Reporting entity

Entity Name: ____________

Fund Manager Organization Name (May be same as entity name): ____________

The 2023 SFDR Infrastructure Fund Assessment Reference Guide (“Reference Guide”) accompanies the 2023 SFDR Infrastructure Fund Assessment and is published both as a standalone document and in the GRESB Portal alongside each Assessment indicator. The Reference Guide reflects the opinions of GRESB and not of the European Union. The information in the Reference Guide has been provided in good faith and is provided on an “as is” basis. We take reasonable care to check the accuracy and completeness of the Reference Guide prior to its publication. While we do not anticipate major changes, we reserve the right to make modifications to the Reference Guide. We will publicly announce any such modifications.

The Reference Guide is not provided as the basis for any professional advice or for transactional use. GRESB and its advisors, consultants and sub‑contractors shall not be responsible or liable for any advice given to third parties, any investment decisions or trading or any other actions taken by you or by third parties based on information contained in the Reference Guide.

Except where stated otherwise, GRESB is the exclusive owner of all intellectual property rights in all the information contained in the Reference Guide. While we do not anticipate major changes, we reserve the right to make modifications prior to the official start of the 2023 reporting year and the official release of the 2023 SFDR Infrastructure Asset Assessment. We will publicly announce any such modifications.

Mission-driven and investor-led, GRESB is the environmental, social and governance (ESG) benchmark for real assets. We work in collaboration with the industry to provide standardized and validated ESG data to the capital markets. The 2022 Real Estate benchmark covered more than 1,800 property companies, real estate investment trusts (REITs), funds, and developers. Our coverage for Infrastructure is more than 800 infrastructure funds and assets. Combined, GRESB represents USD 8.6 trillion AUM. More than 170 institutional investors, with over USD 51 trillion AUM, use GRESB data to monitor their investments, engage with their managers, and make decisions that lead to a more sustainable real asset industry.

For more information, visit gresb.com. Follow GRESB on LinkedIn or @GRESB on Twitter.

The EU’s Sustainable Finance Disclosure Regulation (SFDR) is a new transparency requirement for financial market participants related to key environmental, social and governance (ESG) criteria. The purpose is to increase market transparency and direct capital towards more sustainable businesses.

SFDR imposes different disclosure obligations on Financial Market Participants, depending on their size and the nature of their products. All participants in the EU will need to make general disclosures about sustainability practices for both the entity and their products.

They will also need to report on their Principle Adverse Impacts (PAIs), which are a series of indicators covering a range of ESG issues, such as greenhouse gas emissions and waste management.

At the moment, most companies and funds do not provide disclosures or collect data that is granular enough to satisfy the requirement, once it goes fully in effect, or to provide investors with the level of transparency that is expected by this regulation.

When approaching this data collection-and-reporting challenge starting next year, it is important for Financial Market Participants to consider that the data they report will serve as a basis for year-over-year comparisons of performance that will become required in 2024 for the 2023 and 2024 reporting years.

It is also important to keep in mind that EU rules will likely become a requirement in the not-too-distant future to validate this reported data under CSRD- the new Corporate Sustainability Reporting Directive and the European Sustainability Reporting Standards (ESRS).

GRESB offers an Assessment that provides Financial Market Participants with the framework they need for their Principal Adverse Impact Statement. The Assessment is comprised of around 60 ESG metrics that need to be reported on. It addresses the three tables related to Principal Adverse Impacts, covering Article 7 disclosure requirements for Article 8 and 9 products and funds.

SFDR - Infrastructure Assessments

The SFDR - Infrastructure Asset and Fund Assessments are GRESB’s Infrastructure solution for the Sustainable Finance Disclosure Regulation (SFDR) and reporting on the Principle Adverse Impacts (PAIs). The assessment is based on the 6.4.2022 version of SFDR and provides financial market participants with a means to collect infrastructure asset data so that it can then be aggregated for funds or financial market participants ahead of their expected disclosure requirements in 2023. The methodology is consistent across different regions, investment vehicles and infrastructure sectors and aligns with Annex 1 template principle adverse sustainability impacts statement.

The Infrastructure SFDR Assessment was adapted to provide a standardized and user-friendly way for infrastructure participants to report their sustainability data in a secure platform and help them meet their disclosure requirements. Assessment participants get a head start on disclosure requirements by receiving:

GRESB Infrastructure Assessments

The GRESB Infrastructure Assessments are an ESG engagement and benchmarking tool for institutional investors, fund managers, infrastructure companies and asset operators working in the infrastructure space.

There are two complimentary GRESB Infrastructure Assessments: a Fund Assessment and an Asset Assessment. Both address critical aspects of ESG performance through a globally applicable and standardized reporting and benchmarking framework. The Fund Assessment is intended for infrastructure funds and portfolios of assets, while the Asset Assessment is meant to be completed by the individual underlying assets (portfolio companies). Both Assessments cover the full breadth of infrastructure sectors, including:

GRESB provides a free online training platform for all GRESB assessment participants. The training courses are modular and self-paced, walking participants through the various aspects of the Assessments,and providing detailed examples and tips for a successful submission.

Who can use the SFDR Infrastructure Assessment

The SFDR Infrastructure Assessment is available as a standalone assessment, to anyone that wants to use it to meet their disclosure requirements.

If you do not have a GRESB account, you can create one here.

If you already have a GRESB account, you can simply proceed with the SFDR Assessment by selecting this newly available option in the assessment portal. You will also be able to easily transfer information from the Real Estate asset portal to your SFDR Assessment.

More questions on SFDR? Check our FAQ

The 2023 SFDR Infrastructure Fund Assessment opens in March 2023 and will close at the end of 2023. The reference period is calendar year 2022. Managers can use this assessment to prepare for their product- and entity-level mandatory reporting due in June 2023, using 2022 data.

The Assessment Portal includes indicator-specific guidance, available under the “Guidance” buttons that explains:

In addition to the guidance in the Portal, each Assessment is accompanied by a Reference Guide (this guide). The Reference Guide provides introductory information on the Assessments and a report-format version of the indicator-by-indicator guidance that is available under the Guidance tabs in the Portal.

Moreover, there are several tools and functionalities in the Portal to support submissions. For example, the Portal has real‑time error detection systems and warnings. More detail can be found in Participant Tools.

GRESB works with a select group of Partners who can help participants with their GRESB Infrastructure Assessment submission. To learn more about the services offered by GRESB Partners, take a look at our Partner Directory.

Participants are able to contact the GRESB Helpdesk at any time for support and guidance.

Data is submitted to GRESB through a secure online platform and can only be seen by GRESB Staff and authorized personnel from GRESB’s third party validation provider, SRI. GRESB benchmark scores are not made public.

Access to Assessment results

Data collected through the SFDR Infrastructure Assessments is only disclosed to the participants themselves in 2023.

Participants can share data with their investors themselves outside of the GRESB portal by downloading their report as a PDF.

GDPR compliance

GRESB is fully compliant with GDPR. The GRESB Privacy Statement can be found here. GRESB also has specific internal policies related to GDPR, such as a Data Breach Policy and Data Protection Policy, that cannot be shared externally for security reasons. Note that asset level data does not fall under the incidence of GDPR because it does not contain any personal information.

Cybersecurity

GRESB’s data security measures and systems have been reviewed by an external expert and no issues were flagged. The GRESB website and the GRESB Portal are fully HTTPS/TLS encrypted. GRESB has strict and extensive policies on data security that cannot be shared externally for security reasons.

All Assessment responses must be submitted in English.

Documents uploaded as supporting evidence do not need to be entirely translated. However, for evidence provided in languages other than English, a thorough summary confirming that the requirements have been met is required for validation purposes. Participants may make use of the open text box to provide the document(s) summary. In addition, each selected issue must be identified in the uploaded evidence by providing page number and exact location such as paragraph, clause, sentence, bullet number, etc.

Translation of the GRESB Assessment

The GRESB assessment portal can be translated by using “Google translate” via the Google Chrome web browser. This applies to the assessment portal, guidance notes and online version of the Reference Guide.

How to use Google Translate

Turn translation on

You can control whether Chrome will offer to translate web pages.

If the page is not yet being translated to your language, click on the Translate icon again, select “options”, and make sure your “Translation language” is not set to something else. If it is, change it to the desired language for translation.

This works for the entire GRESB portal.

Refer to Google Chrome Help for more details.

Disclaimer: Note that not all text may be translated accurately or be translated at all. GRESB is not responsible for incorrect or inaccurate translations. GRESB will not be held responsible for any damage or issues that may result from using Google Translate.

This section provides specific guidance for the 2023 GRESB SFDR Infrastructure Fund Assessment (referred to as the “Assessment”) and its inter-relationship with the GRESB SFDR Infrastructure Asset Assessment.

This guide should provide all the basic information needed to complete the 2023 Assessment. Contact the GRESB Helpdesk for any additional support and guidance.

Important: Note that the European Commission has not provided any industry specific guidelines on how financial market participants should report on the Sustainable Finance Disclosure Regulation (SFDR) and the Principle Adverse Impact Statements (PAIs). The guidance below is therefore based on that of the GRESB Infrastructure Asset Assessment.

Infrastructure funds, portfolios and companies can participate in the Fund Assessment. Common examples of infrastructure funds include:

Fund managers complete the Fund Assessment to describe their investment management and engagement processes and performance. Additionally, we encourage funds to participate with their underlying assets participating in the Asset Assessment.

Important: Funds have to participate with at least one of their underlying assets by participating in the SFDR Infrastructure Asset Assessment where Principle Adverse Impacts are reported, see aggregation methodology in the SFDR Infrastructure Asset Reference Guide for more information.

The SFDR Infrastructure FundAssessment consists of a number of aspects that a participant is required to report on, including:

The following tools help participants with the submission process:

Every indicator has a short title (e.g. “ESG Specific Objectives”) and a code (e.g. LE3). These are followed by an initial indicator question that can be answered with ‘Yes’ or ‘No’.

When selecting ‘Yes’, participants are required to provide further information by selecting one or more answer options and/or completing an open text box or table. Participants should select all answer options that accurately describe the entity. Indicators that require evidence are clearly marked in the GRESB Portal and Reference Guide.

When selecting 'No’, participants may not select any additional sub‑options; the indicator will receive no points.

Answers throughout the Assessment must be applicable to the reporting year identified in “Reporting year” (EC4) in the Entity and Reporting Characteristics, unless the indicator specifies an alternative reporting period.

GRESB recommends the use of calendar year over fiscal year for SFDR as per the reference period communicated in the regulation.

In the case you have both financial and calendar year reporting requirements and are unsure on how to proceed, contact us at GRESB contact for any additional support and guidance.

Your response should relate specifically to the reporting entity for which you are submitting a Fund Assessment response.

SFDR is a regulation that applies to Financial Market Participants who will have to disclose at either fund or entity level the aggregate environmental and social impact of their underlying investments.

In the case of infrastructure, this means that the tangible impacts have to be reported by infrastructure assets meaning they will be responsible in large majority in reporting and sharing this data with their investors, the role of financial market participants subject to the regulation on our platform will therefore be for them to encourage participation of the underlying asset investments in our SFDR solution and to then connect to these assets in our portal with the necessary financial information to obtain an aggregate impact report

The aggregation of data follows the calculation methods provided in Annex 1 of the Regulatory Technical Standards pertaining to the PAIs principle adverse impact statements.

Aggregation is completed by an automatic system.

GRESB’s aggregation methodology will only be applicable at a fund level report, although fund of funds and financial market participants (FMPs) could theoretically connect to any of their underlying asset investments reporting on our platform. Like any methodology, where data gaps exist or coverage is limited, data download should help participants who wish to undertake the aggregation themselves.

Aggregation at the fund level is dependent on the following:

Once all assets of the fund have been connected and submitted, the fund is in-turn encouraged to submit.

The SFDR Assessment was designed as a standalone assessment for both existing and new participants. In the scenario where participants are interested in reporting under both GRESB and SFDR,the following features were developed to reduce reporting burden.

Please note, if you have participated in GRESB in the past, there is no need to create new entities in the portal for SFDR if these are the same asset/portfolio/company/fund.

Fund Asset Links: The summary of entity assets of fund participants and their connection to the GRESB assessment will be maintained as there should be no portfolio distinctions between assessments. Please note, that different fields apply for SFDR and GRESB and that these should be filled. Important: connections are common across assessments, these should be reviewed carefully.

Information provided in the Entity and Reporting Characteristics consists of two parts:

The “Entity Characteristics” covers the reporting entity's characteristics that remain constant across different reporting periods (year-on-year).

The “Reporting Characteristics”: Describe the entity, define the reporting scope for the current reporting year and determine the structure of the Assessment submission.

EC1

Reporting entity

Entity Name: ____________

Fund Manager Organization Name (May be same as entity name): ____________

EC1

Identify the reporting (participating) entity. The entity name will be used to identify the entity on the GRESB portal and will be displayed in the entity’s Benchmark Report.

Complete all applicable fields.

*Values in the Entity Characteristics (EC) aspect are fixed to one entity, regardless of assessment year. In order to update these please select the 'Manage Entity' setting in the 'Assessment Portal').

Entity name: Name of the fund or portfolio for which the Assessment is submitted. In the case of listed funds, the entity name is the legal name of the fund, also used for identification on international stock exchanges. In the case of non-listed entities, the entity name identifies the investable fund or portfolio for which the Assessment is submitted.

Fund Manager Organization name (May be same as entity name): Legal name of the organization responsible for the overall management, governance and oversight of the entity.

EC2

Nature of ownership

Public entity (listed on a Stock Exchange)

Specify ISIN: ____________

Private (non-listed) entity

Entity style classification

Debt

Core

Value added

Opportunistic

Open or closed end:

Open end

Closed end

Type of investment vehicle

Direct investment

Joint venture (JV)

Separate account

Special Purpose Vehicle

Other

-

________________________

Legal Entity Identifier (optional): ____________

Government entity

EC2

Describe the ownership status and characteristics of the participating entity.

Select the nature of the participating entity. Select at least one of the applicable sub-options and provide details if applicable. Entities reporting to GRESB are expected to represent investable vehicles, and these entities are expected to represent all infrastructure assets held by the vehicle (i.e., the whole portfolio).

*Values in the Entity Characteristics (EC) aspect are fixed to one entity, regardless of assessment year. In order to update these please select the 'Manage Entity' setting in the 'Assessment Portal').

Other: Other answers must be outside the options listed in the indicator to be valid.

Closed end fund: Fund with a fixed amount of capital and a finite life. Limited liquidity, with the redemption of units provided for at the end of the life of the fund.

Core, Value Add, Opportunistic: These are classifications of investment risk and return sometimes used by infrastructure investors. GRESB does not seek to define these but merely requires participants to select if they apply one of these classifications.

Debt: A fund or similar entity that has been set up for the purposes of issuing or investing in loans.

Direct investment:The purchase of a controlling interest or a minority interest of such size and influence that active control is a feasible objective.

Government entity: An infrastructure portfolio owned and managed by a government agency. Government portfolios are formed of publicly owned, and/or publicly managed assets.

ISIN: International Securities Identification Number. ISINs are assigned to securities to facilitate unambiguous clearing and settlement procedures. They are composed of a 12-digit alphanumeric code and act to unify different ticker symbols, which can vary by exchange and currency for the same security. In the United States, ISINs are extended versions of 9-character CUSIP codes.

Joint Venture: A vehicle where at least two parties share a common investment objective. Control over significant risk management decisions is not transferred to an external manager, but is exercised by members in the venture.

Private entity: A company or fund that is not a listed or traded on any stock exchange. Also known as non-listed entities or private portfolios.

Public entity: A company that is publicly listed and traded on a recognized stock exchange, such as Nasdaq or NYSE. Also known as "listed entities”.

Open end fund: An investment vehicle with a variable and unlimited amount of capital. Investors may purchase or redeem units or shares from the vehicle as outlined in contractual agreements.

Separate account: A portfolio of assets managed by a professional investment firm with a single investor client.

Special Purpose Vehicle: A subsidiary created by a parent company to isolate financial risk.

INREV Guidelines, Definitions, 2017

EC3

Entity commencement date

Year of commencement (listed) or Year of establishment (non-listed)

________________________

EC3

Describe the activity commencement or establishment date of the entity.

Provide the year of commencement/establishment.

*Values in the Entity Characteristics (EC) aspect are fixed to one entity, regardless of assessment year. In order to update these please select the 'Manage Entity' setting in the 'Assessment Portal').

Year of commencement: The year in which the reporting entity began investing in the market. If a listed entity is delisted (i.e., taken private) but remains under the same management, the date of original commencement can be used for “date of first closing” for the new non-listed entity. If the entity is taken private by a new management company, the first day of closing should be the date of privatization. This information is not used for scoring and used for context only; portfolio vintage may affect the ability to implement ESG policies and strategies.

Year of establishment: A date specified by the manager on which the vehicle is launched, the initial capital subscription is completed, and the commitment period commences.

EC4

Reporting year

Calendar year

Fiscal year

Specify the starting month Month

EC4

Set the entity’s annual reporting year.

Select the reporting year approach that applies to the entity.

Important: Please note that SFDR has a reference period that relates to calendar year reporting. In case you have both financial and calendar year reporting requirements and are unsure how to proceed, contact us at for further information.

*Values in the Entity Characteristics (EC) aspect are fixed to one entity, regardless of assessment year. In order to update these please select the 'Manage Entity' setting in the 'Assessment Portal').

The table below details the period for which information throughout the Assessment would be expected, for a selected starting month:

Calendar year: January 1 – December 31

Fiscal year: The period used to calculate annual financial statements. Depending on the jurisdiction the fiscal year can start on April 1, July 1, October 1, etc.

Reporting year: Answers must refer to the reporting period identified in EC3 in the Infrastructure Assessment. A response to an indicator must be true at the close of the reporting period; however, the response does not need to have been true for the entire reporting period. GRESB does not favour the use of calendar year over fiscal year or viceversa, as long as the chosen reporting period is used consistently throughout the Assessment.

RC1

Reporting currency

Values are reported in

Values have to be reported in Euro

To align with SFDR requirements, the reporting currency is set to Euros.

The currency used by the entity for Assessment indicators that require a monetary value as a response should be in Euros.

Where Euros is not the local currency of the entity, a conversion to Euros is expected.

RC2

Economic size

Current value of all investments (in million of €): ____________

Establish the economic size of the entity.

Complete the measure(s) of the economic size of the entity in terms of aggregate Value of investment in millions of Euros (e.g. €75,000,000 must be reported as 75). The value should be provided as at the end of the reporting year.

As with all information provided to GRESB, this information will be kept confidential to just you and any investors for which you give access permission.

Do not include a currency (symbol) with the value provided, as this has been reported in indicator RC1 above

Current value of all investments: ‘current value of all investments’ means the value in EUR of all investments by the financial market participant.

RC3

Sector & geography

What is the sector focus of the entity?

Diversified

Data Infrastructure

Energy and Water Resources

Environmental Services

Network Utilities

Power Generation X-Renewables

Renewable Power

Social Infrastructure

Transport

Other: ____________

What is the regional focus of the entity?

Globally diversified

Africa

Americas

Asia

Europe

Oceania

Establish the sector and geographic focus of the entity.

Select the sector and geographic focus of the entity. If this is sector specific, then select the relevant sector.

Prefill: This indicator has remained the same as the 2022 Assessment and has been prefilled with 2022 Assessment answers. Review the response and/or evidence carefully.

Other: Other answer must be outside the options listed in the indicator to be valid. State the sector focus.

Data Infrastructure: Companies involved in the provision of telecommunication and data infrastructure.

Diversified focus: If the entity is invested in more than one of the listed sectors.

Energy and Water Resources: Companies involved in the treatment and delivery of natural resources.

Environmental Services: Companies involved in the treatment of water, wastewater, and solid waste for sanitation and reuse purposes.

Globally diversified: If the entity is significantly invested in more than one of the listed geographic regions.

Network Utilities: Companies operating an infrastructure network with natural monopoly characteristics (barriers to entry, increasing returns to scale).

Power Generation x-Renewables: Stand-alone power generation using a range of technologies except wind, solar, and other renewable sources.

Renewable Power: Stand-alone power generation and transmission companies using wind, solar, hydro and other renewable energy sources. Also energy storage companies.

Sector: A group of specific industrial activities and types of physical assets and technologies.

Social Infrastructure: Companies involved in the delivery of support and accommodation services for public or other services.

Transport: Companies involved in the provision of transportation infrastructure services.

EDHECInfra, The Infrastructure Company Classification Standards (TICCS™), 2020

United Nations Standard Country or Area Codes for Statistical Use (M49)

RC4

Nature of entity's business

What is the entity's core business?

Management of standing investment/operating assets

Development of new construction and major renovation projects

The entity’s primary business activities during the reporting year is useful for distinguishing infrastructure funds.

Select the option applicable to the reporting entity.

Major Renovations: Alterations that affect more than 50 percent of the total asset or cause relocation of more than 50 percent of regular building occupants. Major renovation projects refer to assets that were under construction at any time during the reporting year.

New Construction: Includes all activities to obtain or change building or land use permissions and financing. Includes construction work for the project with the intention of enhancing the asset's value. Development of new facilities and additions to existing facilities can be treated as new constructions. New construction projects refer to facilities that were under construction at any time during the reporting year.

Standing Investments: Assets where construction work has been completed and which are owned for the purpose of providing a service in exchange of an income. Also known as an operating asset.

RC5

Description of the fund

Provide a description of the entity (max 250 words): ____________

Provide a description of the entity.

The description may include:

It is not necessary to re-state information that has already been provided in prior indicators, such as the entity's sector focus, geographic focus or nature of business.

RC6

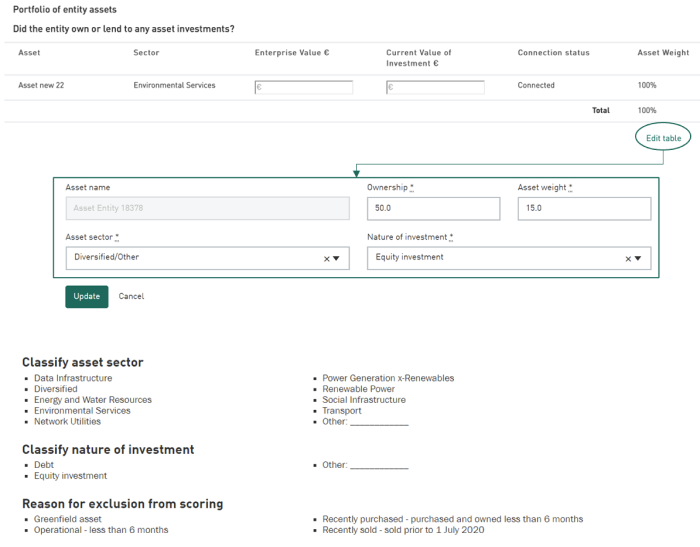

Portfolio of entity assets

Did the entity own or lend to any asset investments?

Provide additional context for the answer provided (not validated, for reporting purposes only)

________________________

The Portfolio Assets Table shows the entity’s portfolio of underlying investments in infrastructure assets. The table includes details on each asset; including Primary Sector and weight within the portfolio. It also allows for participating assets to be 'linked' to the entity so that the score of the underlying assets now referred to as the ‘Performance Component Score - Infrastructure Fund’ can be calculated. This score combined with the score of the fund in its Management Component generates the fund’s overall score, now referred to as ‘GRESB Score - Infrastructure Fund.’

Pre-fill: The Table will be prefilled with assets that were connected in 2022. It is very important to review the table carefully, with particular attention to the weightings assigned. Participants have the option to delete, edit or add assets to the table, if necessary.

The Table can be accessed in two locations, either within the Assessment Portal (via the 'Assets' tab) or within the Assessment Response (in the 'Summary of Entity Assets' section).

It is mandatory for participants to list and complete details for ALL infrastructure assets (operational and greenfield) held by the Fund, as at the end of the reporting year (identified in EC4), irrespective of whether they are participating in the 2023 GRESB Asset Assessment or not.

The Table includes the following columns:

Asset sector: Select the primary sector of the asset from the dropdown box. The sector classification has been aligned with the new EDHECInfra TICCS standard Industrial Classifications and is provided in the Terminology. If the sector of the asset sits outside the listed options, then select 'Other' and specify the sector. This information will not be used for benchmarking purposes.

Asset weight: Enter the weight of the asset within the portfolio. Weights must sum up to 100%. Weights should be equity based i.e. the weight of an asset is the equity invested in the asset divided by the total equity invested in all assets in the fund (i.e. the invested capital).

% ownership: Enter the fund’s % ownership share in the asset as a proportion of the asset’s total GAV. I.e the fund’s investment in the asset divided by the asset’s total GAV.

Enterprise value (Euros): means the sum, at fiscal year-end, of the market capitalisation of ordinary shares, the market capitalisation of preferred shares, and the book value of total debt and non-controlling interests, without the deduction of cash or cash equivalents. The value should be reported in absolute terms eg: 1,250,658€.

Current value of investment (Euros): means the value in EUR of the investment by the financial market participant in the investee company. The value should be reported in absolute terms eg: 1,250,658€.

Contact name: Provide the name of the contact person for the asset entity.

Email: Provide the email address for the contact person for the asset entity.

The 'Connect' button should be selected if the reporting entity wants to create a connection to an existing GRESB Asset Assessment or invite someone to respond for the Asset. Once selected, there are four options (with supporting guidance) to follow in order to Connect. Only select 'Connect' if the asset intends to participate in the 2023 GRESB Asset Assessment, otherwise leave the status at 'Not Connected'.

What happens once a connection request has been sent:

Energy and Water Resources: Companies involved in the treatment and delivery of natural resources.

Environmental Services: Companies involved in the treatment of water, wastewater, and solid waste for sanitation and reuse purposes.

Data Infrastructure: Companies involved in the provision of telecommunication and data infrastructure.

Asset in development: Refers to an investment in a new asset that has some level of development or construction requirement and risk.

Network Utilities: Companies operating an infrastructure network with natural monopoly characteristics (barriers to entry, increasing returns to scale).

Power Generation x-Renewables: Stand-alone power generation using a range of technologies except wind, solar, and other renewable sources.

Renewable Power: Stand-alone power generation and transmission companies using wind, solar, hydro and other renewable energy sources. Also energy storage companies.

Sector: A group of specific industrial activities and types of physical assets and technologies.

Social Infrastructure: Companies involved in the delivery of support and accommodation services for public or other services.

Transport: Companies involved in the provision of transportation infrastructure services.

EDHECInfra, The Infrastructure Company Classification Standards (TICCS™️), 2021

RC7

SFDR product category

Article 8

Article 9

No category

Provide additional context for the answer provided (optional)

________________________

Select the SFDR product category of the fund.

Select the option applicable to the reporting entity.

Article 8: Where a financial product promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.

Article 9: Where a financial product has sustainable investment as its objective.

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector

RC8

Domicile of the fund

Select country domicile Location

The domicile of the fund provides an understanding of the European National Supervisory Authorities (NSA) that could be reviewing the SFDR disclosures of the entity.

Select the country where the fund is incorporated.

Domicile: the country where the fund is authorised or registered or where it has its registered office.