Reporting entity

Entity Name: ____________

Organization Name (May be same as entity name): ____________

The 2024 GRESB Infrastructure Development Asset Assessment Reference Guide (“Reference Guide”) accompanies the 2024 GRESB Infrastructure Development Asset Assessment and is published both as a standalone document and in the GRESB Portal alongside each Assessment indicator. The Reference Guide reflects the opinions of GRESB and not of our members. The information in the Reference Guide has been provided in good faith and is provided on an “as is” basis. We take reasonable care to check the accuracy and completeness of the Reference Guide prior to its publication. While we do not anticipate major changes, we reserve the right to make modifications to the Reference Guide. We will publicly announce any such modifications.

The Reference Guide is not provided as the basis for any professional advice or for transactional use. GRESB and its advisors, consultants and sub‑contractors shall not be responsible or liable for any advice given to third parties, any investment decisions or trading or any other actions taken by you or by third parties based on information contained in the Reference Guide.

Except where stated otherwise, GRESB is the exclusive owner of all intellectual property rights in all the information contained in the Reference Guide. While we do not anticipate major changes, we reserve the right to make modifications prior to the official start of the 2024 reporting period on April 1 and the official release of the 2024 GRESB Infrastructure Development Asset Assessment. We will publicly announce any such modifications.

Mission-driven and investor-led, GRESB is the environmental, social and governance (ESG) benchmark for real assets. We work in collaboration with the industry to provide standardized and validated ESG data to the capital markets. The 2023 Real Estate benchmark covered more than 2,000 property companies, real estate investment trusts (REITs), funds, and developers. Our coverage for Infrastructure is more than 850 infrastructure funds and assets. Combined, GRESB represents USD 8.8 trillion AUM. More than 150 institutional investors with over USD 50 trillion AUM, use GRESB data to monitor their investments, engage with their managers, and make decisions that lead to a more sustainable real asset industry.

For more information, visit gresb.com. Follow GRESB on LinkedIn.

GRESB Infrastructure Assessments

The GRESB Infrastructure Assessments are ESG engagement and benchmarking tools for institutional investors, fund managers, infrastructure companies, asset operators, developers and EPCs working in the infrastructure space.

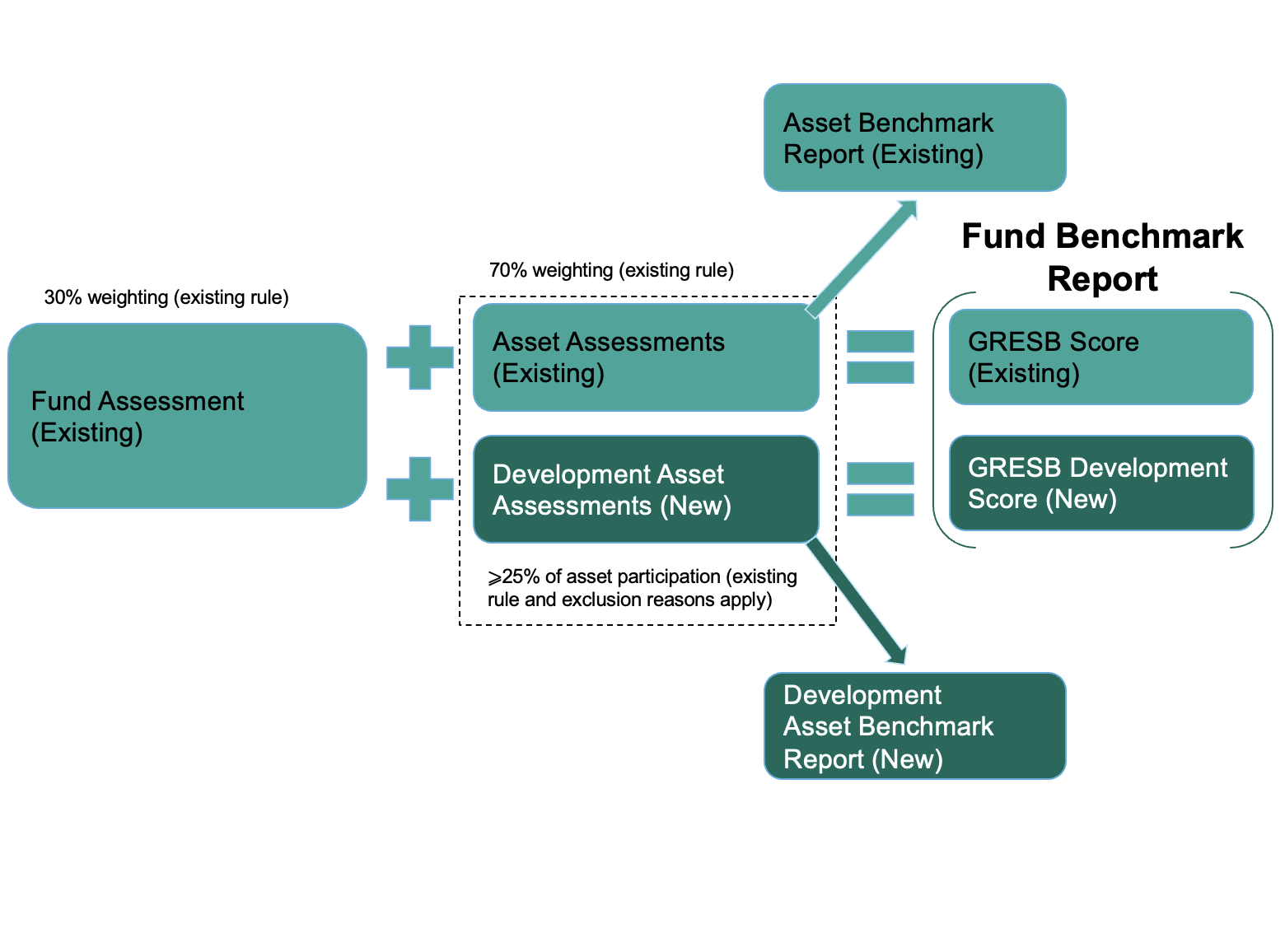

There are three complementary GRESB Infrastructure Assessments: a Fund Assessment, an Asset Assessment and a Development Asset Assessment. All address critical aspects of ESG performance through a globally applicable and standardized reporting and benchmarking framework. The Fund Assessment is intended for infrastructure funds and portfolios of assets, while the Asset Assessment and the Development Asset Assessment are meant to be completed by the individual underlying assets (portfolio companies). All Assessments cover the full breadth of infrastructure sectors, including:

The Infrastructure Development Asset Assessment is composed of a single module that allows any infrastructure asset in either the pre-construction or in the construction phase of development to report to GRESB.

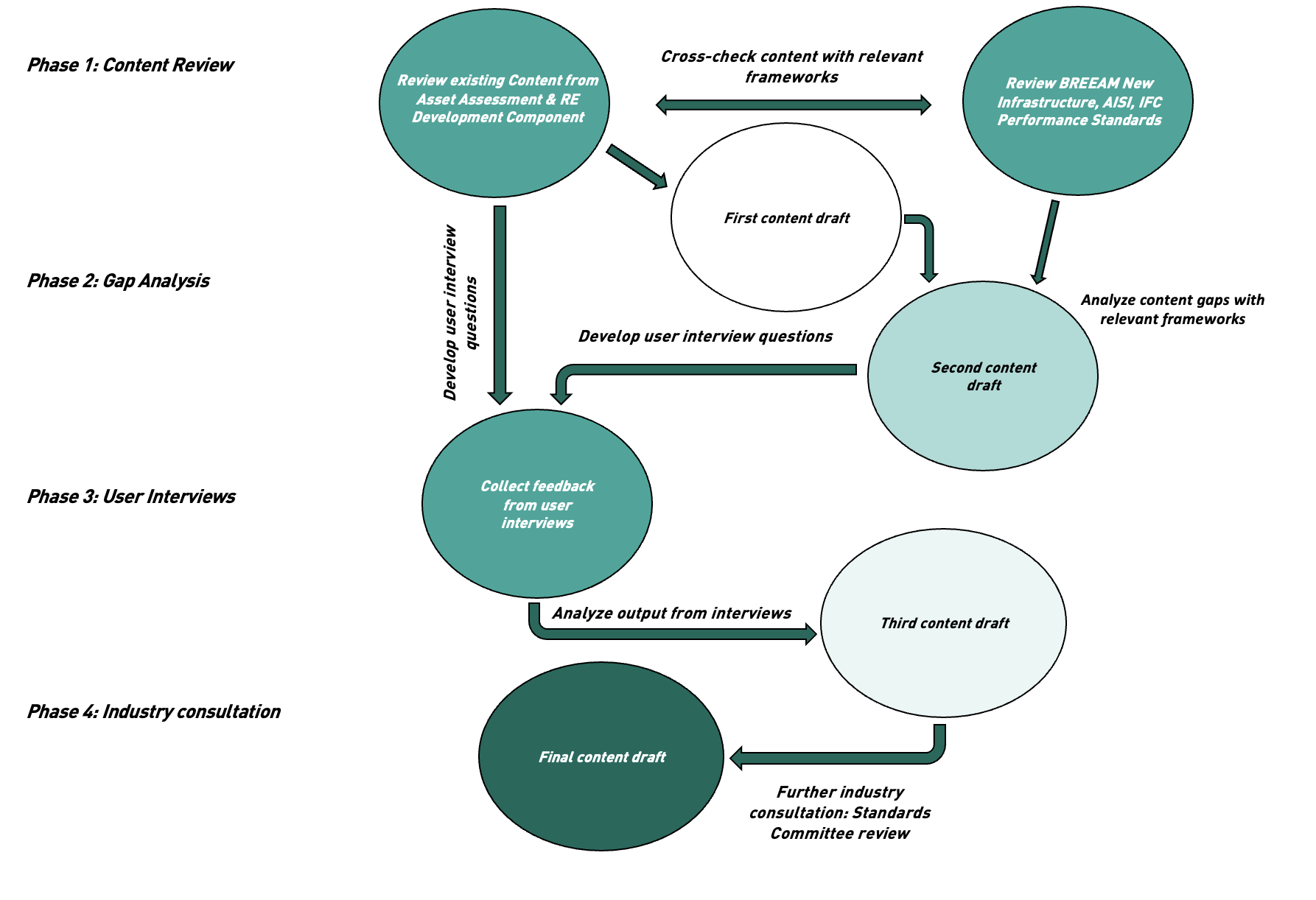

GRESB Standards Development Process

As part of the Standards Development process, the GRESB Foundation, who legally owns the Standards, works to develop, maintain, improve and publish GRESB Standards annually, in time for GRESB B.V. to perform its assessments. The GRESB Foundation is the primary platform for GRESB to engage with the industry in order to advance ESG topics and areas of focus with a strong commitment to positive market transformation powered by transparency and competitive differentiation.

For more information about the 2024 Assessments development process, click here.

The Assessment Portal opens on April 1, 2024. The submission deadline is July 1, 2024 (23:59:59 PST), providing participants with a three‑month window to complete the Assessment. This is a fixed deadline, and GRESB will not accept submissions received after this date. GRESB validates and analyzes all participants’ Assessment submissions.

The GRESB validation process starts on June 15, 2024 and continues until July 31, 2024. Participants may be contacted during this time to clarify any issues with their response.

In 2020 GRESB introduced a new Review Period in the Assessment Cycle to further strengthen the reliability of the Assessments and benchmark results. The Review Period will start on September 2, when preliminary individual GRESB results will be made available to all participants and run for the month. During the Review Period, participants will be able to submit an Assessment Correction Request to GRESB.

The final results will be launched to both Participant and Investor Members on October 1. Public Results events and other results outputs will be scheduled in October and November.

For more information on the Review Period see Appendix 5.

For more information about the 2024 Assessment timeline, click here.

A Pre-Submission Check (formerly Response Check) is a high-level check of your Assessment response prior to final submission. The Pre-Submission Check is carried out by GRESB’s third party validation provider SAS (Sustainability Assurance Services, formerly SRI) and features a careful review of Assessment responses followed by a 1-hour discussion call. It can be particularly useful for first-time participants.

The Pre-Submission Check does not exclude the participant from any element of the validation process, nor does it guarantee a better GRESB score. It is intended to ensure that no important details have been overlooked in the submission and provides the opportunity to ask for additional guidance and clarification on the GRESB Assessment indicators. The Pre-Submission Check helps reduce errors that may adversely impact Assessment results and identifies inconsistent responses and incorrect answer formats.

The Pre-Submission Check is available for request from April 1 to June 1, 2024 (11:59:59 p.m., PST Pacific time) subject to available resources availability. We therefore strongly encourage participants to place their requests and schedule their calls as early as possible. The Pre-Submission Check can be requested before the Assessment has been completed, but the scope of the review will be limited to the information filled in 1 week prior to the scheduled call.

The Assessment Portal includes indicator-specific guidance, available under the “Guidance” buttons that explains:

In addition to the guidance in the Portal, each Assessment is accompanied by a Reference Guide (this guide). The Reference Guide provides introductory information on the Assessments and a report-format version of the indicator-by-indicator guidance that is available under the Guidance tabs in the Portal.

Moreover, there are several tools and functionalities in the Portal to support submissions. For example, the Portal has real‑time error detection systems and warnings. More detail can be found in Participant Tools .

GRESB works with a select group of Partners who can help participants with their GRESB Infrastructure Assessment submission. To learn more about the services offered by GRESB Partners, take a look at our Partner Directory.

Participants can contact the GRESB Helpdesk at any time for support and guidance.

The GRESB Assessment Training is designed to help GRESB participants, potential participants and other GRESB stakeholders (managers, consultants, data partners) that undertake and improve their ESG reporting through the GRESB Assessments.

GRESB provides a free online training platform for all. The training courses are modular and self-paced, walking participants through the various aspects of the Assessments and providing detailed examples and tips for a successful submission.

The preliminary results will be published on September 2 and final results on October 1 after the Review Period. Participants will receive the following outputs (subject to payment of participation fees as noted earlier):

Additional products and services, such as Results Consultation (more information can be found here), can be purchased via the Assessment portal following the results release.

Data is submitted to GRESB through a secure online platform and can only be seen by GRESB Staff and authorized personnel from GRESB’s third party validation provider SAS. GRESB benchmark scores are not made public.

Access to results

Data collected through the GRESB Infrastructure Assessments is only disclosed to the participants themselves and any GRESB Investor and Fund Manager Members that have been granted access by the participant. GRESB Investor Members must request access to participant data in the GRESB Portal, whilst Fund Managers can be added as users on the portfolio participant account.

Non-listed participants must individually approve data access requests from GRESB Investors. A request is received via email and, upon approval by the participant, the requesting GRESB Member may view the participant’s Benchmark Report. Participants may reject data access requests. Rejecting a request blocks the requesting member’s access to the participant’s results.

Participants should always check the identity of the organization requesting access to GRESB Infrastructure Assessment results.

No other third parties will see the data.

Access to uploaded evidence

Documentation provided as evidence can be made available to GRESB Investor and Fund Manager Members on a document-by-document basis. Each uploaded document has a checkbox (with the default set to ‘not available’) which, when selected by the participant, makes this evidence available to all investors with access to that entity. It is not possible for participants to choose a subset of investors to share the documents with.

Access to peer group results

GRESB provides an opt-in option that will disclose the asset’s or fund’s name as well as the scores for the different components to participants in the peer group that also opted to disclose their name and component scores

As a default, GRESB does not disclose a participant’s data to other participants. For listed entities, the entity name is disclosed in the Benchmark Report, as well as the entity names of listed peer group constituents. For non-listed entities, only the fund manager’s name is disclosed, as well as the fund managers peer group constituents.

GDPR compliance

GRESB is fully compliant with GDPR. The GRESB Privacy Statement can be found here. GRESB also has specific internal policies related to GDPR, such as a Data Breach Policy and Data Protection Policy, that cannot be shared externally for security reasons. Note that asset level data does not fall under the incidence of GDPR because it does not contain any personal information.

If participants are unable to report certain metrics such as 'Racial Diversity' and 'International background' due to GDPR restrictions, then they may leave a comment stating this in the open text box provided.

Cybersecurity

GRESB’s data security measures and systems have been reviewed by an external expert and no issues were flagged. The GRESB website and the GRESB Portal are fully HTTPS/TLS encrypted. GRESB has strict and extensive policies on data security that cannot be shared externally for security reasons.

Grace Period

First year participants can submit the Assessment without providing GRESB Investor Members with the ability to request access to their results. This is referred to as a “Grace Period”.

First year participants wishing to report under the Grace Period can select the option on an entity-by-entity basis from the settings section in the Assessment Portal. Participants who select the “Grace Period” option can decide to unselect the option following receipt of their results. The Grace Period is not available in the second year of participation, regardless of whether it was used in the first year or not.

The “Grace Period” allows participants a year to familiarize themselves with the GRESB reporting and assessment process. The names of participating entities are still visible during the Grace Period, but GRESB Investor Members will not be able to request to see their results.

All Assessment responses must be submitted in English.

Providing Evidence in Other Languages

Documents uploaded as supporting evidence do not need to be entirely translated, provided that it meets the following criteria:

All the above information should be provided using one or more of the following:

Following these steps will clarify to the validation team the extent to which the evidence uploaded in a language other than English meets the evidence requirements of the relevant indicator(s).

Translation of the GRESB Assessment

The GRESB assessment portal can be translated by using “Google translate” via the Google Chrome web browser. This applies to the assessment portal, guidance notes and online version of the Reference Guide.

How to use Google Translate

Turn translation on

You can control whether Chrome will offer to translate web pages.

This works for the entire GRESB portal.

Disclaimer: Note that not all text may be translated accurately or be translated at all. GRESB is not responsible for incorrect or inaccurate translations. GRESB will not be held responsible for any damage or issues that may result from using Google Translate.

This section provides specific guidance for the 2024 GRESB Infrastructure Development Asset Assessment.

This guide should provide all the basic information needed to complete the 2024 Assessment. Contact the GRESB Helpdesk for any additional support and guidance.

Precisely what constitutes an infrastructure development asset is typically defined by investors at the investable entity level. These assets (investable entities) may comprise of single or multiple facilities. Either type of asset may participate in the Development Asset Assessment; however, reporting as a single facility provides the best basis for benchmark comparisons and is therefore recommended. Different approaches to participation are explained in the following sections. Note that these are only illustrative and that other scenarios are possible.

Single-facility assets

Single‑facility assets undertake their activities at one facility or across one facility network. These entities may be large and complex, or small and narrowly focused. For participating in the Development Asset Assessments, the facility or facilities would be in construction or pre-construction. The full description of the facility and business activities should be expressed in the Entity & Reporting Characteristics section of the Development Asset Assessment.

Examples of single‑facility assets include:

Multi-facility assets

In some cases, the asset’s activities may be spread across a number of facilities ‑ GRESB considers this to be a multi‑facility asset. A multi‑facility asset has the option to report:

Completing multiple assessments allows comparisons between assets and is strongly encouraged, whilst a single assessment may take less time if the relevant data is more readily available at the aggregated asset level.

Examples of multi‑facility assets include:

If a participant elects to report on multiple facilities in a single development asset assessment, then it is strongly recommended that this aggregation be kept at a single sector and country combination, otherwise peer group comparisons are likely to be far less specific and useful. For example, a multi-facility asset that consists of on-shore wind farms under development in the UK can be compared to other UK wind farms under development, whereas an asset with wind and solar farms in various European countries will likely fall into a peer group of renewable energy in Europe which is far less useful for comparisons. Multi‑facility assets that participate as one entity should have centralized management and aggregated performance data. See “Sector and Geography” (RC3) in the Entity and Reporting Characteristics Aspect for more details.

The Assessment consists of Entity and Reporting Characteristics section, and a single Development assessment module including management as well as performance data.

Development Asset Assessment

The Development Assessment focuses mostly on management and processes, with some focus on performance data relevant to the pre-operational phase and is pitched both at the organizational and project/asset level.

The Development Asset Assessment is suitable for any type of pre-operational infrastructure company, asset and investment strategy.

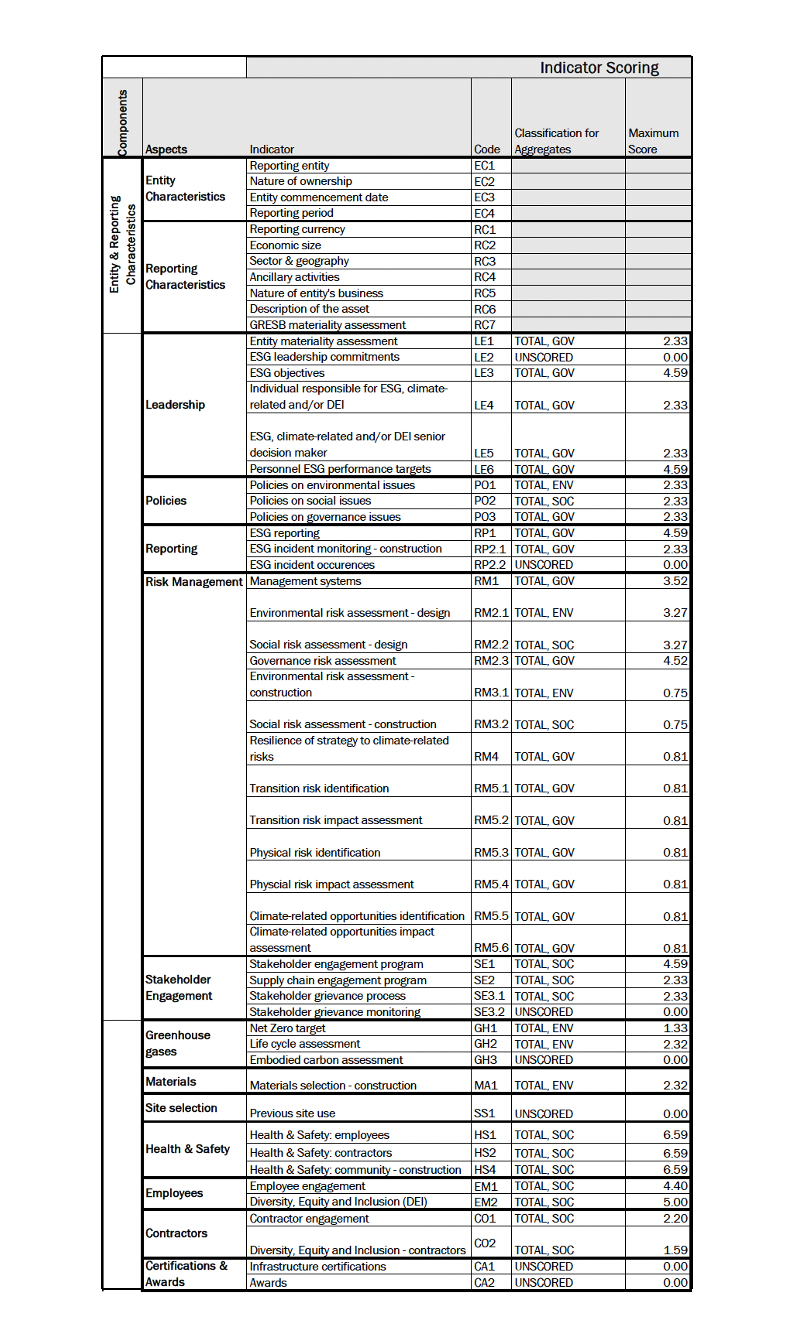

The 2024 Development Asset Assessment consists of 54 indicators, 43 of which are across the following 11 Aspects:

Assets completing the Development Asset Assessment will obtain a GRESB Score – Infrastructure Development Asset.

In the Development Asset Assessment, indicator scores are adjusted depending on the materiality of questions in relation to the reporting entity. Before starting the Development Asset Assessment, entities should therefore first complete the “GRESB Materiality Assessment (RC6) in ‘Entity & Reporting Characteristics’ to determine the materiality weightings for ESG issues and relevant indicators. These weightings will affect how each indicator should be addressed and also determine scoring. For more information, see the Materiality-based Scoring section.

Allocation to E, S, G

Each indicator is allocated to one of the three sustainability dimensions (E‑ environmental; S‑ social; G‑ governance):

| E | S | G | |

|---|---|---|---|

| Development | 12%

Dependent upon materiality |

49%

Dependent upon materiality |

39%

Dependent upon materiality |

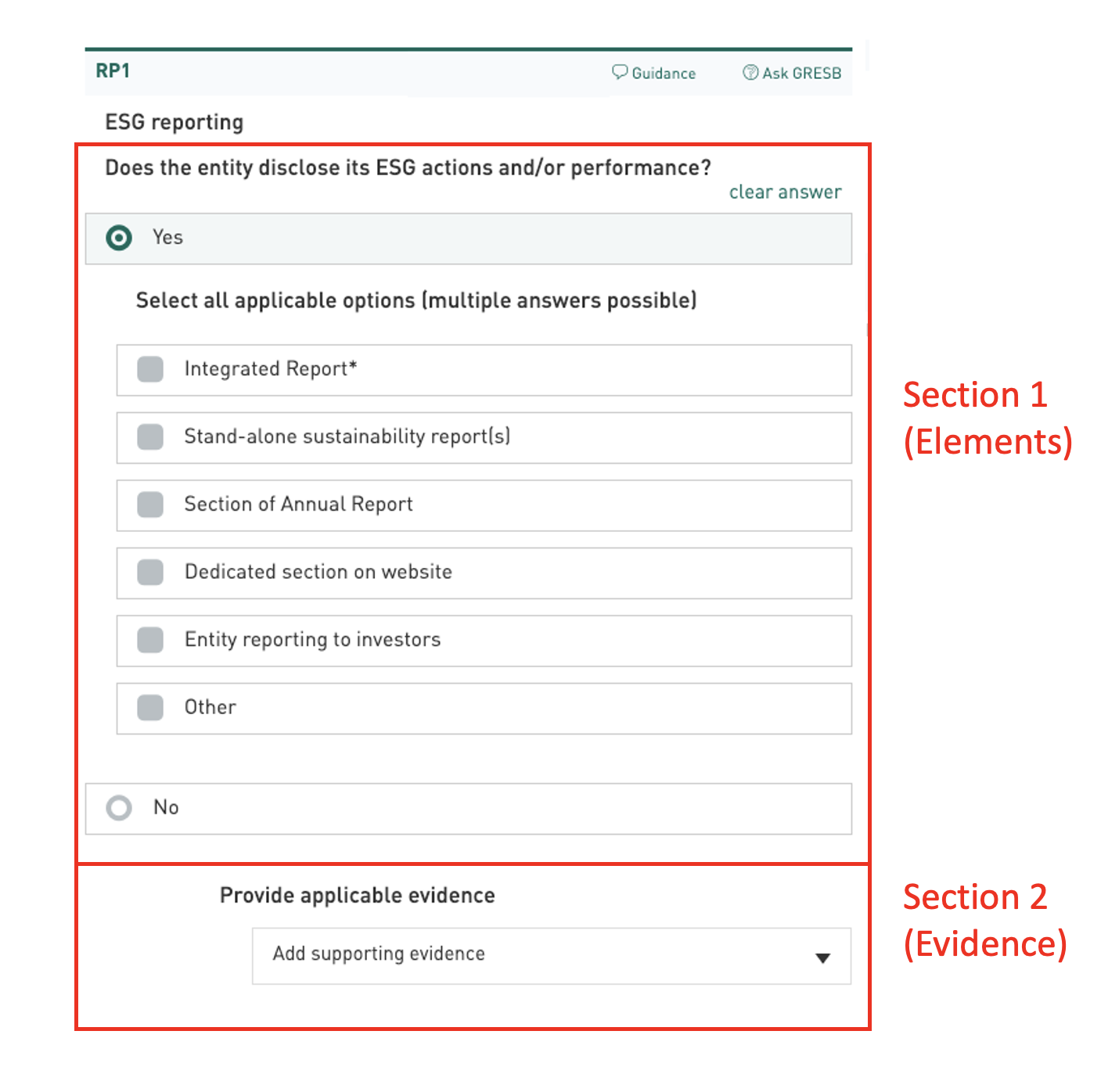

Every indicator has a short title (e.g. ESG Specific Objectives) and a code (e.g. LE3). These are usually followed by an initial indicator question that can be answered with ‘Yes’ or ‘No’.

When selecting ‘Yes’, participants are required to provide further information by selecting one or more answer options and/or completing an open text box or table. Participants should select all answer options that accurately describe the entity and or its activities. Indicators that require evidence are clearly marked in the GRESB Portal and Reference Guide.

When selecting 'No’, participants may not select any additional sub‑options; the indicator will receive no points.

Indicator Elements

Answer options for each indicator may use one or more of the following five core elements: Radio buttons, checkboxes, performance tables, ’Other’ answers and open text boxes. These elements are explained below:

Selected indicators in the Assessment require supporting evidence. Evidence is information that can be used to validate the overall answer to the indicator and support the additionally selected criteria.

GRESB does not have a standard for evidence. Instead, a validator with reasonable domain expertise should be able to review the evidence and find support for the overall indicator response and selected answer options. More information on evidence is provided with each indicator.

Evidence should clearly reference the answer options selected by the participant. The evidence should not require extensive interpretation or inference and participants are strongly encouraged to provide the simplest evidence that supports their claim. Evidence can be provided through a document upload or a hyperlink.

Document Upload

Participants may submit any document that supports selected checkboxes, tables and/or content of an open text box. Uploads are used by the validation team to substantiate claims.

Hyperlink

If a hyperlink is provided, ensure that the relevant page can be accessed within two steps. Ideally, the landing page should contain all the information needed to validate the answer. In order to qualify as valid supporting evidence, the evidence provided must demonstrate the achievement of the criteria selected. The participant has the obligation to ensure that the hyperlink is functioning at the time of validation. Broken links are the responsibility of the participant and will be interpreted as the absence of evidence. Hyperlinks in uploaded documents will not be checked.

Answers throughout the Assessment must be applicable to the reporting year identified in “Reporting year” (EC3) in the Entity and Reporting Characteristics, unless the indicator specifies an alternative reporting period. Exceptions to this temporal boundary must be reported under the “Exceptions” box that is present for indicators with performance tables.

A response to an indicator must be true at the close of the reporting year; however, the response does not need to have been true for the entire reporting year. For example, if a policy was put in place one month prior to the end of the reporting year, this is acceptable, it need not have been in place for the entire reporting year. GRESB does not favour the use of calendar year over fiscal year or vice versa, as long as the chosen reporting year is used consistently throughout the Assessment.

Responses should relate specifically to the “reporting entity” (i.e. the Asset) for which the Assessment is submitted. Evidence in relation to the Entity can come from any of the organizations involved with the activities within the Entity’s boundaries.

In the GRESB Terms and Conditions, the terms ‘Participating Portfolio’ and ‘Participating Asset’ refer to a ‘(Reporting) Entity’ as used in the in the GRESB Assessments, Guidance materials (e.g., Reference Guides and Scoring documents), GRESB Products (e.g., Benchmark Reports and PAT), the GRESB Portal, and in GRESB Training materials.

The Entity may include the physical asset itself, the asset manager and/or the asset developer. Responses may relate to any organization involved with the asset, for example the asset owner, the asset developer or any EPC involved with the development of the asset. Evidence must show that the relevant organization's practices apply to the reporting entity. If the provided evidence does not clearly reference the entity by name, an explanation of the relationship of the provided documentation’s organization to the entity must be provided, either on a cover page or in the text box accompanying the evidence.

Certain indicators refer to different reporting levels (e.g. Group, Operator, Contractor) that should be addressed within the indicator response and supporting evidence.

In the example in the figure below, the Reporting Entity (Asset) is Big City Airport. This Asset is part of Infrastructure Fund IV which is managed by Fund Manager LLC. Information pertinent to the Development Asset Assessment for Big City Airport may come from Big City Airport Management Ltd or the Developer. In some cases, Fund Manager LLC may also provide relevant information for the Assessment. The airline, El Cheapo Air, is outside of the reporting entity boundary and so information relating to El Cheapo Air would not typically be relevant to the Assessment.

Setting and describing appropriate boundaries for reporting on ESG is critical to allow for:

GRESB intends to work with the industry to increase the focus on performance measurement and scoring over the next few years. To cater for this, as well as reporting using accurate boundaries, the scope of reporting will need to become far more standardised across entities, to ensure that ‘apples versus apples’ comparisons can be made and this reflected in scoring.

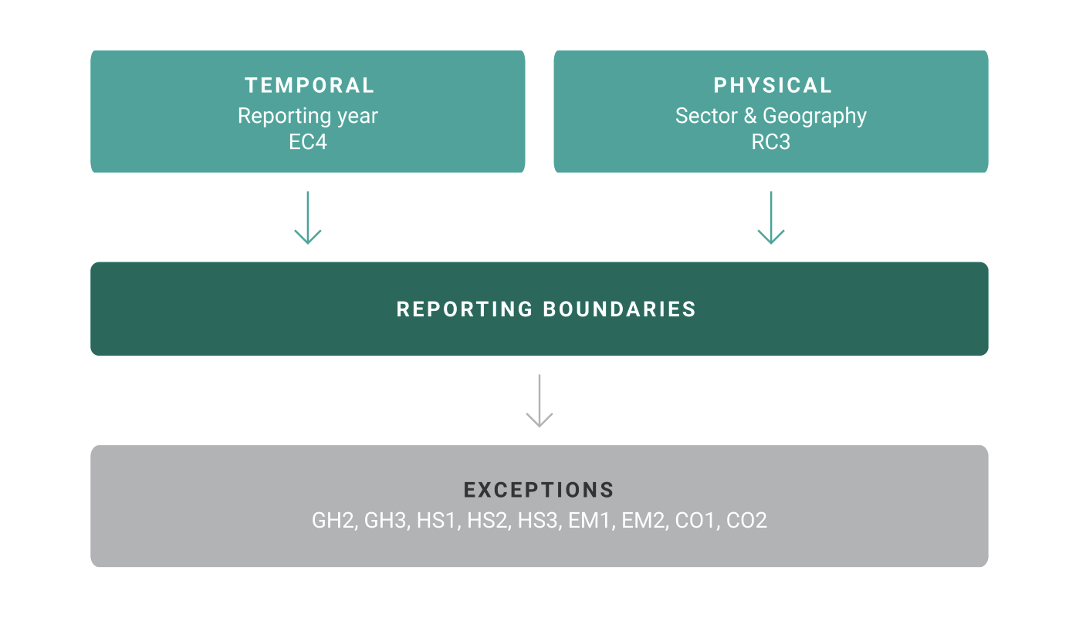

To this end, the Development Asset Assessment includes indicators that help to accurately describe the boundaries of reporting for each entity. These indicators are:

The combination of these indicators provides an accurate picture of the reporting boundary. Everything ‘within’ the boundary should be reported on within the relevant indicators, and everything ‘outside’ the boundary should not be included. We recognize however, that this reporting boundary may not apply to all reported ESG issues. These exceptions to the reporting boundary must be described in the “Exception” boxes that is present in indicators with performance tables.

This reporting boundary data will be carefully analysed and used in future years to standardise the reporting boundaries for all entities within similar sectors, thereby enabling fair and equitable data comparisons and scoring.

Data validation is an important part of GRESB’s annual benchmarking process. The purpose of data validation is to encourage best practices in data collection and reporting. It provides the basis for GRESB’s continued efforts to provide investment grade data to its investor members.

GRESB validation is a check on the existence, accuracy, and logic of data submitted through the GRESB Assessments. The validation process is structured into two categories: automatic validation and manual validation.

Automatic validation is integrated in the portal. As participants fill out their Assessments, the Portal employs real-time error detection mechanisms and displays warnings to help ensure Assessment submissions are complete and accurate.

Manual validation takes place after submission, and consists of document and text review to check that the answers provided in Assessment are supported by sufficient evidence. The validation rules and process are set and overseen by GRESB but the validation is performed by our third party validation provider. SAS.

Good Practice Examples: The reference guide includes good practice examples. These are shared via links under the Evidence section in the guidance and are drawn from evidence provided for the indicators from participants in previous years. The intention is to provide participants with more guidance and examples of good practices to assist their improvement efforts, however, does not guarantee similar evidence will be accepted in validation. Participants should make their own decisions about the suitability of the examples to their own circumstances.

For more information about the 2024 Validation Process, see Appendix 4 .

Participants with questions on individual validation decisions can contact the GRESB Helpdesk.

In 2020, GRESB introduced a new Review Period (see Appendix 5 for more information) in the Assessment Cycle to further strengthen the reliability of our Assessments and benchmark results. The Review Period will start on September 2, when preliminary individual GRESB results will be made available to all participants and run for the month. During the Review Period, participants will be able to submit an Assessment Correction Request to GRESB.

The final results will be launched to both Participant and Investor Members on October 1. Public Results events and other results outputs will be scheduled in October and November.

For a complete interpretation of the validation decisions in the Assessment, participants can request a Results Consultation. For more information about the Results Consultation, click here.

The sum of the scores for all indicators adds up to a maximum of 100 points, therefore the overall GRESB Score - Infrastructure Development is an absolute measure of ESG management and performance expressed as a percentage.

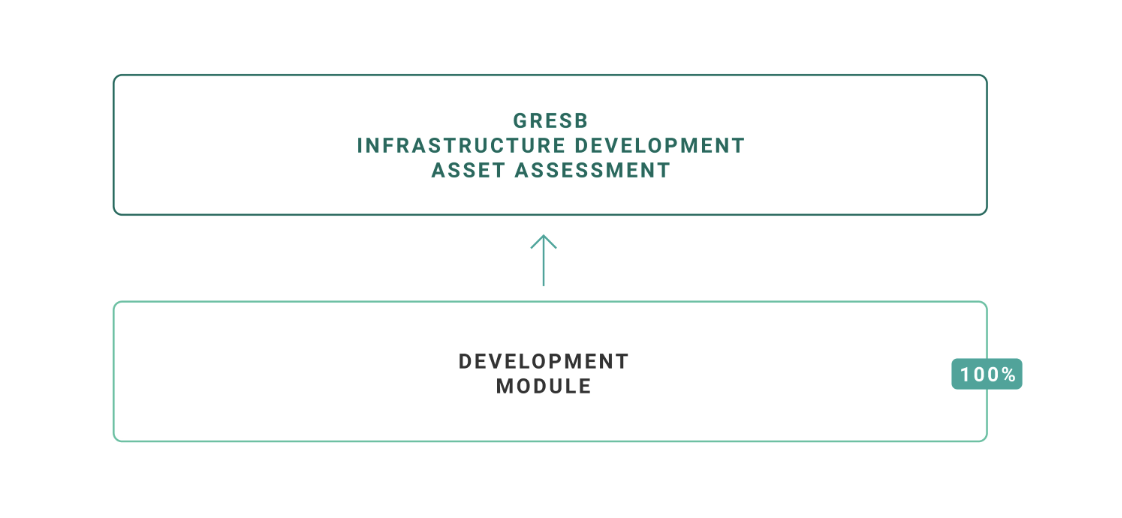

The GRESB Infrastructure Development Asset Assessment is comprised of an Entity and Reporting Characteristics section and a Development module. The overall GRESB Score - Infrastructure Development Asset is the sum of all indicators of the Assessment.

The GRESB Rating is an overall relative measure of ESG management and performance of the asset.

The calculation of the GRESB Rating is based on the GRESB Score and its quintile position relative to the GRESB universe, with annual calibration of the model. If the participant is placed in the top quintile, it will have a GRESB 5‑star rating; if it ranks in the bottom quintile, it will have a GRESB 1‑star rating, etc.

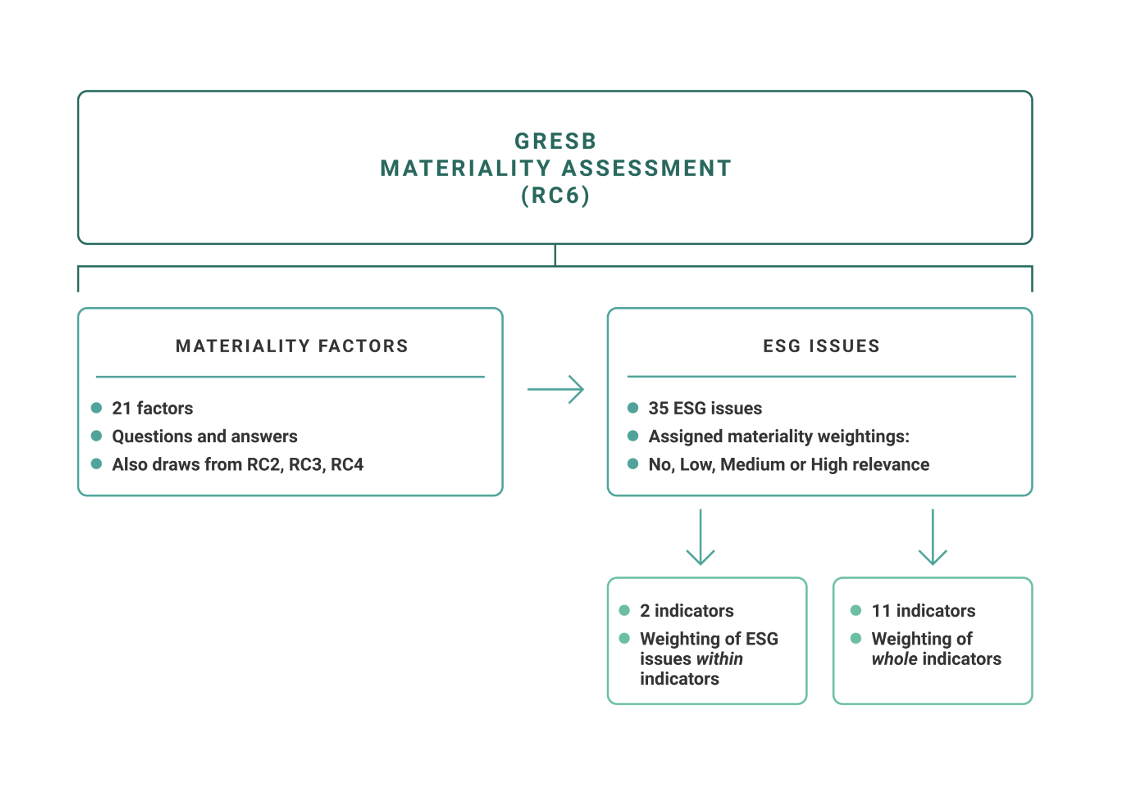

GRESB uses Materiality‑based scoring across the Development Asset Assessment. This process applies the well proven process of materiality assessment to scoring ensuring that all assets are assessed and scored based on the ESG issues that are most material to their circumstances.

The materiality-based scoring process is illustrated in the diagram below.

The main part of the process is contained within the GRESB Materiality Assessment indicator (RC6). In this indicator, a set of 15 simple questions relating to Materiality factors are answered using simple drop-down selections. The answers to these questions have an effect then on the materiality outcomes of the ESG issues and indicators in the Development Asset Assessment.

An additional 5 factors are drawn from indicators RC2, RC3 and RC4. These factors include:

To see how the answers to the materiality factors affect materiality outcomes, please see below:

There are 35 ESG issues (15 Environmental and 20 Social) and 13 indicators affected by materiality in the Development Aset Assessment. Each of the materiality factors is associated with one or more ESG issues and indicators, so that as the factor questions are answered, the materiality of the ESG issues and indicators is determined. Note that the materiality is fixed for two of the 35 ESG issues (i.e. they are unaffected by the Materiality factors), while the materiality for 5 indicators is based on the asset's development phase. There are four possible materiality levels that can be assigned to ESG issues and indicators, and these directly translate to a scoring weighting in the Assessment, as follows:

| Materiality | Weighting |

|---|---|

| No relevance | 0 |

| Low relevance | 0 |

| Medium relevance | 1 |

| High relevance | 2 |

Thus, issues of No or Low relevance are deemed non-material and receive no score in the Assessment - effectively they are removed from consideration. Issues of Medium relevance receive Medium score weighting and issues of High relevance receive a high score weighting. For example, the ESG issue “Air pollution” is of “No relevance” for entities in the primary sector ‘Renewable power: Solar power generation’, therefore it does not need to be considered by entities in this sector in the Assessment. On the other hand, for entities in the primary sector ‘Power generation x-Renewables: Independent Power Producers: Gas-Fired Power Generation’, Air pollution is deemed of High relevance and therefore requires close consideration throughout the Assessment.

The outcome of completing the GRESB Materiality Assessment indicator is an entity-specific materiality weighting for each of the ESG issues. These weightings are displayed at the bottom of each indicator in the portal. Once each of the ESG issues has been assigned a materiality weighting (relevance), these apply to certain indicators in the Assessment in slightly different ways, as described below.

Multiple-issues indicators

These indicators cover the standard list of ESG issues and are scored based on how many of the material issues are addressed. Each of the 15 standard Environmental issues and 20 standard Social issues will receive a materiality weighting from the GRESB Materiality Assessment.

Single-issue indicators

Each indicator addresses a specific ESG issue or is specifically catered for construction-related activities. Indicators relating to ESG issues of High relevance are weighted highly, and Medium relevance moderately. Indicators relating to ESG issues of No or Low relevance are not scored. Indicators relating to construction-related activities are weighted moderately (Medium relevance) if the asset has reported to be in the construction phase, alternatively they are not scored (No relevance) if the asset has reported to be in the pre-construction phase.

Dynamic materiality

After the materiality outcomes of any individual entity are known the scores are then redistributed proportionately across all remaining scored indicators in the assessment, ensuring that the evaluation of a project’s sustainability is contextually nuanced and reflective of the project’s unique circumstances at any given point in its development lifecycle.

For example, an asset in its pre-construction phase will receive a “No relevance” materiality outcome for indicators RP2.1, RM3.1, RM3.2, MA1 and HS3. Dynamic materiality ensures the points are redistributed across the remaining indicators.

This means that materiality-based scoring brings the focus only on material ESG issues and takes into account the different development phases of an asset.

Whilst the GRESB Materiality Assessment and the whole materiality-based scoring process are straightforward to understand and apply, some participants may want to understand them, and how they apply to their situation, in more detail. GRESB provides an Excel based GRESB Materiality & Scoring Tool for this purpose.

This tool duplicates the materiality-based scoring process embedded in the portal but in an easier and more transparent layout. In addition, the tool provides the ability for participants to record their own view of materiality for each issue and provide associated justification for feedback to GRESB in future refinement of materiality-based scoring. Completed feedback should be sent to the GRESB via the contact form . The tool also contains a ‘Materiality Matrix’ and a ‘Sector Determined’ matrix that transparently link each Materiality factor answer to the relevance for the associated ESG issues. Finally, the tool contains a Scoring and Weighting sheet that shows how indicator weightings are modified by the materiality-based scoring.

The Development Asset Assessment is made up of 11 Aspects and contains 43 indicators with the exclusion of Entity & Reporting Characteristics. The below weights apply for 2024.

For informational purposes, the Maximum Scores for the materiality-driven performance indicators have been set as equally weighted*

The following is a scoring overview of indicators in the 2024 Infrastructure Development Asset Assessment. Some general remarks and notes on the structure of indicators:

There are four scoring models used within indicators:

The overall outcome of these models is to generate a fractional score (i.e. between zero and one) which is then multiplied by the indicator weighting (maximum score) to generate the score for the indicator.

Every scored indicator begins with this section which can receive a fractional score (i.e. between zero and one), determined by selections made in checkboxes and radio buttons, and answers provided in open text boxes. Based upon these inputs, fractional scores are calculated using either an aggregated fractions or a diminishing increase in scoring methodology.

Aggregated scoring: For indicators where one or more answers can be selected, fractional scores are awarded cumulatively for each individual selected answer and then aggregated to calculate a final fractional score for the section. In some cases, each checkbox answer may be equally weighted and in others, each checkbox answer may be assigned a higher or lower fractional score each, to reflect best practice responses. For many indicators, the final fractional score is capped at a maximum, which means that it is not necessary to select all checkbox answers in order to receive full points.

Materiality-based scoring: These indicators are similar to Aggregated points, where points are awarded cumulatively for each individual selected answer and then aggregated to calculate a final score for the indicator. Where materiality-based scoring applies, each checkbox answer is weighted to reflect the materiality of the relevant ESG issue, as determined by the GRESB Materiality Assessment.

Some indicators require evidence to verify information provided in section 1 (Elements). In these cases, the fractional score for the evidence section acts as a multiplier to the Section 1 fractional score. Mandatory evidence receives a multiplier of zero (0) for no evidence or not-accepted evidence, 0.5 for providing partially accepted evidence and 1 for providing fully accepted evidence. To clarify, the indicator will receive no points unless the hyperlink and/or uploaded document is considered valid (i.e. partially and/or fully accepted).

The final indicator score is then calculated as:

For benchmarking purposes, each participant is assigned to a peer group, based on the entity’s primary sector, primary location and other factors, as reported in RC3 and EC2. To ensure participant anonymity, GRESB will only create a peer group if there is a minimum of six participants allocated to the peer group (the participant and five other peers).

Peer group assignments do not affect an entity's score, but determine how GRESB puts participant’s results into context.

The goal of the peer group creation process is to compare participants who share important characteristics, while:

Each participant can be part of multiple peer groups, but can only have one active peer group. The active peer group is the one which is used for benchmarking and is displayed in the participant’s Benchmark Report. This means that participant A can be in the active peer group of participant B, without participant B being in the active peer group of participant A.

The peer group composition is determined by a simple set of rules and provides consistent treatment for all participants. If the peer group is too small, we eliminate filters until we have a valid peer group. There are two ways in which the filter can be widened:

The system attempts to find the optimum peer group based on the criteria presented above. This process repeats in a loop following the logic described in Appendix 6: Peer Group Allocation Logic .

Peer group disclosureGRESB provides an opt-in option to disclose the entity’s name in Benchmark Reports. However, this is only disclosed to participants who also opted to disclose their name and dimension scores.

The GRESB Sector Leader program recognizes the best performers annually from across the GRESB Assessments. Achieving sector leader status is clear recognition of best practice ESG performance by Infrastructure assets and funds. A minimum number of entities is necessary to award a Sector Leader. This minimum number is reviewed each year. If any significant ESG fines and/or penalties are reported (see Reporting of ESG-related incidents (RP2.2)), the entity may not be entitled to sector leader status.

Information provided in the Entity and Reporting Characteristics consists of two parts:

Entity characteristics: Identifies the reporting entity's characteristics that remain constant across different reporting periods (year-on-year).

Reporting characteristics: Describe the entity, define the reporting scope for the current reporting year and determines the structure of the Assessment submission.

Note that none of the indicators in the Entity & Reporting Characteristics is scored.

EC1

Reporting entity

Entity Name: ____________

Organization Name (May be same as entity name): ____________

Identify the participating entity. The entity name will be used to identify the entity on the GRESB portal and will be displayed on the entity’s Benchmark Report.

Complete all applicable fields.

Entity name: Name of the asset for which the Assessment is submitted. For example, 'Big City Airport'.

Organization name: Name of the organization that manages the asset. For example, ‘Big City Airport Management Limited’ or ‘Big Global Asset Manager LLC’.

EC2

Nature of ownership

Ownership (Select one)

Public entity (listed on a Stock Exchange)

Specify ISIN: ____________

Private (non-listed) entity

Public-Private Partnership (PPP) entity

Non-profit entity

Government entity

Other: ____________

Legal Entity Identifier (optional): ____________

Describe the ownership status and structure of the participating entity.

Ownership: Select the nature of ownership of the participating entity. The nature of ownership aligns with the EDHECinfra™ TICCS™ classification for “Business Risk”.

Other: 'Other' answers must be outside the options listed in the indicator to be valid.

Government entity: An entity owned and managed by the government.

ISIN: International Securities Identification Number. ISINs are assigned to securities to facilitate unambiguous clearing and settlement procedures. They are composed of a 12-digit alphanumeric code and act to unify different ticker symbols, which can vary by exchange and currency for the same security. In the United States, ISINs are extended versions of 9-character CUSIP codes.

Legal Entity Identifier (LEI): The Legal Entity Identifier (LEI) is a unique global identifier for legal entities participating in financial transactions. Also known as an LEI code or LEI number, its purpose is to help identify entities on a global accessible database.

Non-profit entity: An organization that uses its earnings and/or donations to pursue the organization's objectives. Usually these organizations are listed as charities or other public service organizations.

Private entity: An entity that is not publicly listed or traded on a recognized stock exchange.

Public Entity: A company that is publicly listed and traded on a recognized stock exchange such as Nasdaq or NYSE.

Public-Private Partnerships (PPP): A long-term contract between a private party and a government entity, for providing a public asset or service, in which the private party bears significant risk and management responsibility, and remuneration is linked to performance.

EDHECInfra - The Infrastructure Company Classification Standard (TICCS™), 2020

World Bank Group, Public-Private Partnership in Infrastructure Resource Centre

EC3

Entity commencement date

What is the year of operation commencement?

![[Year]](/images/tables/year/y2024-7140a687.svg)

Establish the age of the entity.

Operation commencement: State the year when the entity first commenced or is expected to commence operation.

If the reporting entity represents a single facility, then the year entered should be when that facility commenced operation. If the reporting entity represents a portfolio of facilities being assessed as one asset (i.e. multi-facility asset) then it should be when the first facility in the portfolio commenced operation.

EC4

Reporting year

Calendar year

Fiscal year

Specify the starting month Month

The intent of this indicator is to set the entity’s annual reporting year. This information is used in combination with the responses to the indicators Sector & Geography (RC3) to understand the entity’s reporting boundary.

Select one of the options.

Participants are required to specify the starting month of their fiscal year. If participants select Fiscal year, starting months between February and June must correspond to calendar years 2023/2024. For example, an entity reporting from April to March will be considered covering the period of April 2023 - March 2024. On the other hand, starting months between July and December must correspond to calendar years 2022/2023. For example an entity reporting from October to September will be considered as covering the period of October 2022 - September 2023.

The table below details the period for which information throughout the Assessment would be expected, should a given starting month be selected:

| Starting month | Reporting Year |

|---|---|

| January | Select "Calendar Year" |

| February | Feb 2023 - Jan 2024 |

| March | Mar 2023 - Feb 2024 |

| April | Apr 2023 - Mar 2024 |

| May | May 2023 - Apr 2024 |

| June | Jun 2023 - May 2024 |

| July | Jul 2022 - Jun 2023 |

| August | Aug 2022 - Jul 2023 |

| September | Sept 2022 - Aug 2023 |

| October | Oct 2022 - Sept 2023 |

| November | Nov 2022 - Oct 2023 |

| December | Dec 2022 - Nov 2023 |

Calendar year: January 1 – December 31.

Fiscal year: The period used for annual financial statements. Depending on the jurisdiction the fiscal year can start on April 1, July 1, October 1, etc.

Reporting year: Responses provided throughout the entire Assessment must refer to the reporting year identified in this indicator and should correspond to the most recently closed calendar year / fiscal year, as applicable. A response to an indicator must be true at the close of the reporting year; however, the response does not need to have been true for the entire reporting year. GRESB does not favor the use of calendar year over fiscal year or vice versa, as long as the chosen reporting year is used consistently throughout the Assessment.

RC1

Reporting currency

Values are reported in Currency

Indicate which currency is used by the Entity to report monetary values in the Assessment.

Currency: Select the currency used by the entity in their reporting throughout the Assessment.

Other: ‘Other’ answer must be outside the options listed in the indicator. Participants should state a currency.

RC2

Economic size

Gross asset value (required) (in millions): ____________

Revenue (required) (in millions): ____________

Number of full time equivalent (FTE) workers (employees): ____________

Number of full time equivalent (FTE) workers (contractors): ____________

Establish the economic size and number of Full Time Equivalent (FTE) workers of the entity. The number of Full Time Equivalent (FTE) workers and contractors influence materiality (see guidance in RC6 and the GRESB Materiality Tool for more details).

GAV: Provide the entity’s GAV, in millions (e.g. $75,000,000 must be reported as 75). GAV should be provided as at the end of the reporting year.

It is mandatory to provide the GAV. Estimates are acceptable. Like all information provided to GRESB, this information will be kept confidential and is only shared with investors to whom you have granted permission.

Do not include a currency, as this has been reported in indicator RC1 above, but make sure the currency applied is consistent with indicator RC1.

Workers: Provide the number of full-time equivalent (FTE) workers of the asset, split into employees and contractors. Entities should determine whether workers classify as employees or contractors; as approaches may differ by locality or jurisdiction, GRESB purposefully leaves the exact distinction up to the asset. In general, though:

Contractor: Someone working for a business contracted by the asset to perform a service or other works at or for the asset.

Employee: Someone who works directly for the asset and receives compensation in the form of an hourly wage or annual salary for their work. This can be both onsite or offsite (such as in an administration office). Employers typically have to pay specific benefits such as contributions to pensions or taxes for employees. Employees may be either full time or part time and may operate on a short term contract.

FTE: Full Time Equivalent, a unit to measure the number of employed persons to make them comparable regardless of the number of working hours. FTE can be calculated by comparing the number of hours worked by an employee against the average number of hours of a full time worker. For example, if the number of hours worked by an employee in a week is 20, and the standard full time work week consists of 40 hours, the employee is counted as 0.5 FTE.

Gross Asset Value (GAV): The gross infrastructure value owned by the entity being the enterprise value associated with the infrastructure asset. The GAV reported here may include cash or cash equivalents where applicable (if it has any, eg. bank accounts, short-term investments etc). Use of the 'tangible fixed assets' or 'property, plant and equipment' value may be a suitable estimate if enterprise value is not known.

Revenue: The annual income generated by the entity in exchange for providing the asset service.

Worker: Someone who is either an employee or a contractor, that is, workers include both employees and contractors, and the number of workers is the sum of employees plus contractors.

https://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:Full-time_equivalent_(FTE)

https://www.irs.gov/newsroom/understanding-employee-vs-contractor-designation

https://www.business.gov.au/People/Contractors/Employee-or-contractor

RC3

Sector & geography

![[DevelopmentAssetSectorFocusFacilities]](/images/tables/development_asset_sector_focus_facilities/y2024-51809b7c.svg)

Describe the sectors and locations of the facility or facilities that comprise the asset. This information is used for materiality-based scoring and to determine peers for benchmarking and reporting purposes. It is also used in combination with the Reporting Year (EC4) descriptions to describe the entity’s reporting boundary.

List all significant facilities that comprise the asset and complete details for each as follows:

It is up to the participant to determine the best structure for reporting of facilities since they have the best understanding of their facilities. Multiple small facilities may be grouped into a facility network or similar, particularly if the core sector is the same for the grouped facilities. For example, a network of wastewater pipelines and pumping stations might be grouped into a single sewerage pipe network. Another grouped facility might be a group of rooftop solar installations within a certain region or country.

Note that the selected structure may affect your peer grouping based on the outcome of the primary sector and location.

Primary Sector: The asset’s primary sector is determined by summing the GAV weights provided in the facility table by sector. Assets are assigned a primary sector at the subclass, class or superclass level, according to the following logic:

Primary Location: Similarly, the primary location is determined based on the location(s) of its facilities. Assets are assigned a primary location at the country, subregion, region or global level, according to the following logic:

Note: The country, subregion, region are defined using the UN historical classification of developed and developing regions here. For the online UN M49 Standard please see here.

This information will be used to identify peers from the same or similar sectors and locations. Additionally, the Asset’s primary sector and primary location determine materiality outcomes for certain ESG issues and scoring (see RC6 for more details).

Facility: A site, structure or installation for engaging in an activity that provides infrastructure services.

Gross Asset Value (GAV): The gross infrastructure value owned by the entity being the enterprise value associated with the infrastructure asset. The GAV reported here may include cash or cash equivalents where applicable (if it has any, eg. bank accounts, short-term investments etc). Use of the 'tangible fixed assets' or 'property, plant and equipment' value may be a suitable estimate if enterprise value is not known.

GPS coordinates: Location based on the latitude and longitude in decimal degrees DD. eg: Latitude (“52.336424”) - Longitude (“4.884971”). Coordinates can be generated using GPS Coordinates.org.

Pre-construction: The facility is in its pre-construction phase. Typically ‘pre-construction’ means the facility is in its planning or design phase.

Sector: A group of specific industrial activities and types of physical assets and technologies.

Under construction: Construction of the facility has started.

EDHECInfra - The Infrastructure Company Classification Standards (TICCS™), 2022

UN - Standard Country or Area Codes for Statistical Use (M49)

RC4

Nature of entity's business

Structure

Corporate

Special Purpose Vehicle (SPV)

Other: ____________

Business Risk (Revenue basis) - (optional)

Merchant

Concessionary/Contracted

Regulated

Other: ____________

Asset Development Phase

Is the asset in its construction phase?

Yes

No (Pre-construction)

Materiality results

![[DevelopmentAssetMaterialityOutcome:Construction]](/images/tables/development_asset_materiality_outcome_construction/y2024.svg)

Describe the structure and business risk of the participating entity. The Asset Development Phase influences materiality (see guidance in RC6 and the GRESB Materiality Tool for more details) and peer grouping.

Structure: Select whether the entity’s structure is that of a Corporate, a Special Purpose Vehicle or some other structure (if so, then please describe).

Business risk (revenue basis): Select the most significant business risks (or revenue basis) borne by the entity being Merchant, Concessionary/Contracted, Regulated, or Other. More than one selection (i.e. a combination) is allowed. This aligns with the EDHECinfra™TICCS™ classification for Business Risk. Multiple answers are possible. For ‘Other’ answer, describe the business risk borne.

Asset Development Phase: Answer 'Yes' if the asset was under construction or 'No' if it was in its pre-construction phase during the reporting period specified in indicator EC4.

This information will be used for peer-grouping and will affect phase-materiality (see ‘Materiality Based Scoring’ in the Reference Guide for more).

Note: If one or more facilities of the asset are under construction, then the asset is considered to be in its construction phase.

Asset Development Phase: An asset under development will be either under construction and the asset is in its construction phase, or the asset has not started construction yet and it is in its pre-construction phase.

Concessionary/Contracted: A contracted infrastructure organization that enters into a long-term contract to presell all or most of their output at a pre agreed price. All or the majority of market risk (price and/or demand) is transferred to a third party. The contract is for a significant period of the investment’s life, typically one or several decades.

Corporate: A corporate structure is that of a legal entity that is separate and distinct from its owners. Corporations have limited liability, which means that shareholders may take part in the profits through dividends and stock appreciation but are not personally liable for the company's debts.

Merchant: An organization that collects fees and tariffs from end users as a function of the effective demand for the provided service. The organization is mostly or fully exposed to market risks (price and demand risk).

Public entity: A company that is publicly listed and traded on a recognized stock exchange such as Nasdaq or NYSE.

Regulated: An organization whose business is regulated by government agencies via limits on tariffs, rate of returns, or revenues. Also referred to as discretionary regulation.

Special Purpose Vehicle (SPV): A subsidiary entity with an asset/liability structure and legal status that makes its obligations secure.

EDHECInfra - The Infrastructure Company Classification Standards (TICCS™), 2022

IPWEA - International Infrastructure Management Manual

RC5

Description of the asset

Provide a description of the entity (max 250 words): ____________

Can the entity upload (as supporting evidence) a photo(s) that represents the asset (for GRESB marketing purposes)?

By uploading an image, you give GRESB permission to credit the image to the Reporting Entity specified in EC1, and to use the image, both in print and digitally, for marketing and communication purposes only.

Yes

or URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide a description and image of the entity that may be used for marketing and/or communication purposes.

Description: The description may include:

It is not necessary to re-state information that has already been provided, such as the entity's sector focus or location of operations.

RC6

GRESB materiality assessment

Select the answers applicable to your entity below

Habitat and biodiversity - What will the entity's proximity to ecological habitat be?

Containing, overlapping, adjacent

Close (<100m)

Distant (>100m)

Contaminated land - Will the entity have contamination on site?

Yes

No

Physical risk (climate-driven and otherwise) - Will the entity be located in an area exposed to climate-related phenomena or natural catastrophes?

Yes

The entity will be exposed

Only the surrounding area will be exposed

No

Water inflows/withdrawals - What will the scale of the entity's water use/withdrawal and water stress in the location be?

High (>1000 Megaliters) water withdrawals in locations with high water stress

High (>1000 Megaliters) water withdrawals in locations with low water stress

Low (<1000 Megaliters) water withdrawals in locations with high water stress

Low (<1000 Megaliters) water withdrawals in locations with low water stress

No withdrawals

Water outflows/discharges - Will there be a risk of pollution from discharges to waterways (including groundwater)?

Yes and waterways are in locations with high water stress

Yes but waterways are not in locations with high water stress

No

Light pollution - Will the entity use significant external lighting at night?

Yes and the location is densely populated

Yes but the location is not densely populated

No

Noise pollution - Will the entity emit noise externally?

Yes and the location is densely populated

Yes but the location is not densely populated

No

Heritage - Will archaeological and/or natural heritage be material for the entity?

Yes

No

Indigenous people - Will indigenous people be material for the entity?

Yes

No

Landscape and visuals - Will landscape and visuals be material for the entity?

Yes

No

Transport/Traffic management - Will transport/traffic management be material for the entity?

Yes

No

Number of customers - What will the number of customers be?

>100

10-100

<10

Number of users - What will the number of users that physically interact with the asset be?

>1000

100-1000

10-100

<10

Not scored

Infrastructure is a diverse asset class, where the relevance (materiality) of ESG issues can vary between assets due to a range of factors. The intent of this indicator is to determine the materiality of a range of ESG issues covered by the GRESB Development Assessment. Once this indicator is completed, the entity will see an overview of the ESG issues covered within the GRESB Development Assessment and their materiality outcome.

The questions are formulated in the future tense as the development materiality assessment is designed to assess the relevance (materiality) of issues for the asset once it becomes operational.

It is mandatory to complete the GRESB Materiality Assessment as it affects the materiality-based scoring applied in this Assessment.

Materiality questions: Complete the list of questions. The response to these, along with responses to other indicators in the Entity Characteristics and Reporting Characteristics will determine the entity-specific materiality weighting for all ESG issues covered within the GRESB Development Assessment, which will be displayed at the bottom of this indicator in the portal.

Specific materiality weightings are assigned to the entity based on eighteen materiality factors:

Scoring weightings are assigned to ESG issues at one of four possible materiality levels, which directly translate to a scoring weighting in the Assessment:

These entity-specific weightings are used in several indicators for scoring. Scoring details are provided within the guidance of each relevant indicator.

For more details refer to the section on ‘Materiality Based Scoring’ in the Reference Guide or download the Materiality Tool.

| Factor | Question | Answers | Guidance |

|---|---|---|---|

| Primary Sector (RC3) | What will the entity's Primary Sector be? | See GRESB Materiality & Scoring Tool |

See the guidance for RC3 (Sector & Geography) on how the primary sector is determined. |

| Primary Location (RC3) | Will the entity's Primary Location be in developed countries, developing countries or mixed? | Developed | Developed countries are Japan, Canada, United States, Australia, New Zealand, Israel and Europe. See RC3 for more details. |

| Developing | Developing countries are any that are not developed. | ||

| Mixed | Mixed means that the entity is located in locations that are a mix of developed and developing countries. | ||

| Biodiversity and habitat | What is the entity's proximity to ecological habitat? | Containing,overlapping,adjacent | Ecological habitat means terrestrial or aquatic areas distinguished by geographic, abiotic and biotic features, whether entirely natural or semi-naturale.g. as per the classifications in Annex I of the EU Habitat Directive. The distance should be measured as the closest point of any part of the asset to any part of an ecological habitat. Adjacent means directly bordering or where habitat is within the asset facility boundary. To see whether the asset is located adjacent to ecological habitat, theNatura 2000 tool can be used by participants. |

| Close (<100m) | |||

| Distant (>100m) | |||

| Contaminated Land | Will the entity have contamination on site? | Yes | Contaminated land contains substances that are causing or could cause (a) significant harm to people, property or protected species; or (b) significant pollution of surface waters (for example lakes and rivers) or groundwater. Land contamination can result from a variety of intended, accidental, or naturally occurring activities and events such as manufacturing, mineral extraction, abandonment of mines, national defense activities, waste disposal, accidental spills, illegal dumping, leaking underground storage tanks, hurricanes, floods, pesticide use, and fertilizer application. |

| No | |||

| Physical risk (climate driven and otherwise) | Will the entity be located in an area exposed to climate-related phenomena or natural catastrophes? | Yes, the entity is exposed | The location (any part of the current asset area) has been and/or could be affected by physical risks. |

| Yes, but only the surrounding area is exposed | The surrounding area (10km radius) has been and/or could be affected by physical risks. | ||

| No | No part of the asset or surrounding areas has been or could be affected by physical risks. | ||

| Water inflows/withdrawals | What will the scale of the entity's water use/withdrawal and scarcity of water in the location be? | High (Greater than 1000 Megaliters) water withdrawals in location with high water stress | High withdrawals means greater than 1000 Megaliters. High water stress means High or Extremely High Baseline Water Stress as classified by the World Resources Institute's (WRI) Water Risk Atlas tool, Aqueduct.

Medium/Low consumption means less than 1000 Megaliters Low water stress means not High or Extremely High Baseline Water Stress as classified by the World Resources Institute's (WRI) Water Risk Atlas tool, Aqueduct. |

| High (Greater than 1000 Megaliters ) water withdrawals in locations with low water stress | |||

| Low (Lower than 1000 Megaliters ) water withdrawals in locations with high water stress | |||

| Low (Lower than 1000 Megaliters) water withdrawals in locations with low water stress | |||

| No consumption | |||

| Water outflows/discharges | Will there be a risk of pollution from discharges to waterways (including groundwater)? | Yes and waterways are in locations with high water stress | Risk of pollution means there are measurable pollutants in the discharge that if their levels were elevated could cause negative impact.

High water stress means High or Extremely High Baseline Water Stress as classified by the World Resources Institute's (WRI) Water Risk Atlas tool, Aqueduct. |

| Yes but waterways are not in locations with high water stress | |||

| No | |||

| Light pollution | Will the entity use significant external lighting at night? | Yes and the location is densely populated | Densely populated means greater than 2000 people per square kilometer. |

| Yes but the location is not densely populated | |||

| No | |||

| Noise pollution | Will the entity emit noise externally? | Yes and the location is densely populated | Densely populated means greater than 2000 people per square kilometer. |

| Yes but the location is not densely populated | |||

| No | |||

| Heritage | Will archaeological and/or natural heritage be material for the entity? | Yes | Physical and non-physical elements of cultural and/or natural heritage. |

| No | |||

| Indigenous people | Will indigenous people be material for the entity? | Yes | May be referred to in different countries by such terms as “Indigenous ethnic minorities,” “aboriginals,” “hill tribes,” “minority nationalities,” “scheduled tribes,” “first nations,” or “tribal groups.” |

| No | |||

| Landscape and visuals | Will landscape and visuals be material for the entity? | Yes | Landscape and visual impacts within a proposed development area. |

| No | |||

| Transport/Traffic management | Will transport/traffic management be material for the entity? | Yes | The movement of construction materials and waste, construction workforce transport, as well as disruption to other users of the transport network during the life of the asset. |

| No | |||

| Number of customers | What will the number of customers be? | >100 | Customers are people or organisations that purchase the service(s) provided by the asset. This can include business (B2B) and retail customers. |

| 10-100 | |||

| <10 | |||

| Number of users | What will the number of users that physically interact with the asset be? | >1000 | Users are people that interact physically with the asset when they use its services.Interaction means using one or more of their physical senses e.g. a mass transit passenger service. There is typically a safety risk associated with the users physical interaction. |

| 100-1000 | |||

| 10-100 | |||

| <10 | |||

| Number of employees (RC) | What is the number of FTE employees? | >100 | Employees are the workers working for and employed directly by the asset. (FTE) Full Time Equivalent of the entity's employees. FTE is calculated by adding all hours paid to employees (full-time, part-time, or any other) and dividing them by the number of hours that a full-time employee should work in that given period. |

| 20-100 | |||

| <20 | |||

| Number of contractors (RC) | What is the number of FTE contractors? | >100 |

(Contractors are people working for another business (or are self-employed) and are contracted by the asset. FTE) Full Time Equivalent of the entity's contractors FTE is calculated by adding all hours paid to contractors(full-time, part-time, or any other) and dividing them by the number of hours that a full-time contractor should work in that given period. |

| 20-100 | |||

| <20 | |||

| Number of workers (RC) calculated | What is the number of FTE workers (employees and contractors)? | >100 | (FTE) Full Time Equivalent of the entity's employees and contractors

FTE is calculated by adding all hours paid to workers (full-time, part-time, or any other) and dividing them by the number of hours that a full-time workers should work in that given period. |

| 20-100 | |||

| <20 |

Environmental issues: The impact on living and non-living natural systems, including land, air, water and ecosystems. This includes, but is not limited to, biodiversity, transport and product and service-related impacts, as well as environmental compliance and expenditures. Full reference to listed environmental issues can be found in Appendix 2.

Governance issues: Governance structure and composition of the organization. This includes how the highest governance body is established and structured in support of the organization’s purpose, and how this purpose relates to economic, environmental and social dimensions. Full reference to listed governance issues can be found in Appendix 2.

High relevance: An issue is of high relevance if it is of high importance for (a) reflecting an entity's environmental, social or governance impacts; or (b) substantively influencing the assessments and decisions of stakeholders.

Low relevance: An issue is of low relevance if it is of low importance for (a) reflecting an entity's environmental, social or governance impacts; or (b) substantively influencing the assessments and decision of stakeholders

Material: An issue is material if it may reasonably be considered important for reflecting an entity's relevant environmental, social or governance impacts; or substantively influencing the assessments and decisions of stakeholders.

Materiality assessment: The process for determining which ESG issues are material to an entity.

Medium relevance: An issue is of medium relevance if it is of medium importance for (a) reflecting an entity's environmental, social or governance impacts; or (b) substantively influencing the assessments and decisions of stakeholders.

No relevance: An issue is of no relevance if it is of no importance for (a) reflecting an entity's environmental, social or governance impacts; or (b) substantively influencing the assessments and decisions of stakeholders.

Primary sector: The main infrastructure sector of the entity as provided in RC3.

Social issues: Concerns the impacts the organization has on the social systems within which it operates. Full reference to listed social issues can be found in Appendix 2.

Columbia University/NASA Socioeconomic Data and Applications Center’s (SEDAC) Gridded Population of the World (GPW), v4

Council Directive 92/43/EEC of 21 May 1992 on the conservation of natural habitats and of wild fauna and flora (2013)

Eurostat Glossary - Coastal area 2018

Eurostat - Environment Glossary

UK Environmental Protection Act

United Nations Standard Country or Area Codes for Statistical Use (M49)

World Resources Institute - Aqueduct Water Risk Atlas

Alignment with External Frameworks

DJSI CSA 2019 - 3.2 Materiality GRI Standards 2016 - 101-1.3: The Materiality Principle

Leadership

LeadershipThis aspect evaluates how the Entity integrates ESG into its overall business strategy, its ESG commitments and objectives, and how responsibilities for making decisions relating to ESG have been assigned within the entity.

LE1

Entity materiality assessment

Has the entity undertaken an ESG materiality assessment in the last three years?

Yes

Elements covered in the materiality assessment report (multiple answers possible)

Identification of the material ESG issues from the entity's operations

Engagement with relevant stakeholders to identify which issues are material

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

2.33 points , G

The intent of this indicator is to assess whether the entity has undertaken a materiality assessment. A materiality assessment is a common exercise adopted to inform sustainability reporting and communication strategies.

As well as guiding the issues for ESG reporting, a materiality assessment should also be used as a strategic business tool. A materiality process delivers greatest benefits when used as an opportunity to apply an ESG lens to business risk, opportunity, trend-spotting and enterprise risk management processes, and as an engagement tool with stakeholders.

Select Yes or No: If selecting ‘Yes’, select applicable sub-options.

Materiality assessment: Note that this is in regards with the entity’s own ESG materiality assessment, separate from the GRESB materiality assessment in RC6.

This indicator is not subject to automatic or manual validation.

This indicator is scored as a one section indicator consisting of a checklist of elements. Evidence is not required.

Points are evenly divided between the selected elements, with maximum points awarded if all checkboxes have been selected.

This indicator is affected by dynamic materiality (see ‘Materiality Based Scoring’ in the Reference Guide for more information or download the GRESB Development Materiality & Scoring Tool).

Click here for the Development Asset Assessment Scoring Document .

Material: An issue is material if it may reasonably be considered important for reflecting an entity's relevant environmental, social or governance impacts; or substantively influencing the assessments and decisions of stakeholders.

Materiality assessment: The process for determining which ESG issues are material to an entity.

Relevant impacts: Are those that are a subject of established concern for expert communities, or that have been identified using established tools, such as impact assessment methodologies or life cycle assessments. Impacts that are considered important enough to require active management or engagement by the entity are likely to be considered relevant.

Good practice example: Please refer to pages 13 to 17 of the "Sustainability Plan" found on this page.

Alignment with External Frameworks

DJSI CSA 2019 - 3.2 Materiality

GRI Standards 2016 - 101-1.3: The Materiality Principle

GRI Standards 2021 - 3: Materiality Topics 2021

LE2

ESG leadership commitments

Has the entity made a public commitment to ESG leadership standards or principles?

Yes

General ESG commitments (multiple answers possible)

Commitments that are publicly evidenced and oblige the organization to take action (multiple answers possible).

UN Global Compact

Other: ____________

Commitments that are publicly evidenced and do not oblige the organization to take action (multiple answers possible).

Support the Goals

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Formal environmental issue-specific commitments (multiple answers possible)

Commitments that are publicly evidenced and oblige the organization to take action (multiple answers possible).

Business for nature

Climate League 2030

EV100

Powering Past Coal Alliance (PPCA)

RE 100

Science Based Targets Initiative

UN Global Compact Our Only Future

Other: ____________

Commitments that are publicly evidenced and do not oblige the organization to take action (multiple answers possible).

Task force on Climate-related Financial Disclosures

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Formal social issue-specific commitments (multiple answers possible)

Commitments that are publicly evidenced and oblige the organization to take action (multiple answers possible).

40:40 Vision

Other: ____________

Commitments that are publicly evidenced and do not oblige the organization to take action (multiple answers possible).

The Responsible Labor Initiative (RLI)

World Business Council for Sustainable Development's Call to Action

30% Club

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Formal governance issue-specific commitments (multiple answers possible)

Commitments that are publicly evidenced and oblige the organization to take action (multiple answers possible).

List commitment(s): ____________

Commitments that are publicly evidenced and do not oblige the organization to take action (multiple answers possible).

List commitment(s): ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

Net Zero Commitments (multiple answers possible)

Net Zero Asset Managers initiative: Net Zero Asset Managers Commitment

PAII Net Zero Asset Owner Commitment

Science Based Targets initiative: Net Zero Standard commitment

The Climate Pledge

Transform to Net Zero

WorldGBC Net Zero Carbon Buildings Commitment

UN-convened Net-Zero Asset Owner Alliance

UNFCCC Climate Neutral Now Pledge

Other: ____________

Provide applicable hyperlink

URL____________

Indicate where in the evidence the relevant information can be found____

No

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

Not scored , G

The intent of this indicator is to assess the entity's commitment(s) to ESG and/or Net Zero leadership standards or principles. By making a commitment to ESG/Net Zero leadership standards or principles, an entity publicly demonstrates its commitment to ESG/Net Zero, uses organizational standards and/or frameworks that are universally accepted and may have obligations to comply with the standards and/or frameworks.

Select Yes or No: If selecting ‘Yes’, select all applicable sub-options.

Commitments: All commitments should be publicly available, and the entity should be either a member or signatory if it selects an option. The commitments are divided between those that require action to be taken by the entity and those that do not.

It is possible to report using the ‘Other’ answer option. Ensure that the ‘Other’ answer provided is not a duplicate or subset of another option.