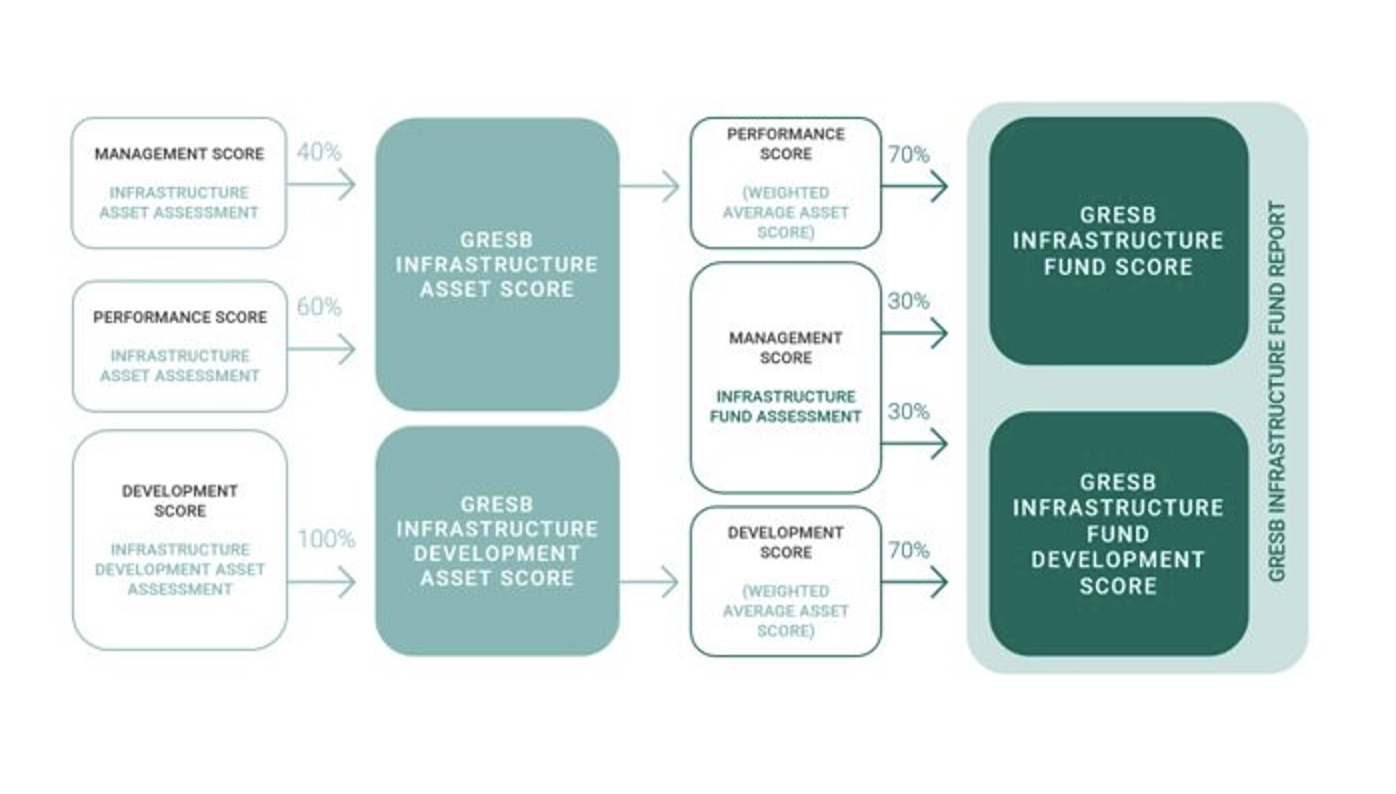

GRESB Scoring Model

Scoring within the GRESB Infrastructure Fund Assessment is fully automated and completed without manual intervention. The maximum score for the Infrastructure Fund Assessment is 100 points, distributed across components as follows:

Fund Benchmark

- Management Component: 30 points

- Performance Component: 70 points

Fund Development Benchmark

- Management Component: 30 points

- Development Component: 70 points

Fund GRESB Scores

Management Score

All funds that complete the Fund Assessment earn a Management Score.

Performance and Development Scores

To receive a Fund Performance Score and/or Fund Development Score, at least 25% of the fund’s underlying assets (based on equity invested) must participate in a GRESB Infrastructure Assessment and be connected to the fund on the GRESB Portal.

- To earn a Performance Score, at least at least one asset within that 25% must complete the Asset Assessment.

- To earn a Development Score, at least one asset within that 25% must complete the Development Asset Assessment.

Note: If fewer than 25% of assets participate in the GRESB Assessment, the Fund will only receive a Management Score. This rule also applies to funds using the “New Fund Participant” exclusion reason.

The Fund Performance and Development Scores are weighted averages of the GRESB Scores that the underlying assets (as listed in indicator RC6) obtained within their respective Infrastructure Asset/Development Asset Assessments.

GRESB Fund Score Calculation Considerations

- Non-reporting assets, or assets without a 'Confirmed’ connection status, will receive a score of zero for the purposes of calculating the Fund Performance/Development Score.

-

Funds are entitled to exclude specific assets from contributing to their Performance/Development Score if there is a valid reason. The weights of excluded assets will be redistributed among the remaining assets. See indicator RC6 of the Fund Reference Guide for additional details on valid exclusion reasons.

-

[New in 2025] First-time Fund Assessment participants can exclude any assets from scoring using the ‘New Fund Participant’ exclusion reason, under the following conditions:

- The fund must increase asset participation in the second year of reporting for this exclusion reason to remain valid.

- If using the “New Fund Participant” exclusion reason, the fund’s coverage level will be displayed alongside the score in the Scorecard summary of the Fund Benchmark Report, and it will be highlighted in the Benchmark Report when a fund is using this exclusion reason.

- Funds that use the ‘New Fund Participant’ asset exclusion will not be eligible for Sector Leader awards.

- [New in 2025] This weighted average score excludes the scores of assets that used a Grace Period.

Indicator Score Breakdown

Each indicator within the GRESB Infrastructure Fund Assessment is assigned a specific scoring weight. The maximum score an entity can achieve for each indicator depends on several factors, with the scoring process incorporating scoring weights and scoring multipliers.

Simple Scoring Weights

The options and sub-options of most scored indicators have different scoring weights. These weights, displayed in red on the left side of each indicator, represent the distribution of total available points per indicator according to the priorities established by the GRESB Foundation, aligning with market trends and sustainability best practices.

When indicators have options and sub-options, the scoring weight for each sub-option is first summed, and the resulting value is multiplied by the main fraction assigned to that option. The final score is the cumulative sum of these weighted sub-options across all main options within the indicator, multiplied by the indicator's maximum points.

If the sum of sub-option weights surpasses one, the value is capped at one. If the sum of the options surpasses the indicator's maximum score, the value will be capped at that maximum.

The score for these indicators is determined as follows:

Indicator Score = [(Sum of sub-option scoring weights) * (Selection weight)] × (Maximum score for the indicator)

Example: Indicator LE3 – ESG, climate-related and/or Human senior decision maker (1.62 points).

The indicator consists of three main options: ‘ESG,’ ‘Climate-related risks and opportunities,’ and ‘Human Capital’. ESG, for example, carries a weight of (3/5). Within each main option, there are several sub-options (i.e., Board of directors, C-suite level staff), each assigned its own weight. In the case of LE3, each sub-option contributes a scoring weight of 1. If an entity chooses two elements under ‘ESG,’ one element under ‘Climate-related risks and opportunities,’ and one element under ‘Human Capital’, the calculation would read as:

Note: Diminished scoring may influence sub-options’ scoring weights. See this section below for more information.

Diminishing Increase in Scoring

For other indicators, diminishing scoring impacts the assigned scoring weight of the options and sub-options. In the Fund Assessment, this only applies to indicator RP2.1, as indicated in the Scoring Document by a blue line next to the selections’ fractional weights.

The idea behind this concept is that the fractional score achieved for each additional data point provided decreases as the number of provided data points increases. This means that the fractional score achieved for the first data point will be higher than the fractional score achieved for the second, which again will be higher than for the third, and so on.

In this approach, the full assigned scoring weight is only achieved per selection if the entity selects the minimum number of required elements. In indicator RP2.1, for example, selecting ‘Clients/customers’ as an applicable stakeholder will only earn a 1/8 scoring weight if the entity selects eight stakeholder groups. Otherwise, the scoring weight of this selection would be a logarithmic function of the fractional score.

Scoring Multipliers

Validation Multipliers

For indicators that are subject to manual validation (see Appendix 4 of the Reference Guide), the evidence’s validation status acts as a multiplier to determine the indicator’s final score.

If supporting evidence for indicators is fully accepted, it results in the application of the full multiplier (100%) to the indicator's score. If supporting evidence is partially accepted, it results in a reduced multiplier (50%). If the evidence is not accepted, the multiplier is set to 0, regardless of the original selection’s predefined scoring weight. Indicators and responses subject to manual validation can be found in Appendix 4 of the Reference Guide.

Validation Multiplier Example

For indicators with a validation multiplier, the final score is calculated using the following formula:

Indicator Score = ((Sum of scoring weights) × (Multiplier)) × (Maximum score for the indicator)

Example: Indicator LE4 - Personnel ESG Performance Targets (1.62 points). Each selected personnel group contributes a specific scoring weight. It is mandatory to upload evidence that supports the entity’s selections. The evidence’s validation status (i.e., accepted, partially accepted or not accepted) is associated with a scoring weight that is used as a multiplier to determine the final score.

If an entity chooses ‘ESG managers’ and ‘Investment analysts’ but its evidence is given a partially accepted validation status (multiplier: 0.5), the calculation would be as follows:

Coverage Multipliers

When applicable, coverage percentage can also be used as a multiplier to determine the assigned score. This multiplier applies to the following indicators as follows:

- Percentage of employees: SE2, SE3

Coverage Multiplier Example

Example: Indicator SE2 - Employee training (1.08 points). Taking the following scenario:

- The entity provides professional and ESG-specific training for employees. 100% of employees received professional training during the reporting year, and 25% received ESG-specific training during the reporting year.

Scoring is then calculated as follows:

Additional Clarifications

Open text boxes are not used for scoring purposes but are intended for additional reporting or explanatory purposes.

Leadership

Leadership

Policies

Policies Targets

Targets

Reporting

Reporting Risk Management

Risk Management Stakeholder Engagement

Stakeholder Engagement